India’s credit system is evolving — moving beyond paperwork and traditional banking to embrace digital footprints and financial inclusion. Today, even gig workers and first-time entrepreneurs are building creditworthiness through Aadhaar-linked banking, UPI, GST, and digital payment trails.

With MSME loan schemes now recognizing commercial vehicles as a business investment, the Tata ACE Pro has become a gateway to entrepreneurship. Women-led self-help groups are also leveraging the Tata ACE to power local supply chains, creating employment and independence in their communities.

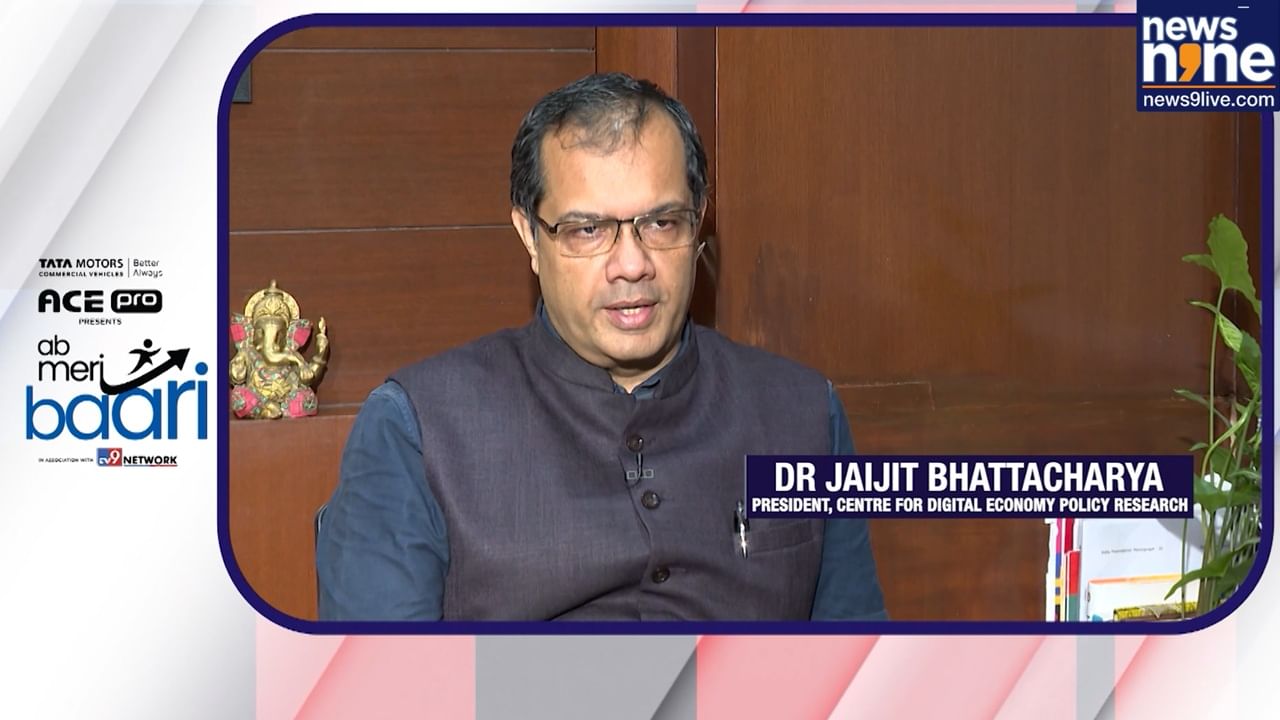

Dr. Jaijit Bhattachary highlights this transformation — where financial access meets opportunity, and a vehicle becomes more than mobility: it becomes ownership, dignity, and growth.

With Tata Motors’ easy financing and inclusive loan support, the path from worker to owner has never been closer.