On the company’s earnings call, Ashim Gupta said UiPath delivered a strong performance, hitting major profitability and customer-growth milestones.

- UiPath recorded quarterly revenue of about $411 million, reflecting a 16% increase year-on-year.

- Its annual recurring revenue (ARR) climbed to approximately $1.78 billion, up around 11% YoY.

- The number of customers with at least $100,000 in ARR rose to 2,506.

UiPath, Inc. (PATH) Chief Operating and Financial Officer Ashim Gupta said that the third-quarter (Q3) marked the first time UiPath posted a GAAP-profitable result, an achievement that puts the firm on course for a profitable full year.

On the company’s earnings call, Gupta said UiPath delivered a strong performance, hitting major profitability and customer-growth milestones.

“Another quarter of solid top line and bottom line performance, including our first GAAP profitable third quarter and putting us on track for our first GAAP profitable year.”

-Ashim Gupta, CFO, UiPath

Solid Revenue, Expanding ARR

UiPath recorded quarterly revenue of about $411 million, reflecting a 16% year-over-year (YoY) increase. Adjusted earnings per share (EPS) were $0.16. Both revenue and EPS surpassed the analysts’ consensus estimate of $392.87 million and $0.15, respectively, according to Fiscal AI data.

Its annual recurring revenue (ARR) climbed to approximately $1.78 billion, up around 11% YoY. Net new ARR added during the quarter was roughly $59 million. UiPath’s stock traded over 10% higher in Thursday’s premarket.

The number of customers with at least $100,000 in ARR rose to 2,506; those with $1 million or more reached 333. Dollar-based gross retention remained at 98%, while net retention hit 107%.

What Are Stocktwits Users Saying?

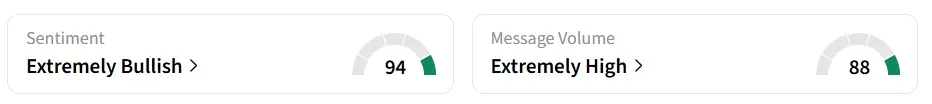

On Stocktwits, retail sentiment around the stock improved to ‘extremely bullish’ from ‘bullish’ territory the previous day, and message volume shifted to ‘extremely high’ from ‘high’ levels in 24 hours.

A bullish Stocktwits user said that UiPath is a steady, less volatile stock.

Another user said the stock is undervalued.

PATH stock has gained over 16% in 2025 and declined 3% in the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<