If the losses hold, the stock could see its worst day since Feb. 5, 2024.

- If an agreement is reached, Yara would acquire the ammonia facilities at Air Products’ low-carbon energy complex in Louisiana for between $8 billion and $9 billion.

- Yara also intends to buy ammonia from Air Products’ NEOM project.

- Mizuho warned that, under this deal, Air Products risks being at the mercy of market ammonia prices for what it produces at Neom.

Air Products (APD) stock fell over 9% on Monday after the company said that it is in advanced discussions with Norway’s Yara on low-emission ammonia projects.

If the losses hold, the stock could see its worst day since Feb. 5, 2024. The stock was the top decliner among the S&P 500 companies on Monday, at the time of writing.

What Is The Partnership About?

If an agreement is reached, Yara would acquire the ammonia facilities at Air Products’ low-carbon energy complex in Louisiana for between $8 billion and $9 billion. Air Products would own and operate industrial gas production in the same complex, with approximately 80% of the low-carbon hydrogen supplied to Yara under a 25-year long-term offtake agreement to produce 2.8 million tonnes of low-carbon ammonia per year.

Final investment decisions by both companies are targeted for mid-2026, and project completion is expected by 2030.

The second agreement would be about Air Products’ NEOM Green Hydrogen Project in Saudi Arabia, which is expected to begin commercial production in 2027. Yara intends to commercialize, on a commission basis, the ammonia not sold by Air Products as renewable hydrogen in Europe.

What Are Analysts Saying?

According to a MarketWatch report, Mizuho warned that from this deal, Air Products risks being at the mercy of the market price of ammonia for what it produces at Neom. If global ammonia prices fall, Air Products’ revenues and margins could shrink, even though Yara guarantees volumes through commission sales, analyst John Roberts reportedly said.

“Air Product retains price risk on Neom ammonia, but not volume risk, which Yara will place on a commission basis,” he stated. Since these projects are skewed toward the longer term, Roberts doesn’t expect any change to fiscal 2026 and 2027 estimates.

What Are Stocktwits Users Thinking?

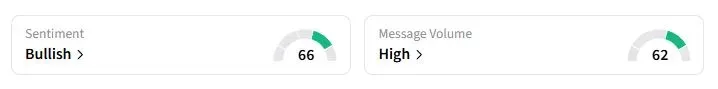

Retail sentiment on Stocktwits about Air Products, however, moved to ‘bullish’ territory compared with ‘neutral’ a day ago.

Air Products’ stock has fallen by over 17% this year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<