Rosenblatt Securities downgraded Netflix to ‘Neutral’ from ‘Buy’, citing concerns about the uncertainty and risks following the acquisition.

- Rosenblatt noted that the expected return on invested capital (ROIC) is modest and unlikely to justify the transaction.

- Pivotal Research Group analyst Jeffrey Wlodarczak reportedly downgraded Netflix to ‘Hold’ from ‘Buy’.

- Wlodarczak stated that Netflix’s aggressive move reflects management’s anxiety over shifting consumer behavior.

Netflix Inc. (NFLX) shares witnessed multiple downgrades on Monday as analysts weighed the implications of its blockbuster acquisition of Warner Bros. Studios and HBO.

On Friday, the streaming giant announced a deal to acquire Warner Bros., including its film and television studios, HBO, and HBO Max, valued at $82.7 billion in enterprise value and $72 billion in equity.

Rosenblatt Downgrade

Rosenblatt Securities downgraded Netflix to ‘Neutral’ from ‘Buy’, citing concerns about the uncertainty and risks following the acquisition, according to TheFly. The firm also lowered its price target to $105 from $152, reflecting a more cautious view of Netflix’s near-term prospects.

The firm suggested that the acquisition appears to rely heavily on speculative opportunities tied to Warner Bros.’ extensive film and television library rather than clear, quantifiable financial returns. The firm noted that the expected return on invested capital (ROIC) is modest and unlikely to justify the transaction.

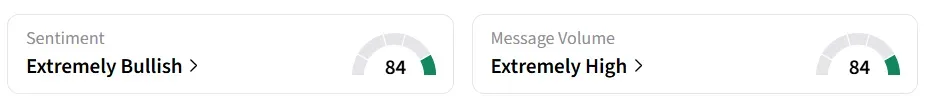

Netflix’s stock traded 2% lower on Monday, after the morning bell. On Stocktwits, retail sentiment around the stock remained in ‘extremely bullish’ territory amid ‘extremely high’ message volume levels.

According to a CNBC report, Pivotal Research Group analyst Jeffrey Wlodarczak downgraded Netflix to a ‘Hold’ from ‘Buy’ and trimmed the target price to $105 from $160.

The analyst cited risks related to the 18-24-month closing period and the possibility of a bidding war with Paramount Skydance (PSKY) that could drive the acquisition price even higher, the report said.

As predicted by Wlodarczak, Paramount launched an all-cash tender offer to acquire Warner Bros. Discovery, offering $30 per share in cash for the entire company. Paramount highlighted that its offer will provide WBD shareholders $18 billion more in cash than Netflix.

According to the report, Wlodarczak stated that Netflix’s aggressive move reflects management’s anxiety about shifting consumer behavior, in which short-form entertainment increasingly captures attention, potentially eroding traditional long-form streaming engagement.

“We are moving to more conservative stance on our outlook as we believe this expensive deal does partly signal concern from management about trying to combat mediocre subscriber engagement trends,” he noted.

NFLX stock has gained over 10% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<