Ashwini Container Movers IPO: The initial public offering (IPO) of Ashwini Container Movers opened for bidding on Friday, December 12 and will close next week on Tuesday, December 16.

The company is looking to raise ₹71 crore via the maiden share sale, which is priced in the range of ₹135 to ₹142 apiece.

Ashwini Container Movers IPO is entirely a fresh issue of 0.50 crore shares, meaning all proceeds will be received by the company, which it plans to use for repayment of borrowings availed by it and funding capital expenditure and general corporate purposes.

Investors can apply for the IPO in lots of 1000 shares. With the retail investors required to apply for at least two lots, the minimum investment requirement at the upper end of the price band is ₹2,84,000.

The allotment of Ashwini Container Movers IPO will be finalised on December 17 while the listing is expected on December 19 on NSE SME.

Ashwini Container Movers IPO Subscription Status

Ashwini Container Movers IPO was subscribed 4% so far on the first day of the bidding process as of 11.15 am. The retail portion was booked 9%. Meanwhile, the non-institutional investor (NII) and qualified institutional buyer (QIB) quotas have not seen any bids so far.

Overall, the IPO received bids for 1,44,000 shares as against 33,34,000 at the time of writing this report.

Ashwini Container Movers IPO GMP

Ashwini Container Movers IPO GMP (grey market premium) today is ₹8. This is the highest GMP for the IPO so far. At the prevailing GMP, Ashwini Container Movers IPO listing price could be ₹150, a premium of 5.63% over the upper end of the price band.

In the last seven sessions, the lowest GMP for the Ashwini Container Movers IPO has been recorded as nil, while the highest GMP has been ₹8.

About Ashwini Container Movers

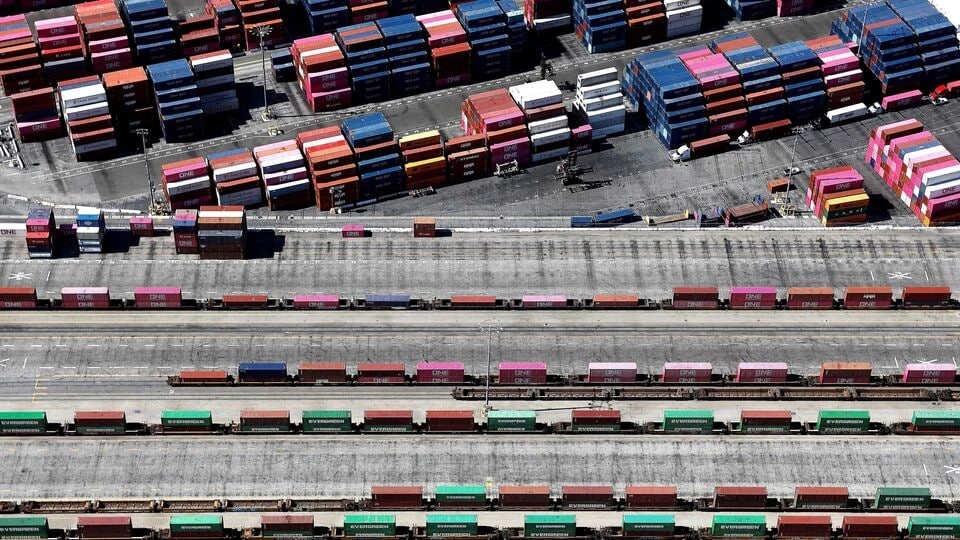

Incorporated in April 2012, Ashwini Container Movers is a transportation company specialising in cargo movement across India, with a strong presence in Maharashtra and Gujarat.

The company focuses on the surface transportation of goods using containerised lorries. As of 30 September 2025, its logistics operations are supported by a self-owned fleet of over 300 containerised vehicles, including both 20-foot and 40-foot trucks.

Financially, the company has seen a sharp growth in its profit to ₹11.45 crore in Fiscal 2025 from ₹1.38 crore in Fiscal 2024. Meanwhile, its total income has seen a growth to ₹96.06 crore from ₹79.27 crore YoY.