Some investors expected GameStop to announce a significant growth plan or pivot given its strong cash position, but were left disappointed.

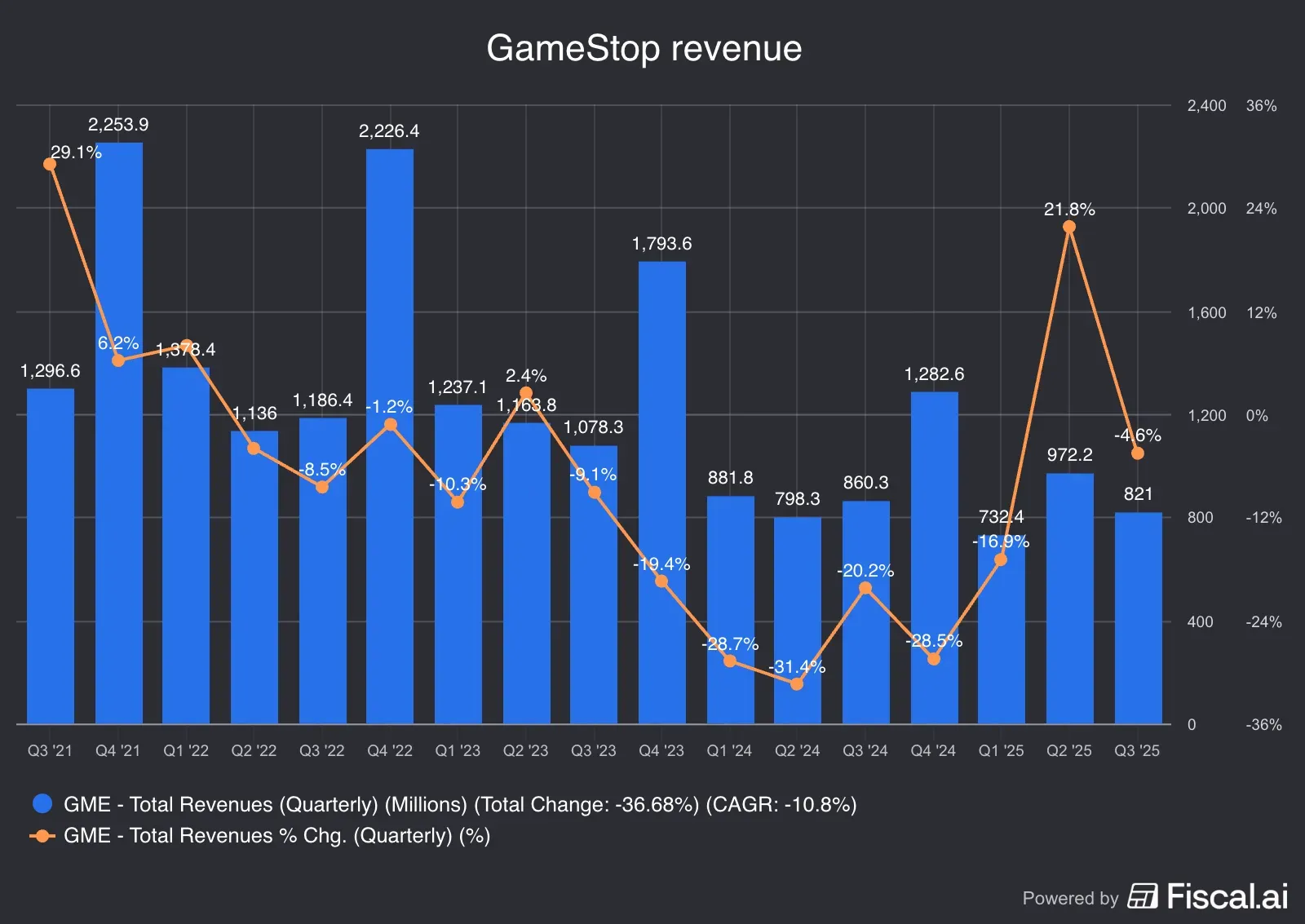

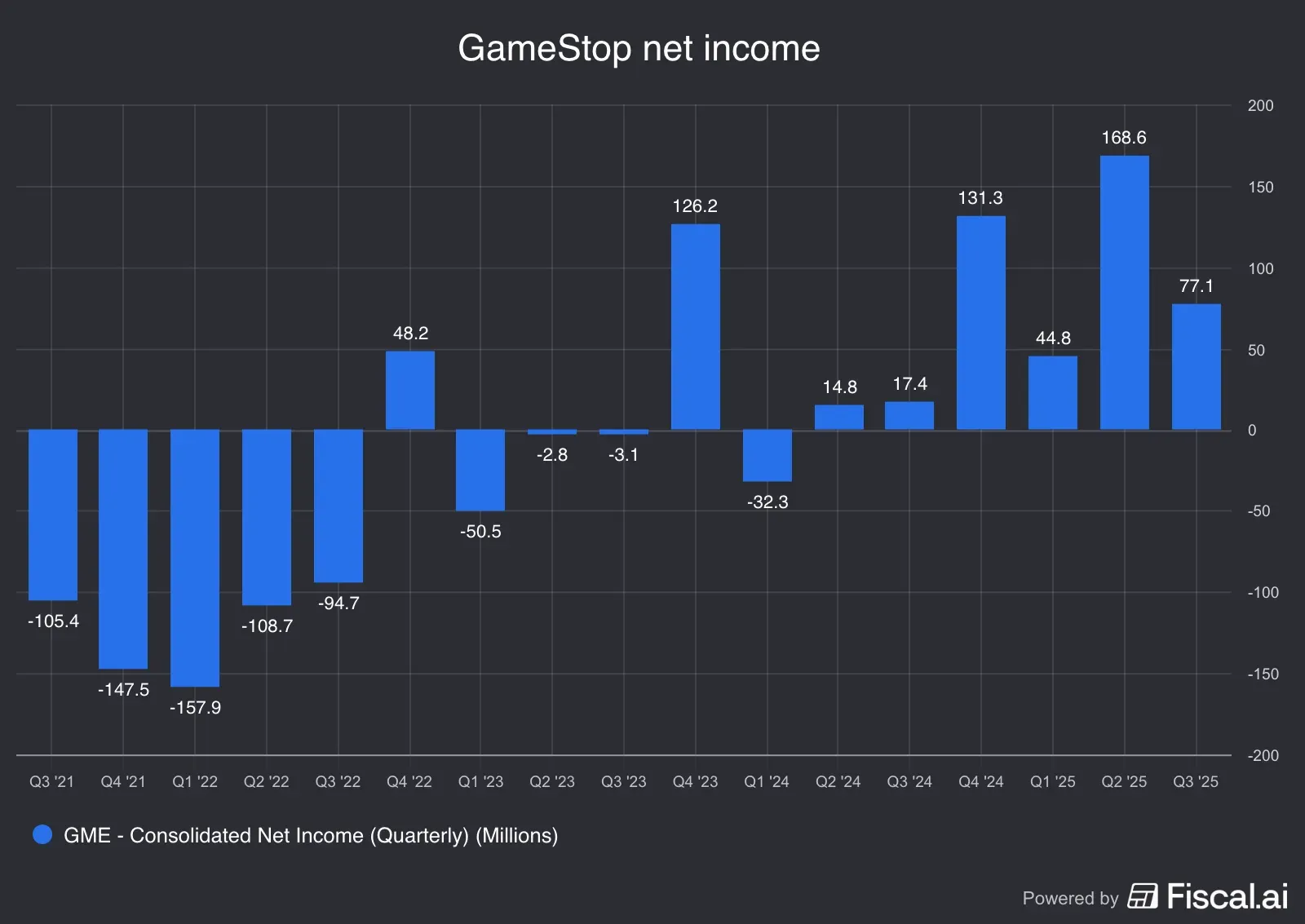

- GameStop reported another quarter of falling revenue; however, its net income expanded.

- The stock declined in the after-market session following the results, leaving investors frustrated.

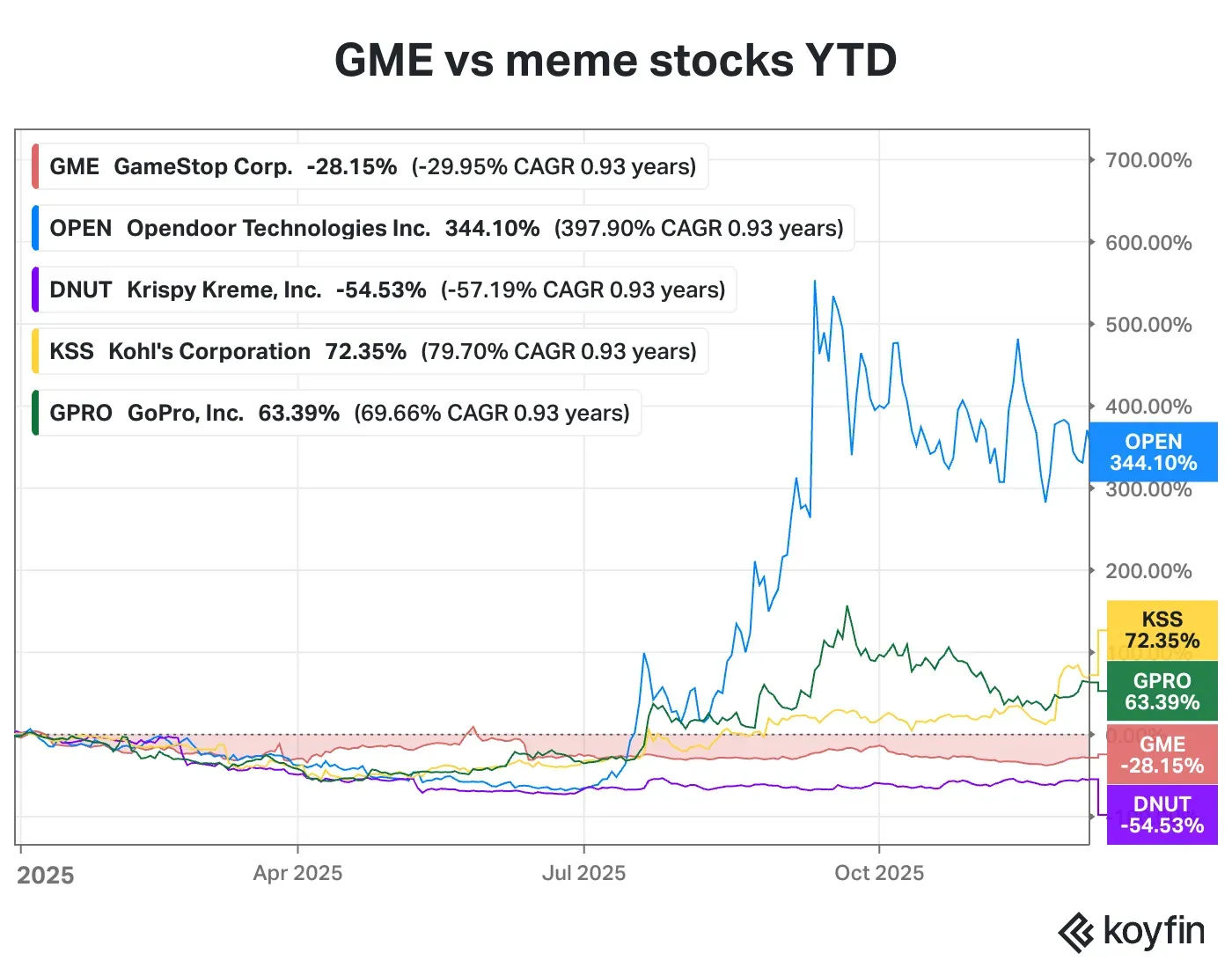

- GME has been largely absent from meme-stock activity this year, which saw the emergence of new names such as Opendoor.

For some, GameStop is a curious case. For others, it’s straightforward.

The video games retailer posted another quarter of declining sales, showing that its pivot to e-commerce isn’t turning the lever just yet, at a time when most consumers are buying games on Amazon.com.

However, GameStop managed to rein in costs as it closed more stores, helping to grow quarterly net profit about fivefold compared to the year-ago quarter. Its cash reserve, which includes a sizable number of Bitcoins, also swelled – presenting a complicated case for investors betting on the well-known meme stock.

Stocktwits reported earlier that GameStop has been absent from meme-stock activity this year, with attention shifting to new names such as Opendoor Technologies, GoPro, and Kohl’s, among others. Some investors expected GameStop to announce a significant growth plan or pivot given its strong cash position, but were left disappointed.

GME dropped 5.7% in the after-market trading on Tuesday, following the results announcement. The stock is down 26.3% year-to-date as of the last close, heading for its worst year since 2021.

No Fireworks

Notably, GameStop has stopped hosting a post-earnings analyst call since early 2023. And with the last of analysts suspending coverage on the company, its quarterly filing is the only resource left to form a stock view. The picture looks, at best, mixed.

In the third quarter, revenue fell 4.6% to $821 million, marking the eighth quarter of degrowth in the last nine quarters. Sales in the company’s mainstay hardware and accessories business fell 12% to $367.4 million, while its software sales dropped 27% to $197.5 million.

The collectibles segment stood out, jumping 50% to $256.1 million. It now accounts for just under one-third of total revenue, compared with about 20% a year earlier. Recently, GameStop has made a bigger push into collectibles, including trading cards, board games, and video game merchandise.

Net income rose to $77.1 million, up from $17.4 million in the year-ago quarter. The company’s bottom line has steadied, and Q3 marked the sixth consecutive quarter of positive net income.

Cash and cash equivalents were $7.84 billion as of the end of the quarter, although the figure dropped from $8.7 billion in Q2. Notably, GameStop did not purchase any new Bitcoin in Q3, maintaining the holding at 4,710.

Battered Retail Investors Still Bullish

On Stocktwits, retail sentiment for GME rose several points within the ‘bullish’ territory, with 24-hour message volume for the ticker rising by over 160%. Many members posted about their frustration with the stock’s underperformance, while some advised loading up at current prices.

“$GME Been holding forever. tired man. just want to see some returns,” said one user, with a few others blaming CEO Ryan Cohen.

A bullish user argued that if another company had posted an earnings report like GME’s latest, and and displayed an actual financial turnaround like the company is, “that stock would be Carvana level crazy (along with S&P inclusion).”

“It’s only a matter of time. I’ll just keep buying more (GME shares).”

For updates and corrections, email newsroom[at]stocktwits[dot]com.<