The company raised its outlook as more customers adopted its Falcon platform amid rising AI-led demand.

- Q3 Earnings and revenue edged past expectations, driven by strong ARR gains.

- Demand broadened across security segments with continued Falcon Flex adoption.

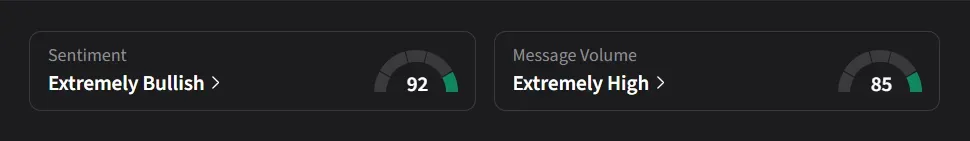

- Retail sentiment on Stocktwits was ‘extremely bullish’ even as some traders flagged broader market fatigue.

CrowdStrike Holdings (CRWD) on Tuesday posted quarterly results that came in slightly ahead of Wall Street expectations and raised its full-year forecast, helped by stronger demand for its Falcon platform and rising AI-related adoption.

The stock closed the regular session up 2.5% and edged up 0.7% in after-hours trading at the time of writing.

Q3 Review

The cybersecurity firm reported adjusted earnings per share (EPS) of $0.96, above the $0.94 consensus, and revenue of $1.23 billion, edging past estimates of $1.22 billion. Net new annual recurring revenue reached $265 million, up 73% from a year earlier, while ending ARR rose 23% to $4.92 billion. CEO George Kurtz said, “Q3 was one of our best quarters in company history.”

Subscription revenue totaled $1.17 billion, up 21% from a year ago. GAAP subscription gross margin was 78% and non-GAAP 81%. The company’s GAAP net loss was $34 million versus $16.8 million a year ago. Adjusted net income increased to $245.4 million from $190.9 million.

The company said growth accelerated across endpoint, cloud security, next-generation identity and security information and event management (SIEM) businesses and highlighted rapid adoption of its Falcon Flex subscription model, and cited partnerships with names like AWS, EY, CoreWeave and Kroll.

Outlook

For the fourth quarter (Q4), CrowdStrike expects adjusted EPS of $1.09 to $1.11, above the $1.08 analyst consensus. The company guided Q4 revenue to $1.29 billion to $1.30 billion, in line with analysts’ $1.29 billion estimate.

For the full year, the company raised its outlook and now sees revenue between $4.79 billion and $4.80 billion. It expects adjusted net income of $949.6 million to $954 million and EPS of $3.70 to $3.72, while maintaining a 21% non-GAAP tax rate.

Stocktwits Users Weigh In With Bullish Praise

On Stocktwits, retail sentiment for CrowdStrike was ‘extremely bullish’ amid ‘extremely high’ message volume.

One user said the stock was the “best gamble of my life and keeps on giving!”

Another user suggested that the market looks worn out, noting that even solid earnings, new deals, and stronger guidance aren’t triggering much excitement. They pointed out that CrowdStrike remains a “solid long-term hold,” but said investors shouldn’t expect steady performers to suddenly rally 20%–30% in the near term. They added that any sharp move higher would likely face quick profit-taking.

CrowdStrike’s stock has jumped 51% so far this year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<