Canopy Growth is set to acquire all outstanding MTL shares and settle MTL’s debt in a deal valued at around $125 million on a fully diluted equity basis and about $179 million on an enterprise value basis.

- Canopy Growth expects the transaction to be highly accretive, with annualized run-rate synergies of around $10 million within 18 months.

- Integrating MTL’s cultivation assets is expected to boost CGC’s high-quality flower supply for European medical markets.

- The transaction is expected to close before the end of February 2026.

Canopy Growth Corp. (CGC) shares climbed more than 4% higher in Monday’s premarket after the company announced the acquisition of Canadian firm MTL Cannabis for an enterprise value of $179 million.

CGC stock is on track to open at its highest levels since August 29.

Details Of The Deal

Canopy Growth is set to acquire all outstanding MTL shares and settle MTL’s debt in a deal valued at around $125 million on a fully diluted equity basis and about $179 million on an enterprise value basis. Each MTL shareholder will receive 0.32 of a Canopy Growth share plus $0.144 in cash for every MTL share held.

Canopy Growth expects the transaction to be highly accretive, with annualized run-rate synergies of around $10 million within 18 months. MTL’s profitable operations, which generated $84 million in trailing twelve-month revenue, a 51% gross margin before fair value adjustments, and $11 million in operating cash flow, are expected to support Canopy’s goal of achieving positive adjusted earnings before interest, tax, depreciation, and amortization (EBITDA).

The transaction is expected to close before the end of February 2026.

Acquisition Rationale For Canopy Growth

The acquisition enhances Canopy Growth’s footprint in Québec, Canada’s second-largest cannabis market, adding two cultivation facilities and well-known brands such as MTL and Québec-exclusive R’Belle.

Beyond Canada, integrating MTL’s cultivation assets is expected to boost high-quality flower supply for European medical markets, helping Canopy meet rising international demand.

Sun Shines On Cannabis Stocks

On Friday, cannabis stocks, including CGC, surged on reports that the White House is expected to ease federal restrictions on marijuana. President Donald Trump is reportedly expected to issue an executive order, possibly later on Monday, directing federal agencies to pursue the reclassification of marijuana.

Trump has previously signaled support for the move and recently discussed the plan with House Speaker Mike Johnson, as well as industry executives and senior health officials.

The order would seek to shift marijuana from Schedule I to Schedule III, a change that would ease restrictions on research and medical use without fully legalizing or decriminalizing the drug. Marijuana is currently classified alongside substances such as heroin and LSD under federal law.

CGC stock surged nearly 54% on Friday and decisively broke past its 50-day moving average (50-DMA) for the first time since October 16.

How Did Stocktwits Users React?

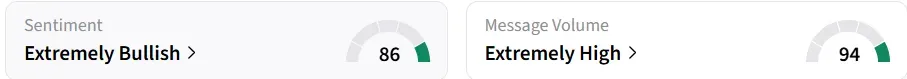

Retail sentiment on Stocktwits remained in the ‘extremely bullish’ territory over the past 24 hours, accompanied by ‘extremely high’ message volumes.

One user sees $3 as a key resistance point. The stock is currently trading at $1.8.

0

Year-to-date (YTD), the stock has declined nearly 39%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<