Muthoot Finance has surged on record earnings and a breakout rally, while Manappuram is consolidating near support, with analysts projecting medium-term upside if gold prices remain favorable.

Indian gold loan stocks have been on a roll this year, and analysts see more upside potential for both Muthoot Finance and Manappuram shares.

Muthoot Finance shares hover near their 52-week high, after rallying over 6% in their last five sessions. The gains come on the heels of a record financial performance in its June quarter (Q1 FY26). And Manappuram Finance is consolidating near key support levels.

Muthoot Finance: Earnings Spurs Breakout Rally

SEBI-registered analyst Akhilesh Jat noted that Muthoot Finance broke two months of prolonged consolidation last week.

Jat highlighted that the stock was trading in an upward channel. He believes its bullish trend is intact as the strong earnings reinforce the company’s leadership in gold loan & financial services. Net profit soared 65% to ₹19,742 crore vs ₹11,957 crore year-on-year (YoY). While net interest income rose 45% to ₹62,880 crore vs ₹43,483 crore.

Meanwhile, analyst Vinay Taparia said that the stock has given a superb breakout with huge volume. He said it is likely to move to ₹3,500 level in nine months to one year, with ₹2,500 acting as a good support. But a close below ₹2,450 negates this view.

Manappuram Finance: Consolidation Before Breakout?

Analyst Deepak Pal highlighted that the stock has been in a consolidation phase post a strong rally, forming a base near the ₹250 support zone. But recent price action indicates healthy accumulation by investors, with technical indicators supporting a medium-term bullish undertone.

On the technical front, the stock is trading above 20, 50, and 100-day Exponential Moving Averages (EMA), confirming a strong uptrend in the medium term. However, Pal noted that in the short term, it faces resistance around ₹275–285, which, if breached, opens the doors to ₹300. Support is seen at ₹250 – ₹245.

Overall, the technical setup suggests the buy-on-dip strategy as the stock sustains above ₹250, according to him.

If its upcoming results are positive, Manappuram could see a breakout above ₹285. Over the short term (1–2 months), he sees it rangebound between ₹250 – ₹285, with a rally towards ₹300 and higher. Over the medium to long-term (6-12 months), Pal said it may test ₹320–340, if gold prices remain favorable and results are strong.

It has a strong brand presence and trust in the gold loan segment, a diversified business mix into microfinance, housing finance, and vehicle loans to reduce dependency on gold loans.

But Pal cautioned that its heavy reliance on gold prices means that any fluctuation in prices can affect loan repayments and demand. Additionally, intense competition from peers like Muthoot Finance and banks, as well as RBI’s regulatory actions, remain a key external risk.

What Is The Retail Mood?

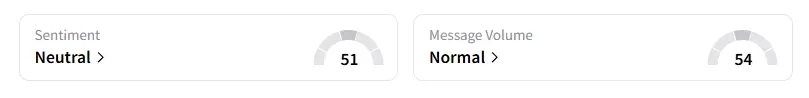

Data on Stocktwits shows that retail sentiment turned ‘bullish’ last week amid ‘high’ message volumes for Muthoot. Meanwhile, retail sentiment is ‘neutral’ for Manappuram.

Muthoot Finance shares have risen 24% year-to-date (YTD), while Manappuram has surged 42%

For updates and corrections, email newsroom[at]stocktwits[dot]com.<