Paramount Skydance and Comcast are also bidding, in what is turning out to be a battle between billionaires.

- Netflix and Warner Bros are reportedly entering exclusive negotiations for a deal in which Netflix is bidding for the latter’s streaming and studio assets.

- Netflix is said to be making a primarily cash offer and plans to run its own streaming and HBO Max as separate services.

- Paramount and Comcast are also in the bidding, and it’s still not official that Netflix has clinched the deal.

Stranger things are happening in the world of streaming. No, not the hit web series. We’re talking about Netflix, Inc. itself, which may have pulled off an incredible M&A heist in the world of entertainment.

Reports suggest that Netflix has entered exclusive negotiations to buy the studio and streaming assets of Warner Bros Discovery, in a three-way bidding war with giants such as Paramount-Skydance and NBCUniversal owner Comcast.

Details remain sparse. The Wall Street Journal first reported late Thursday that the two sides would enter exclusive talks. At the same time, Reuters added that the negotiations value Warner Bros at roughly $28 per share, implying a total valuation of approximately $70 billion based on the total outstanding shares.

Battle Of Billionaires

Netflix is clearly a top contender: it’s sitting on $9.3 billion in cash, runs the world’s leading streaming platform, and has the consumer insights to squeeze maximum value from HBO’s iconic catalog. Plus, WBD’s chief executive David Zaslav and Netflix co-CEO Ted Sarandos are reportedly on good terms. Although it is also possible that Sarandos is just driving up the price for his friend Zaslav, Bloomberg reporter Lucas Shaw speculates.

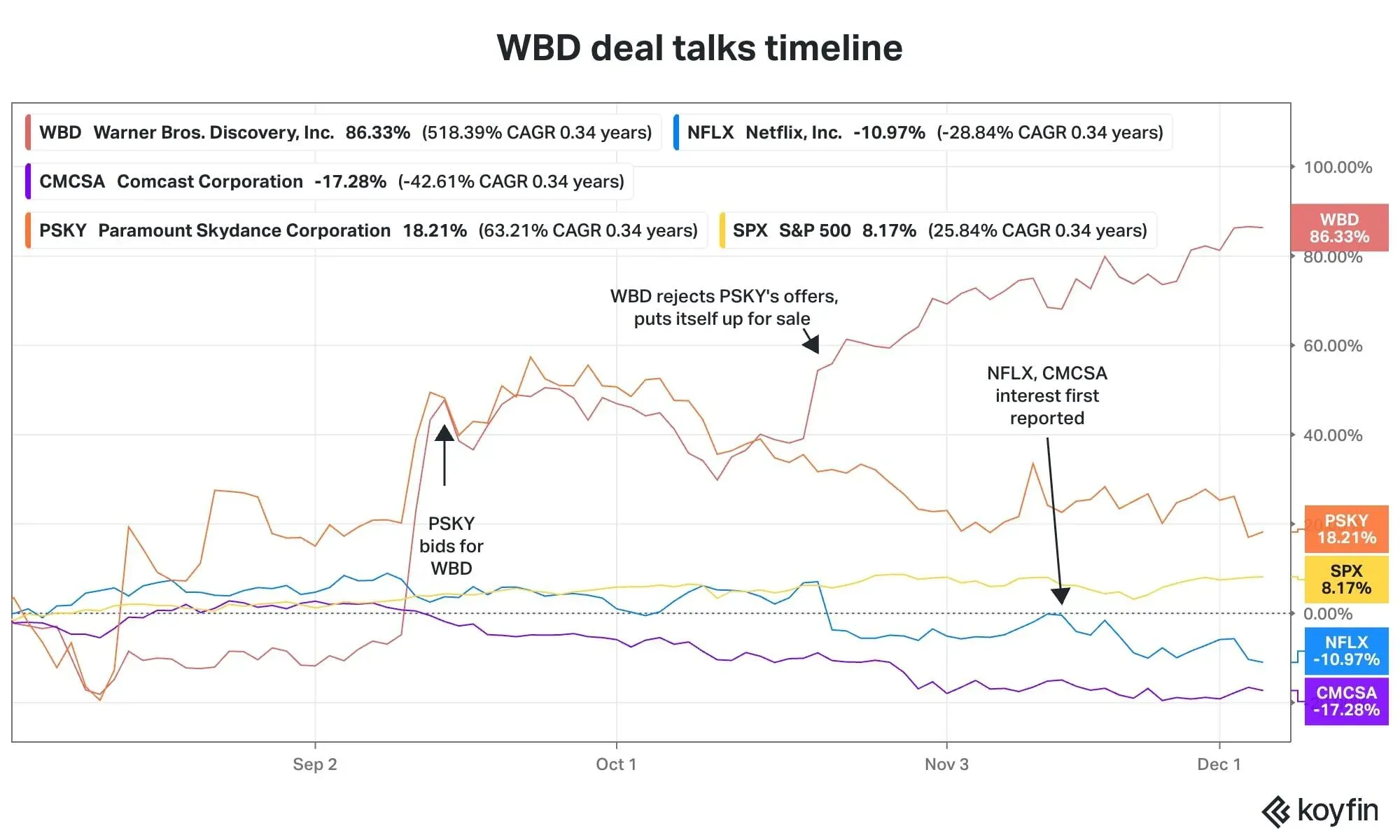

The newly formed Paramount Skydance is the most interested party, having been the first to submit a $60 billion offer for the entire company three months ago. The Ellisons (Paramount chairman David Ellison and his father, Larry Ellison, the co-founder of Oracle) also have significant cash muscle. In fact, Paramount is engaging in a bit of gamesmanship — arguing that a Netflix deal would never clear antitrust hurdles, touting its stronger sway in Washington, and even dangling a hefty $5 billion breakup fee to WBD if a Paramount–Warner Bros. merger falls through. It has even questioned the fairness of the sale process.

All in all, it’s a battle of the billionaires, and their deal makers are probably skipping the holidays. Stocktwits previously wrote about what buying out Warner Bros. would mean for each of the contenders, and here’s a closer look at what the Netflix deal would mean for both parties.

Content Strategy

Reports suggest that Netflix would keep the HBO Max platform independent and might sell a bundled offering. That would not only lower subscriber costs but also appeal to competition regulators.

Acquiring only the studio and streaming assets would bolster Netflix’s own content and streaming operations while allowing it to steer clear of the one area it knows little about: cable TV.

But there’s a hitch: both Netflix and HBO Max remain relative laggards in sports — a major growth arena where rivals like Amazon Prime Video and Paramount have pulled far ahead in recent years. That means, even after a potential combination, Netflix would be spending billions of dollars on sports rights.

Financials

Netflix is reportedly making a majority-cash offer for Warner Bros.’ assets and is also working to secure tens of billions in financing to fund the purchase. That means it would spend only a small part of its cash in the bank and shares for the deal, but would end up with hefty debt. Netflix currently has a debt-to-equity ratio of about 3.8%, which is way lower than the median S&P 500’s 21% (a lower percentage implies a better figure.)

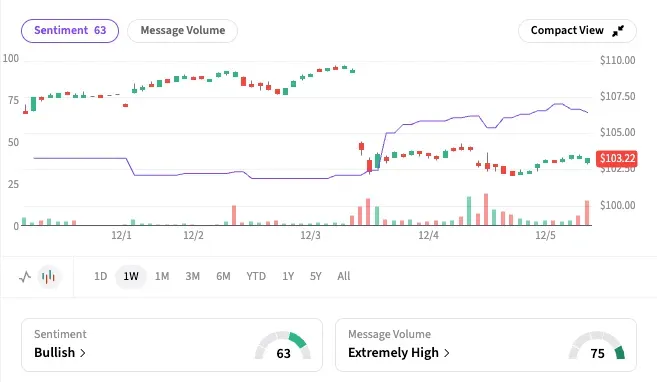

The other question is how much of Warner Bros.’ hefty $60 billion debt Netflix would be expected to assume. Without financial terms, Netflix investors are growing slightly concerned. Since Nov. 13, when interest from Netflix and Comcast was first reported, NFLX stock has declined about 10%.

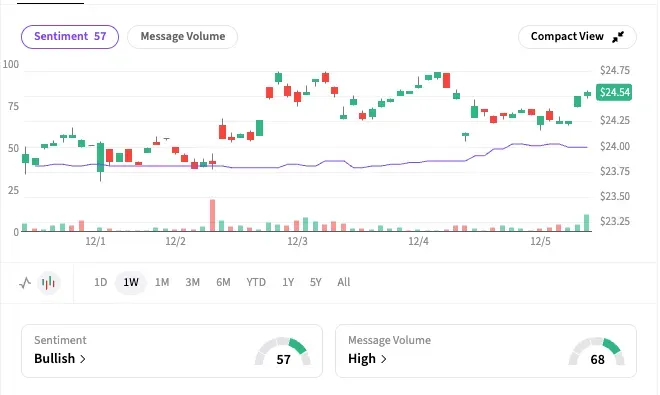

WBD closed at $24.54 on Thursday, amid a sharp rally this year. As per the latest figures, the company had a market capitalization of $60.8 billion and total liabilities of $63.2 billion.

On Stocktwits, Netflix’s retail sentiment has risen over the past week to ‘bullish,’ with significant retail chatter around the stock on the platform. The sentiment for WBD has also been trending upward, with the most recent rating ‘bullish.’

For updates and corrections, email newsroom[at]stocktwits[dot]com.<