A flurry of high-profile departures is reshaping Apple’s upper ranks just as the company grapples with questions about its design mojo and its next big product.

- Four senior leaders are exiting, marking Apple’s most concentrated leadership turnover in years.

- Meta is aggressively poaching Apple’s design and AI talent, underscoring intensifying competition for hardware-software visionaries.

- Despite stock strength, concerns linger over Apple’s reliance on incremental upgrades and the absence of a breakthrough product since the iPhone.

Apple, Inc. (AAPL) has long been a safe bet for both investors and employees. When all the other high-and-mighty tech names let go of their workforce in droves during the 2022 inflation-induced economic softness, Cupertino chose to preserve its workforce. But now there seems to be a shakeup in the top echelons of Apple’s leadership.

Just this week, as many as four key C-suite executives have been confirmed to leave. Is Apple no longer a cool place to work? Or is it a signal that Apple’s future hasn’t offered these executives any conviction?

Apple’s Leadership Flux

The week began with Apple confirming that its artificial intelligence (AI) chief, John Giannandrea, would retire after nearly seven years at the company. Investors took the move in their stride as Apple’s stock ended Monday’s session at a fresh record of $283.10. Apparently, they were excited about the new hire, Amar Subramanya — an ex-Microsoft executive.

Deepwater Asset Management Managing Partner Gene Munster saw Giannandrea’s retirement and Subramanya’s appointment as good news for Apple, signaling CEO Tim Cook’s intention to have serious AI features.

After rumors that Alan Dye, Apple’s long-serving head of user interface (UI) design — most recently behind the “Liquid Glass” rollout — was leaving the company circulated, Meta’s Mark Zuckerberg confirmed the move on Thread. He also stated that Billy Sorrentino, who served as Senior Director of the Apple Design Team for a decade, has joined Meta.

The mandate for these executives — “elevate design within Meta, and pull together a talented group with a combination of craft, creative vision, systems thinking, and deep experience building iconic products that bridge hardware and software.”

There have also been executive moves in staff functions. Apple released a statement on Thursday that Kate Adams, who has served as General Counsel since 2017, will step down and be replaced by Jennifer Newstead, effective March 1, 2026. Incidentally, Newstead is poached from Meta, where she currently serves as the chief legal officer. Apple’s VP for Environment, Policy and Social Initiatives, Lisa Jackson, will also retire in January.

Was Jony Ive The First Trigger?

The design team at Apple, behind iconic products that deliver an excellent user experience — one of their key selling points — has been whittled down since its legendary Chief Design Officer, Jony Ive, left Apple in 2019. He quit to start his own venture, LoveForm, but continued to work with Apple as a client until mid-2022. The core of the design team left along with him for his venture. Ive has since forged a partnership with Sam Altman’s OpenAI to create a palm-sized device without a screen that can take audio and visual cues from the physical environment and respond to users’ requests.

In July, Meta hired AI foundation model chief Ruoming Pang, absorbing him into its newly set-up Superintelligence Group, reportedly at a jaw-dropping annual compensation of $200 million.

Losing The Midas Touch?

Ever since the baton passed to Cook, hardware design hasn’t undergone any radical changes, leaving a large chunk of investors and users fuming. The oft-heard comment ahead of key product launches is that Apple often makes only incremental changes — minor tweaks or feature updates — rather than launching truly new or revolutionary products.

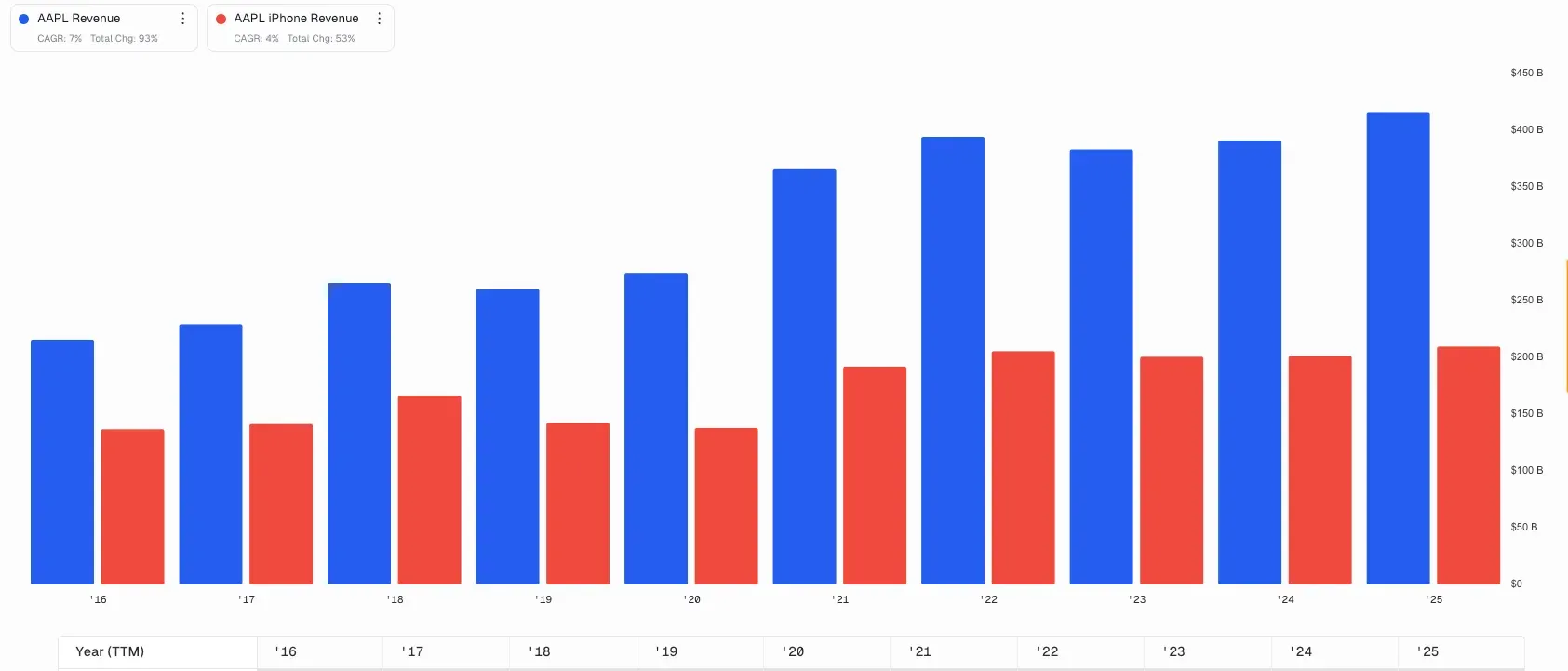

iPhone has remained Apple’s cash cow for a long time, and in fiscal year 2025, which ended in September, it accounted for half of the company’s total revenue.

Apple’s Annual Revenue vs. iPhone Revenue (Since 2016)

Chart courtesy of The Fly<

Reliance on the iPhone has declined over the years, primarily due to the Services segment’s rising share. Since the 2007 launch of the iPhone, Apple’s attempts to unveil the next big thing have not been successful. After dabbling with an electric vehicle venture for about a decade, reportedly pouring over $10 billion into it, the company pulled the plug on the project. Its Vision Pro reality headset, launched amid considerable fanfare in 2023, hasn’t seen any meaningful uptake.

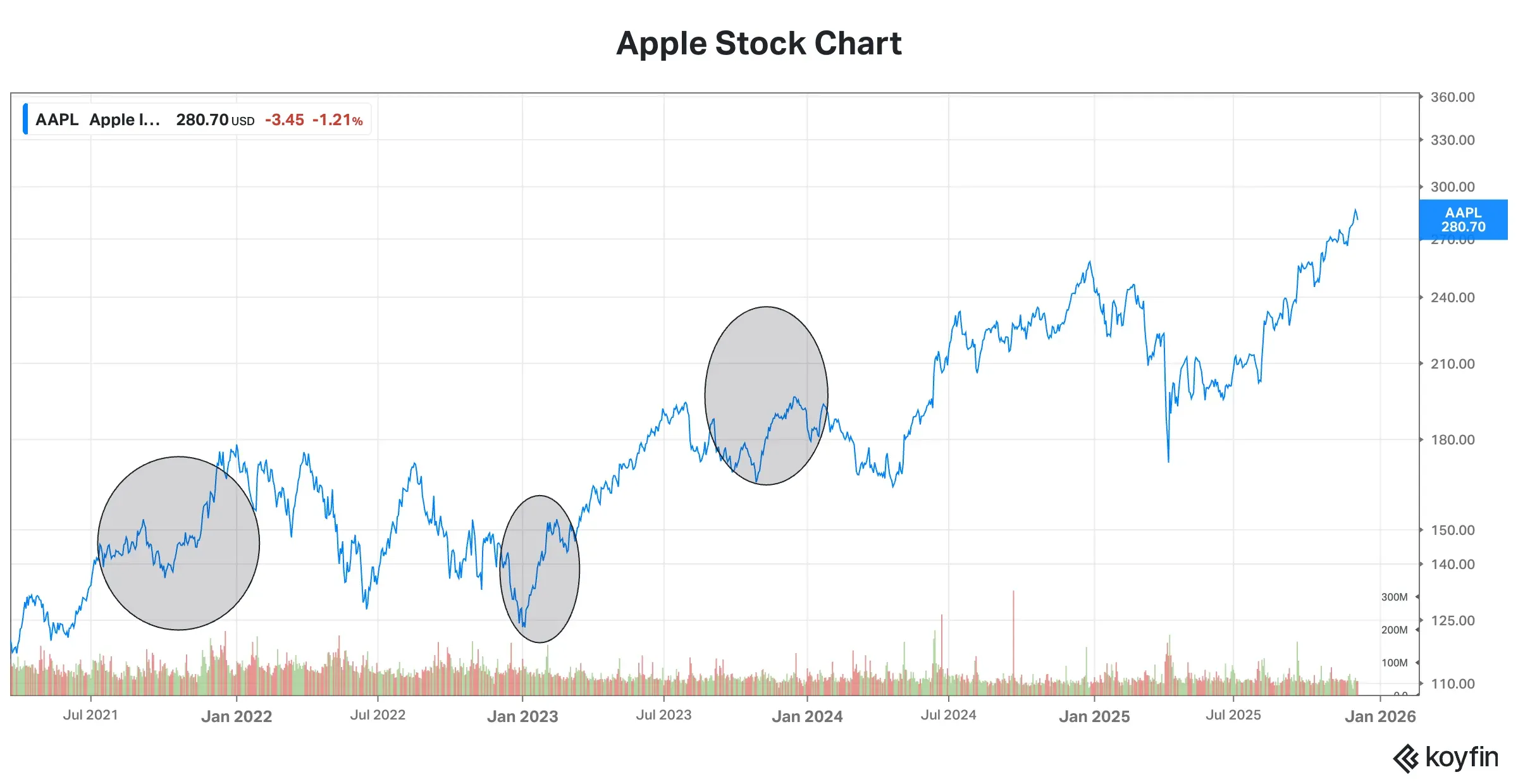

Apple Stock On Tear

Apple stock has been an outperformer in recent sessions, but don’t get fooled by the year-end run. It is typical of the stock to rally into the year-end.

Source: Koyfin<

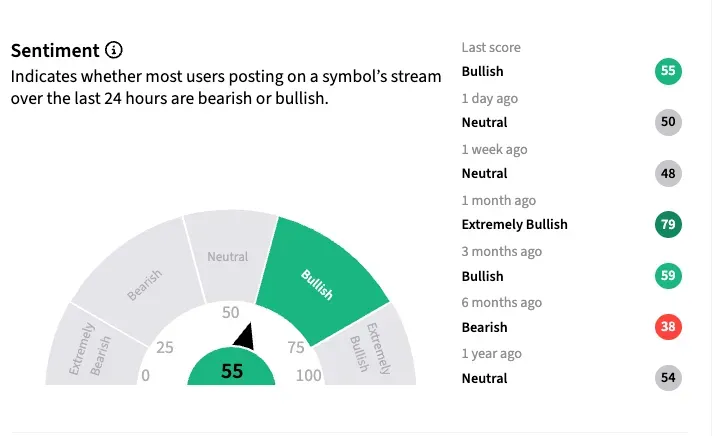

Retail traders have begun to warm to the stock following its recent surge. On Stocktwits, retail sentiment toward the stock has turned ‘bullish’ after being ‘neutral’ at the start of the year. The message volume on the stream is at ‘high’ levels.

Apple stock has gained 12.6% this year, after being in the red until late September. According to Koyfin, the average 12-month analysts’ price target for the stock is $283.58, implying merely 1% upside from current levels.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<