The breakout is being reinforced by bullish long-term autonomy expectations, even as some analysts urge caution around valuation.

- Wedbush’s Dan Ives sees a path to a $3 trillion valuation as Tesla’s autonomy push accelerates.

- Robotaxi expansion and driverless testing add momentum amid rising competition.

- Future Fund’s Gary Black is cautious on execution risks despite the rally.

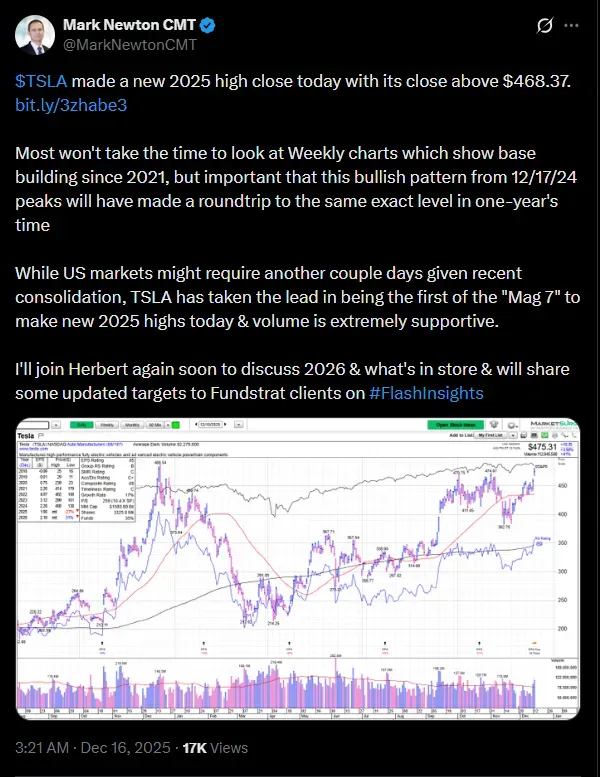

Tesla shares closed at a fresh 2025 high, breaking above a key resistance level and becoming the first of the so-called “Magnificent Seven” stocks to reach new highs this year, according to Fundstrat Head of Technical Strategy Mark Newton.

The stock closed 3.6% up in the regular session on Monday to close at 475.31, before easing 0.5% in after-hours trading at the time of writing.

Chart Signals Turn Bullish

Newton said in a post on X that Tesla’s close above $468.37 marked a decisive breakout, noting that weekly charts show the stock has been building a base since 2021. He added that the move completes a one-year “round trip” back to the same peak reached in December 2024, with trading volume described as “extremely supportive.”

While broader U.S. markets may still need additional sessions following recent consolidation, Newton said Tesla has clearly taken the lead.

Wedbush Sees Path To $3T Valuation

The technical breakout comes alongside growing optimism from Wedbush. Dan Ives, global head of tech research at the firm, said on Monday that Tesla’s market capitalization could double to $3 trillion by the end of 2026.

Ives said Tesla is entering what he called a “monster year” as its autonomous driving and robotics strategy accelerates. He expects the company’s market value to reach $2 trillion in 2026, while his bull-case scenario sees a 100% upside by year-end. Ives has previously set a bull-case price target of $800 and said investors continue to underestimate Tesla’s transformation as its AI-driven autonomy roadmap comes into focus.

Robotaxi Expansion And Autonomous Testing

Tesla already offers Robotaxi services in Austin, Texas and in the San Francisco Bay Area and plans to launch in Las Vegas, Phoenix, Dallas, Houston and Miami. The company confirmed over the weekend that full autonomous testing is now live in Austin, with CEO Elon Musk writing that at least some Robotaxis are being tested empty of any occupants.

Meanwhile, Waymo, Alphabet’s autonomous vehicle unit, already operates fully driverless taxis in certain areas of California and Arizona, and also partners with Uber in select cities.

Tesla also faces increased competition in robotaxi services from Rivian as the latter last week announced its plans to have its Autonomy+ driver assistance system operational in early 2026. The Rivian system will allow for hands-free driving over longer distances, but still requires the presence of a human driver.

Caution On Valuation And Near-Term Demand

Not all investors are convinced. Future Fund Managing Partner Gary Black said he remains cautious on Tesla despite progress toward unsupervised autonomy. Black warned that Tesla’s valuation already reflects much of that progress, citing a price-to-earnings multiple near 210 versus long-term earnings growth of about 35%, which implies a stretched price-to-earnings growth ratio.

Black also pointed to weak fourth-quarter volumes, following the expiration of the $7,500 U.S. EV tax credit at the end of September. Cox Automotive estimates showed Tesla’s U.S. sales fell nearly 23% year over year in November to about 39,800 vehicles, the lowest level since January 2022. Overall U.S. EV sales declined more than 40% during the month, according to the data.

How Did Stocktwits Users React?

On Stocktwits, retail sentiment for Tesla was ‘bullish’ amid ‘high’ message volume.

One user said, “what a beautiful day to be long. Sold my calls bought Friday for a 2X plus and this held up through the onslaught. $BTC crashed the market.”

Another bullish user said, “Such a strong stock against a red market day. This is 100% going over 500.”

Tesla’s stock has risen 18% so far in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<