After grappling with weak margins for several quarters, refiners saw their fortunes reverse this year amid tighter fuel supplies.

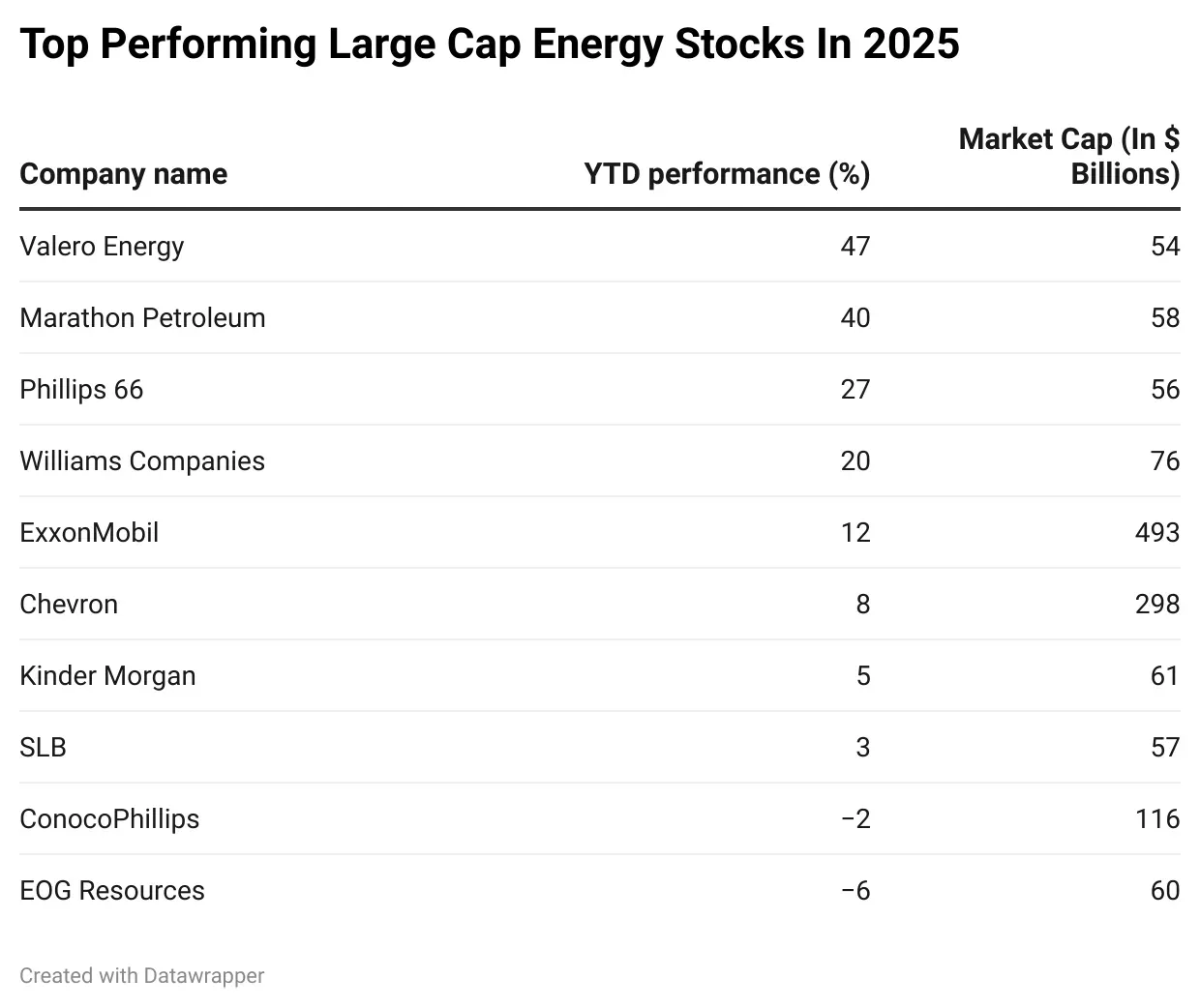

- Valero Energy, Marathon Petroleum, and Phillips 66 led the energy sector in gains this year.

- Energy infrastructure firms such as Williams have benefited from the sustained demand for its pipelines and other facilities amid a boom in electricity demand.

- Oil major Exxon has raised its output to 4.8 million barrels per day.

The energy sector has been navigating plenty of turbulence this year amid geopolitical tensions, Trump’s tariffs, and wild swings in commodity prices.

Oil prices plunged below $60 per barrel after U.S. President Donald Trump unveiled the ‘Liberation Day’ tariffs. Prices had jumped to nearly $80 per barrel when the conflict between Iran and Israel escalated. At the time of writing, Brent crude fell to about $62 per barrel, as OPEC production continued to add to concerns about oversupply.

Stocktwits examines how the 10 largest oil companies in the S&P 500 by market valuation performed this year, as of Dec. 8.

Refiners Stage A Comeback

After grappling with weak margins for several quarters, refiners saw their fortunes reverse this year amid tighter fuel supplies stemming from maintenance work, refinery closures, and geopolitical tensions.

The strong fuel prices have also supported Brent crude amid concerns of oversupply. The top three best-performing oil companies in 2025 were the refiners Valero Energy, Phillips 66, and Marathon Petroleum.

Valero Energy

San Antonio, Texas-based Valero has led the pack, logging 46.5% gains this year. The company’s refinery utilization rate stood at 97% in the third quarter, backed by strong global demand and persistently low inventory levels despite high utilization rates. The company’s ethanol segment also logged record production in the third quarter, further boosting its earnings.

“Although OPEC began unwinding their production cuts in April, much of that volume was offset by an increase in summer power burn. So it wasn’t really until September that we saw any meaningful increase in the export volume from OPEC,” Valero Chief Operating Officer Garry Simmons said in October.

Marathon Petroleum

The biggest U.S. refiner by capacity has closely followed Valero, with 39.6% gains. However, the stock took a hit earlier in November, after its third-quarter earnings missed Wall Street’s estimates, hurt by weak results in the renewable diesel segment. Its refinery maintenance costs also rose to $400 million during the quarter, up from $287 million, which hit its bottom line.

However, the company also projected a resilient fuel market heading into 2026. “Gasoline and distillate inventory levels remain below five-year averages. Current market fundamentals are indicative of tightness in supply and supportive demand, which we believe will persist into 2026,” said Marathon CEO Maryann Mannen.

Phillips 66

The refiner, up over 27% this year, has been steadily improving its operating performance amid Elliott Investment Management’s efforts to effect change at the company. The refiner topped third-quarter earnings in October and logged an average utilization rate of 99%.

The company plans to shut its Los Angeles-area refinery by the end of this year, due to uncertain long-term viability, weak margins, increased renewable diesel, high costs, and market shifts.

Williams Co.

The energy infrastructure firm Williams, which has risen nearly 20% this year, has benefited from the sustained demand for its pipelines and other facilities amid a boom in electricity demand. In October, the company said it would invest $3.1 billion in two projects to capitalize on the robust growth driven by AI data centers.

U.S. data centers will require 22% more grid power by the end of 2025 than they did one year earlier, and will need nearly three times as much in 2030, according to a report by the S&P Global. Artificial intelligence data centers are driving a surge in power demand as U.S. firms spend billions to build infrastructure.

ExxonMobil

The oil major has gained over 12.4% this year, despite the volatility in commodity prices. Its production has surged to 4.8 million barrels per day, aided by robust output from the Permian Basin and Guyana. Stronger refinery margins have also helped it offset losses from weak oil prices.

The company could further bolster its production as it is in talks with the Iraqi government to buy Lukoil’s stake in a giant oilfield following U.S. sanctions on the oil producer.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<