Ives noted that Nvidia’s chip demand-supply imbalance, if confirmed, could be a major tailwind for the stock and reinforce the bullish thesis that demand for AI infrastructure remains strong globally.

Wedbush’s Daniel Ives said the AI boom is still in its early stages and that the resurfaced concerns over inflated valuations and a possible market correction are no cause for worry.

On Tuesday, tech investors faced renewed volatility, as key artificial intelligence stocks like Palantir Technologies Inc. (PLTR) and Nvidia Corp. (NVDA) came under pressure. Despite short-term noise around geopolitical risks, chip supply disruptions, and trade friction with China, Ives, in a note shared on platform X, stated that the technology sector is being reshaped by one of the most significant innovation cycles in decades, ‘the AI Revolution.’

With Nvidia set to release earnings on August 27, Wall Street is expected to pay close attention to any updates from CEO Jensen Huang. According to industry checks, demand for Nvidia’s top AI chips may be outpacing supply by as much as 10 to 1, Ives said.

He added that the imbalance, if confirmed, could be a major tailwind for the stock and reinforce the bullish thesis that demand for AI infrastructure remains strong globally.

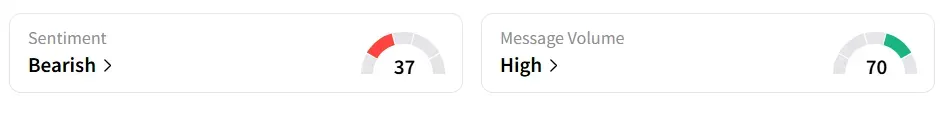

Nvidia stock inched lower by 0.1% in Wednesday’s premarket. On Stocktwits, retail sentiment toward the stock improved to ‘neutral’ from ‘bearish’ territory the previous day amid ‘low’ message volume levels.

Ives further drew attention to the fact that major U.S. tech firms are expected to pour nearly $350 billion into capital expenditures in 2025, much of it aimed at AI capabilities. That investment wave is now being joined by governments and enterprises across the globe, including the Middle East.

Even as skeptics warn of overvaluation risks, the analyst argued that companies like Palantir could see their valuations expand over the next few years. The firm’s AI platforms have the potential to turn it into a trillion-dollar business within 2–3 years, according to Ives.

Palantir stock traded over 2% lower in Wednesday’s premarket. On Stocktwits, retail sentiment around the stock remained in ‘bearish’ territory. Message volume shifted to ‘high’ from ‘low’ in 24 hours.

Overall, Ives concluded, saying the broader AI trend remains intact and is expected to drive growth over the next 2–3 years.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<