As a disappointing year comes to a close, some retail investors expect fireworks after GME’s quarterly report next week.

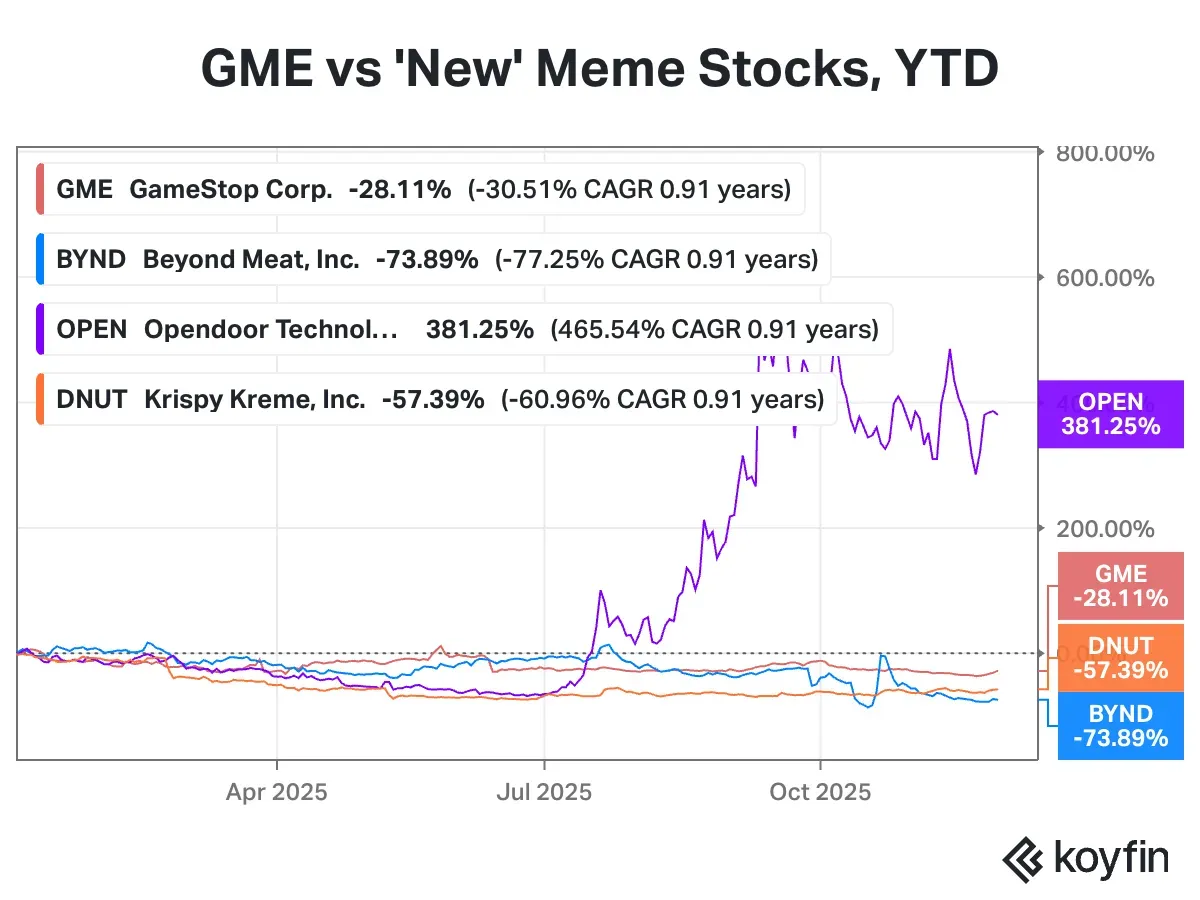

- GameStop shares have declined about 30% year to date, as “new” meme stocks such as Opendoor and Beyond Meat have drawn significant interest.

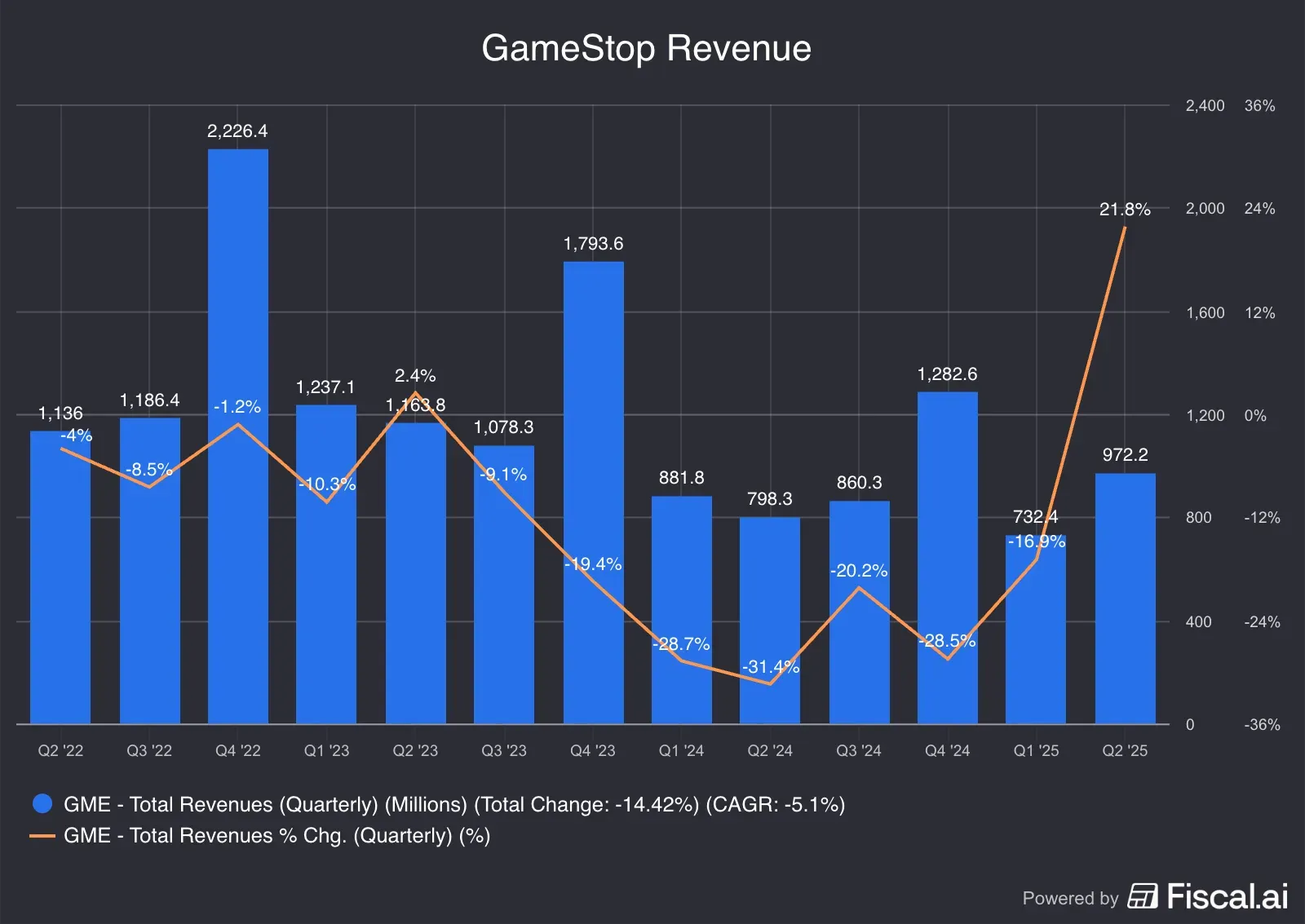

- GameStop’s core business is in decline, even as it doubles down on e-commerce and collectibles and shutters stores.

- Retail investor forums, however, are buzzing with speculation, including on a buyback; the company will report Q3 results on Dec. 9.

Investors waited and waited some more in 2025, but the GameStop rally never really came.

In a year that saw the emergence of a “new” crop of meme stocks, such as Opendoor, Krispy Kreme, and Beyond Meat, among others, the OG meme stock has faded into oblivion.

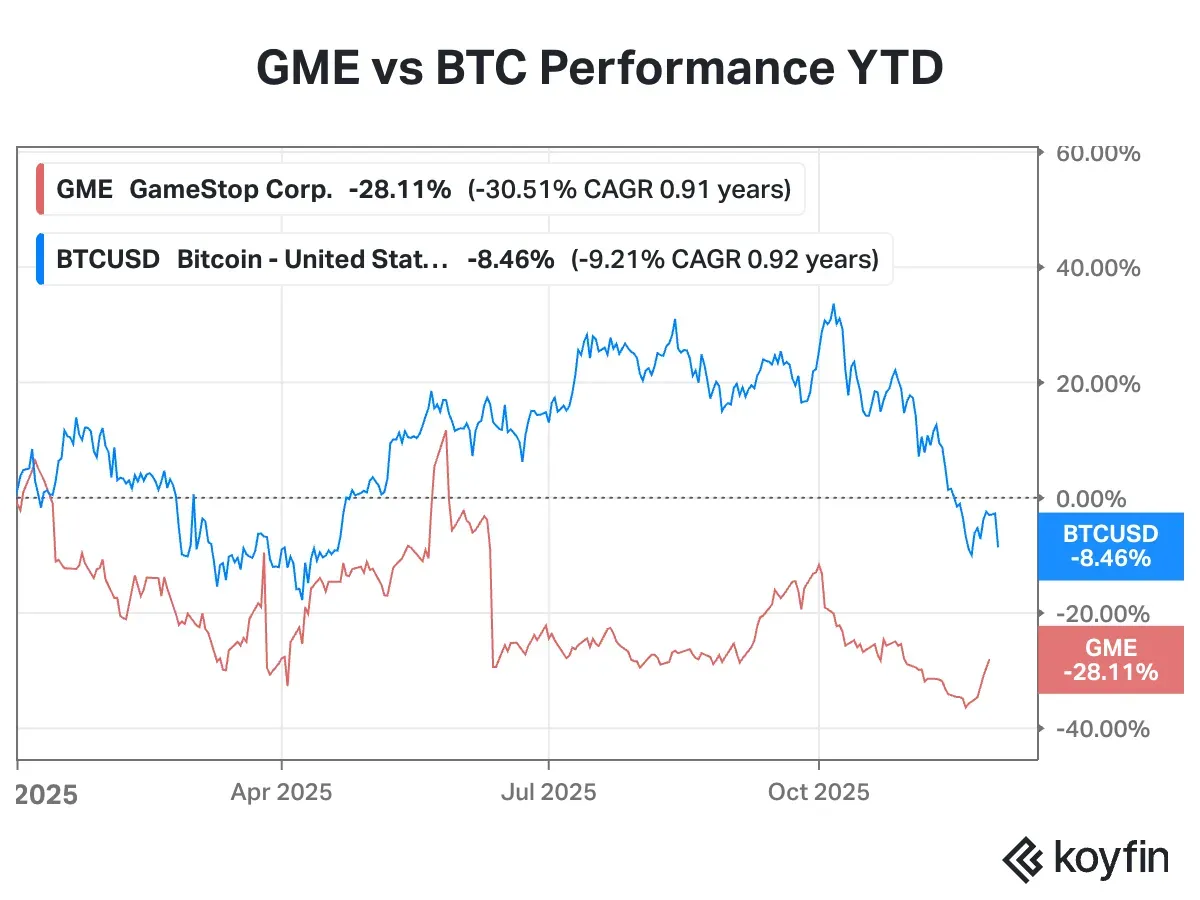

Not that the video game retailer didn’t try to bring itself back to the centre of retail discourse – there was its famous Bitcoin treasury pivot from March, a doubling down in June, and a recent warrant issue – but its bleak fundamental performance is now driving the shares.

What’s more, its biggest supporter, Keith Gill a.k.a. “Roaring Kitty,” has been virtually absent from the scene this year.

With a modest rebound in shares – GME gained about 12% last week after declining for four weeks straight – chatter has picked up again on retail investor forums like Stocktwits and Reddit’s r/WallStreetBets. But will it sustain?

At the time this report was written, GME was the top-trending ticker on Stocktwits, with a ‘bullish’ sentiment reading, a score a notch higher than a year ago but lower than the ‘extremely bullish’ mood from six months prior. The stock’s retail following on the platform has grown by only about 3% over the past year.

But optimism very much lingers in the air. “There is something i feel it!” a user posted excitedly with a GIF showing an ascending line in a chart.

It’s hardly the first time retail investors are expecting a rally based on their gut, but some also made valid arguments. GameStop is reporting its third-quarter results on Dec. 9 – and with $8.7 billion in cash and equivalents (twice as much as last year) and another $528 million in Bitcoin, the company has the capacity to announce big moves. At least one Stocktwits user was upbeat.

What Happened Last Week?

“Big Short” fame investor Michael Burry posted a previously unseen 2019 letter from Gill backing Burry’s then-recent comments regarding GameStop. Burry, a GameStop shareholder, had written to the company’s board, urging it to aggressively do buybacks and reduce senior management pay, among other suggestions.

In 2021, Gill rallied behind GameStop, sending its stock up multifold.

“Burry kept that email private for six years. He posted it today. With the stock back in the low 20s. You can’t make this up,” a user posted on r/Superstonk, a dedicated forum for GME, speculating a big move.

Separately, GameStop on Friday unveiled a notably innovative initiative that’s drawing fresh attention from everyday consumers. On Dec. 6, the company is hosting a “Trade Anything Day,” where consumers can bring in almost any physical item and swap it for $5 in store credit.

There are some rules: Each customer gets only one item, it must fit inside a 20-by-20-by-20-inch box, and store managers can refuse anything that doesn’t meet the guidelines. Social media is lit up with comments about the promotion.

What’s Working For GME — And What’s Not?

Recently, GameStop has made a bigger push into collectibles, including trading cards, board games, and video game merchandise, and shuttered more physical stores to sharpen its e-commerce focus. The latter is a response to more game sales happening online on platforms such as Amazon.

Fans are also upbeat about GameStop’s recently launched platform for trading and storing gaming cards, also known as Power Packs.

However, on a broader level, it’s a bleak picture. GameStop’s revenue has shrunk in the last three financial years, although there has been some rebound in the past two quarters.

Its Bitcoin play has also failed to deliver the expected upside for GME stock (see chart). For the year, the shares have dropped 29%.

With the last of the analysts suspending their coverage, according to Koyfin data, there are no reliable projections. That said, the year is not yet, and the OG meme player might still have some moves up its sleeve. Investors will know next week.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<