Intel stock staged a stunning turnaround this year as the struggling chipmaker began to reverse the slide under a new CEO.

- Two of Intel’s smaller chip rivals — AMD and Nvidia — have moved from laggards to leaders through proactive approaches.

- All along, Intel has suffered several product missteps and execution issues, and its foundry business has also been margin-squeezing.

- Retail traders have pinned their confidence on the company, giving TSMC a run for its money in the foundry business.

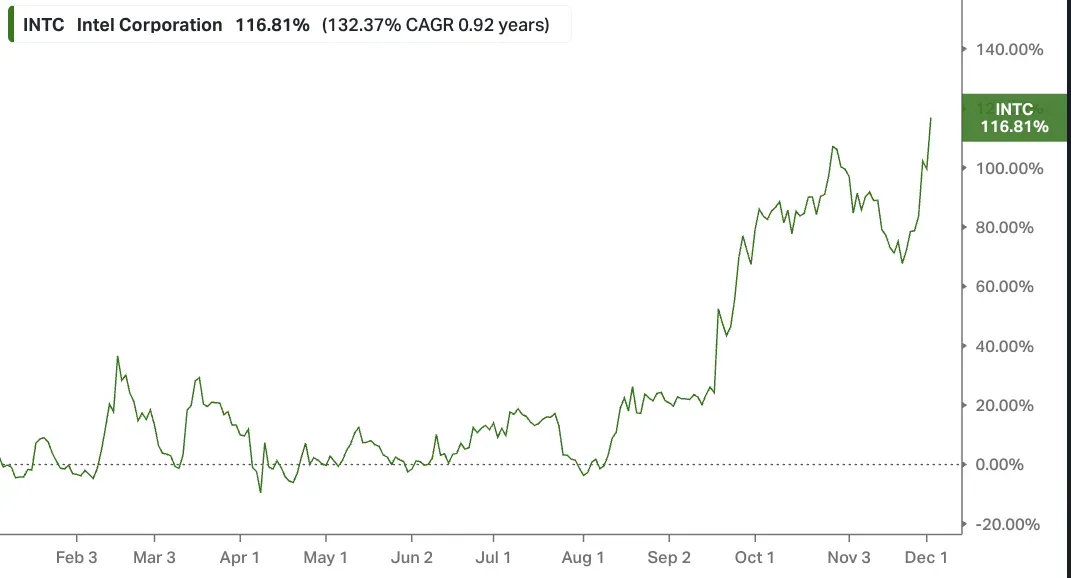

Who could have foreseen that Intel’s battered and beaten-down stock would close out 2025 as one of the S&P 500’s top performers? INTC was down about 16% on the first trading day of the year, with its losses intensifying amid the early-April market plunge. It had lost a quarter of its valuation at that time.

Even as late as August, the stock was languishing. The turnaround came after the Trump administration, with its “America First” agenda, took a 9% stake in the Santa Clara, California-based company. The stake came via conversion of the government’s grant money under the CHIPS Act.

Intel Among Top 10 S&P 500 Performers

Following the stock resurgence, Intel is now the tenth-best-performing S&P 500 stock this year. It is one of the two chipmakers featured on the list, with Micron being the other. Intel’s stock is up 117% year-to-date.

Source: Koyfin Charts<

Stars Align For Intel

Things began to fall into place for Intel with the Trump largesse. In conjunction with the government investment, Masayoshi Son-led SoftBank agreed to plow in $2 billion in Intel. As a cherry on the cake, Nvidia came on board with a $5 billion investment in Intel. The two also agreed to develop custom data center and PC products to accelerate applications and workloads across hyperscale, enterprise, and consumer markets.

The good tidings didn’t end there. On Tuesday, the stock took off on unconfirmed rumors that Apple could tap Intel for sourcing advanced processors. It ended the session up 8.65% at $43.47, its highest level in over 1-½ years.

If the rumors are confirmed, it could be a coup of sorts, as Intel could be back as a significant Apple supplier years after the latter moved away from the chipmaker and began relying on its in-house chips to power its hardware.

A social media post over the weekend by Taiwan-based TFI Securities analyst Ming-Chi Kuo was the source of the rumor, with the rumor spreading around only on Tuesday, buoying Intel’s stock.

New CEO Works His Magic?

Intel may not be out of the woods, but at least it is not staring down the barrel. Two of Intel’s smaller chip peers — AMD (AMD) and Nvidia (NVDA) — have moved from laggards to leaders through proactive approaches.

AMD has never looked back since it began to chart a turnaround with the launch of its Ryzen processors in 2017. The company has also made meaningful inroads into the server market with its EPYC processors. Nvidia, which initially made a name for itself with its gaming GPUs, lapped up the data center opportunity with both hands when it presented itself.

All along, Intel has suffered several product missteps and execution issues, and its foundry business has also been margin-squeezing. Both AMD and Nvidia are fabless chip companies, designing their own chips but outsourcing mass manufacturing.

Intel’s turnaround this year may have been partly orchestrated by a change of guard at the helm in March. Lip Bu Tan took over as CEO after Pat Gelsinger was ousted in December 2024 for failing to make much progress on the assignments he was tasked with.

Under Tan, the company took some bold initiatives, including rightsizing operations and the team, scaling down foundry plans, and focusing on artificial intelligence (AI), which it had previously ignored.

Intel’s foundry business could have a key role in its future. In a November note, Citi analysts said Qualcomm, Broadcom, and Apple could be evaluating Intel Foundry for their chip needs, according to The Fly. In an X post, Tesla CEO Elon Musk said the company’s growing chip needs may force it to look beyond its current suppliers and toward Intel.

Intel Analysts Cautious, But Retail Upbeat

Among the 45 analysts covering Intel, 34 remain on the sidelines, and only four analysts have either ‘Buy’ or ‘Strong Buy’ ratings. Seven analysts have either ‘Sell’ or ‘Strong Sell’ recommendations, according to Koyfin. The caution may have been due to the strong stock run since August. The average price target for Intel’s stock ($37.27) implies roughly 14% downside from current levels.

On Stocktwits, retail sentiment toward the stock has turned ‘bullish’ following the Apple chip speculation. Some users premise their optimism on the company emerging as a potent rival to TSMC if it can scale up its 18A 2-nanometer process node technology.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<