Yardeni Research recommended going underweight the Magnificent Seven stocks, anticipating a shift in the source of earnings growth.

- Ed Yardeni warned that the group’s exceptional profit margins are drawing increasing competition.

- Yardeni recommends moving information technology and communication services sectors from ‘Overweight’ to ‘Market Weight,’ while increasing exposure to financials and industrials.

- The firm also recommends taking an overweight position in health care.

Yardeni Research has reportedly advised investors to dial back exposure to the market’s high-flying “Magnificent Seven,” marking a major shift after more than a decade of bullish positioning on mega-cap technology stocks.

Yardeni Research recommended going underweight the Magnificent Seven stocks, anticipating a shift in the source of earnings growth. Founder and Wall Street veteran Ed Yardeni warned that the group’s exceptional profit margins are drawing increasing competition, Bloomberg reported.

“We see more competitors coming for the juicy profit margins of the Magnificent 7,” Yardeni said, adding that “Every company is evolving into a technology company.”

The investor argued that the broader index will benefit from rising productivity and margin expansion.

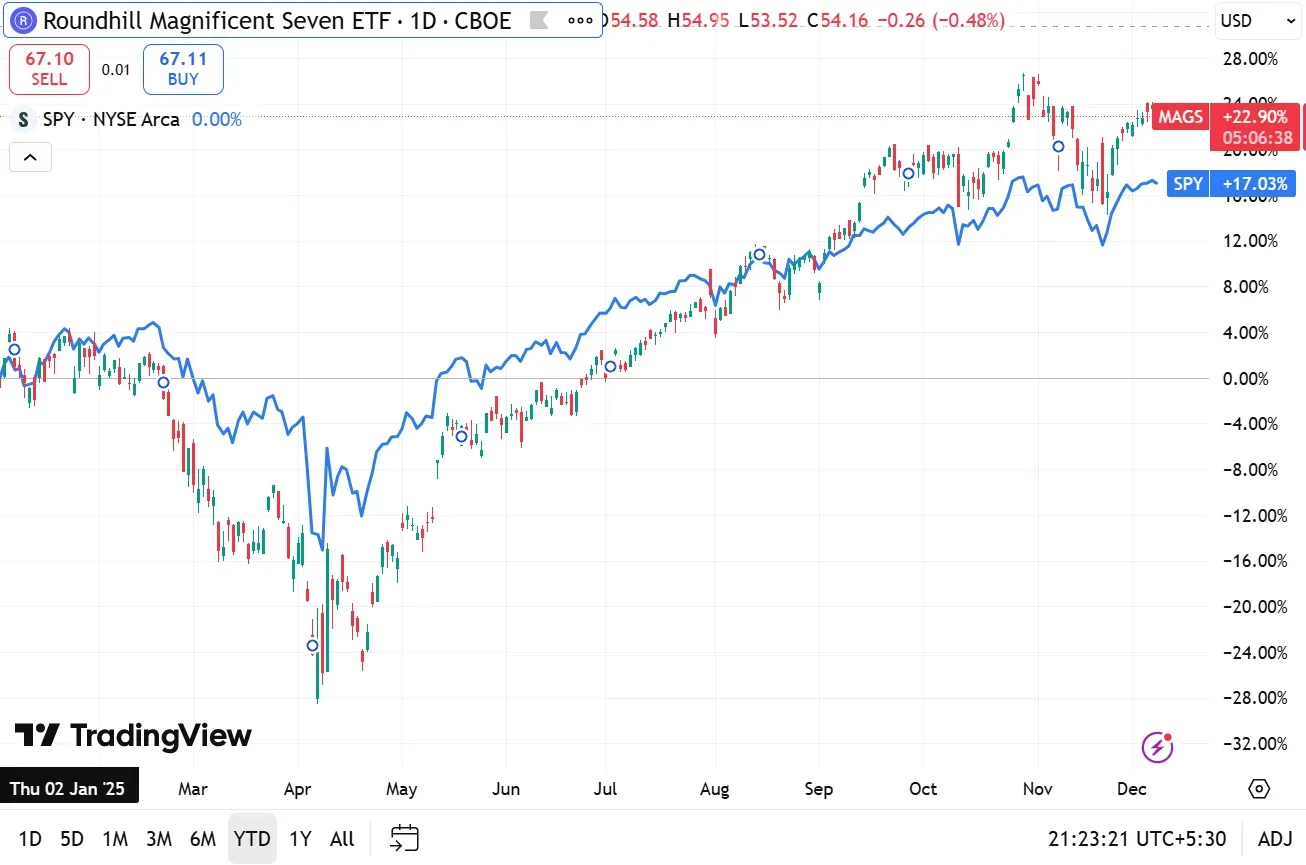

The Magnificent Seven stocks have soared more than 600% since the end of 2019, far outpacing the S&P 500’s 113% rise. Their exceptional run has been driven first by the pandemic-era shift toward Big Tech and more recently by the artificial intelligence boom.

Yardeni recommends moving information technology and communication services sectors from ‘Overweight’ to ‘Market Weight,’ while increasing exposure to financials and industrials, and taking an overweight position in health care.

US Markets Lagging Peers

The firm also believes there is less reason to overweight U.S. equities in global portfolios, as lower valuations, a weaker dollar, and stronger earnings have allowed international markets to outperform this year. “The US now accounts for 65% of the market cap of the world’s stock market, so it’s hard to recommend overweighting something that is already quite overweight,” he told Bloomberg TV.

How Did Stocktwits Users React?

Retail sentiment on Roundhill Magnificent Seven ETF (MAGS) remained in the ‘bearish’ zone over the past 24 hours.

At the time of writing, MAGS was down 0.8%, having gained around 23% so far this year.

Only Microsoft (1.25%) and NVIDIA (0.65%) traded higher on Monday. Alphabet was down 1.64%, Tesla was trading 3% lower, META fell 0.8%, Apple declined 0.6%, and Amazon slumped 0.7%.

Read Also: Is Rivian Losing Its Spark? Morgan Stanley Downgrades Amid EV ‘Winter’

For updates and corrections, email newsroom[at]stocktwits[dot]com.<