The company reported an IRS refund, bringing it closer to monetizing roughly $1 billion in accrued refundable credits.

- The refund follows earlier 2025 payments of $186.5 million tied to fiscal-year 2023 and 2024 federal tax filings.

- With the latest cash injection, Wolfspeed’s liquidity has swelled to about $1.5 billion.

- Support from section 48D has helped the company’s shift from 150 mm to 200 mm wafer technology.

Wolfspeed, Inc. (WOLF) announced on Monday that it has received $698.6 million in cash tax refunds from the Internal Revenue Service (IRS) under the Advanced Manufacturing Investment Credit (AMIC).

The refund marks a significant move, bringing Wolfspeed closer to monetizing roughly $1 billion in accrued refundable credits under section 48D.

Refund Boosts Cash Position

The refund follows earlier 2025 payments of $186.5 million tied to fiscal-year 2023 and 2024 federal tax filings. With this cash injection, Wolfspeed’s liquidity has swelled to about $1.5 billion, giving the firm greater flexibility to expand its 200 mm silicon carbide wafer production capacity.

The firm plans to use roughly $192.2 million of the refund to pay down approximately $175 million of existing secured debt, with the remainder supporting general corporate needs.

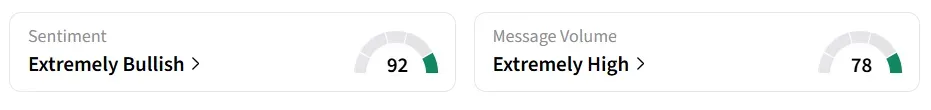

Wolfspeed’s stock traded over 7% higher on Monday mid-morning. On Stocktwits, retail sentiment around the stock remained in ‘extremely bullish’ territory, and message volume jumped to ‘extremely high’ from ‘low’ levels in 24 hours.

Strategic Investments

Wolfspeed has invested heavily in building a U.S.-based, vertically integrated supply chain for silicon carbide wafers and power devices over the past few years. Support from section 48D has helped the company’s shift from 150 mm to 200 mm wafer technology.

The refund not only strengthens Wolfspeed’s balance sheet but also aids its ability to scale advanced manufacturing operations at a time when global demand for energy-efficient, high-performance power devices is rising.

“This substantial cash infusion further strengthens our liquidity position at a critical phase in Wolfspeed’s strategic evolution.”

-Gregor Van Issum, CFO, Wolfspeed

WOLF stock has gained over 227% in 2025 and over 96% in the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<