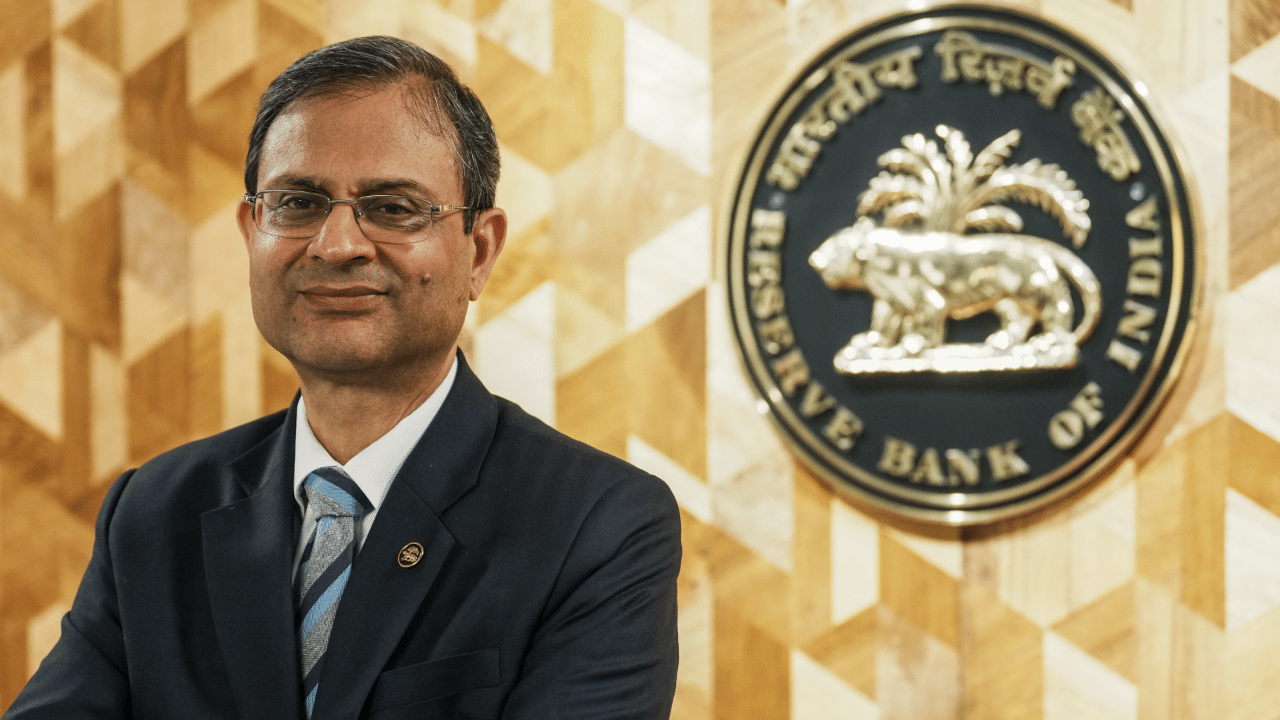

Kolkata: Though the GDP growth rate of 8.2% in Q2FY26 was beyond the expectations of most experts, there is a growing opinion that Reserve Bank of India MPC might not snip the policy Repo Rate further from the existing 5.5% today. All eyes are therefore set on what the central bank governor Sanjay Malhotra announces at 10 am.

The most significant aspect of a Repo Rate cut for the common person is that EMIs on a whole range of loans — home loan, car loan, personal loan as well as education loan — will come down. While those who will apply for new loans will get cheaper rates, those who have already taken loans, will get the benefit of lower EMIs or reduced repayment period to extinguish their running loan.

Rate cut unlikely

RBI has a dual role — one, to keep inflation in check and two, keep growth rates high. In short, it has a balancing act between growth and inflation. While one view is that the central bank an take the advantage of low inflation to try to bring down the cost of capital to boost consumption, and thereby further push the growth upwards, the other view is the RBI can relax this time since the growth rate is already quite satisfactory.

Low inflation, high GDP growth

The retail inflation, or consumer price index-based headline retail inflation, is below the 2% lower band mandated by the government for the last two consecutive months. Therefore, some analysts believe with GDP growth being pushed by GST rate cut, public investment, fiscal consolidation and other reforms, RBI can sit back this time.

RBI has cut the Repo Rate thrice this year between February and August, when a total of 100 basis points were shaved off the policy rate which was at 6.5% at the beginning of this year.

“Close call” says HDFC Bank

“Therefore, the upcoming RBI rate decision remains a close call. But given the lingering risks on growth (in H2) and inflation expected to remain well below 4 per cent until Q3 FY27, we see that there may still be a chance of another 25bps rate cut at the upcoming policy,” read a HDFC Bank report.

SBI Research the economic think tank of the State Bank of India has said that helped by strong GDP growth and minimal inflation, it is now for the RBI to communicate to the broader markets the rate trajectory in the MPC meeting this week. It has signaled that RBI could maintain its neutral stance.

“It would be a close call on the repo rate. Given that monetary policy is forward-looking and inflation in Q4-FY26 and FY27 is likely to be in the 4 per cent plus region, yielding a real repo rate of 1-1.5 per cent, the policy rate appears to be at a fair level…. Under these conditions, we do not think that there should be any change in the policy rate,” Madan Sabnavis, chief economist, Bank of Baroda was quoted in the media as saying.

Aditi Nayar, Chief Economist, ICRA opined that with the Q2 FY2026 GDP growth exceeding 8 per cent, a rate cut in the December 2025 MPC review now appears unlikely, notwithstanding the series-low CPI inflation print for October 2025.