The Japanese 10-year bond yield has risen to levels not seen in more than 17 years.

- Japan, with its zero-interest rates and massive liquidity, has served as a major funding source for global carry trades.

- According to estimates, Japanese institutions now hold about $1.1 trillion in U.S. Treasuries, the largest foreign position.

- Businessman and author Robert Kiyosaki said, “The biggest crash into history began over Thanksgiving,” with Japan signaling its intention to raise rates.

Japan has once again sparked panic among U.S. investors, even as they are grappling with a raft of domestic headwinds. The Bank of Japan (BoJ), which maintained its interest rates at near-zero to negative levels for more than two decades, may have chosen an inopportune time to restart its rate-hike chatter.

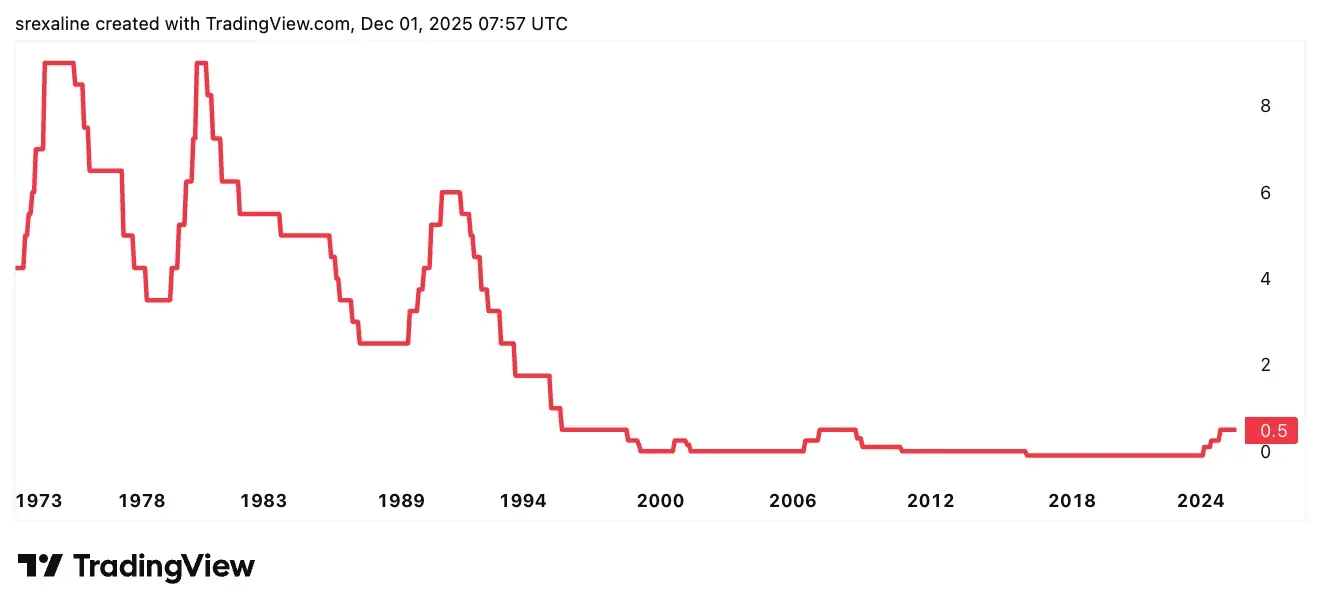

When the Japanese central bank began raising interest rates from negative to 0-0.25% in March 2024, marking the first increase in 17 years, and then raised them further to around 0.25% in July 2024, the domestic and global markets took a tumble.

The global markets could be witnessing a deja vu. Why does a Japanese rate hike create a ripple in the U.S. markets, impacting riskier bets across the board?

On Aug. 5, 2024, the S&P 500, a measure of broader market performance, fell 3% after Japan’s Nikkei 225 Average slumped 12%, marking the worst day since the Black Monday crash in 19867. Fears concerning the unwinding of carry trades were blamed for the sell-off.

What Are Carry Trades?

For decades, Japan’s zero-rate policy made the yen one of the cheapest funding currencies on earth. Some of investors’ favorite plays were to borrow in yen at near-zero rates, invest in higher-yielding assets (like U.S. stocks or Treasuries), and pocket the spread. This “carry trade” actually carries a lot of weight.

Japan, in fact, pursued an ultra-easy monetary policy since the start of the century, inspiring a flourishing carry trade. When the underlying currency strengthens, there is less incentive to put it to work, leading to unwinding of positions. This, in turn, results in a large-scale sell-off.

As author and businessman Robert Kiyosaki put it bluntly on X: “The Japanese ‘carry trade’ blew the assets of the world into the biggest bubble in the world.” Put simply, a surge in JGB yields threatens that entire structure. If borrowing costs in Japan rise, the math behind the carry trade no longer makes much sense, and capital can rush out of America.

Source: TradingView<

Japan held a net $3.62 trillion in overseas stocks and bonds at the end of June, Reuters reported, citing IMF data. An August 2024 report from JPMorgan stated that a negative policy rate in Japan enticed Japanese households, pension plans, state-owned banks, and the BoJ to create a $20 trillion carry trade. Japan used its low-cost borrowing rate to invest in overseas assets and longer-term domestic assets.

JGB Yields Spiral Higher

On Monday, the yield of Japanese government bonds, called JGBs, spiked across the curve, with Bank of Japan Governor Kazuo Ueda’s comments on the monetary policy trajectory triggering the rise. While speaking to business leaders in the city of Nagoya, Ueda said the mechanism by which both wages and prices rise moderately has been restored and that the central bank is actively collecting information on companies’ wage-raising intentions, according to Nikkei.

The BoJ will “consider the pros and cons of raising the policy interest rate and make decisions as appropriate,” Ueda said.

A Reuters report stated that the odds of a rate hike at the Dec. 18-19 BoJ Monetary Policy Committee meeting have risen to 80%, up from 60% last week.

The 10-year JGB yield was last seen trading up 3.77% to 1.87%, marking the highest level in more than 17 years. The 2-year bond yield jumped 5.03% to 1.023%, its highest level since June 2008.

Markets React

Japan’s main stock market gauge, the Nikkei 225 average, shed nearly 2% on Monday, which happens to be the first trading session of December, as domestic rate-hike chatter sent the yen higher against major global currencies and bond yields higher.

Against this backdrop, the SPDR S&P 500 ETF (SPY) and the Invesco QQQ Trust (QQQ), exchange-traded funds (ETFs) that track the S&P 500 and Nasdaq 100 Indices, fell 0.55% and 0.67%, respectively, in Monday’s premarket session. The major index futures were also lower early Monday.

For the year, the SPY, QQQ, and the iShares MSCI Japan ETF (EWJ) have gained 17.6%, 21.6%, and 24.7%, respectively.

Fed To Go The Other Way?

The Federal Reserve is widely expected to cut the Fed funds rate by a quarter point at its rate-setting meeting scheduled for Dec. 9-10. The central bank has already cut rates by the same magnitude twice this year. The Trump administration is pressuring the central bank to reduce rates further to reinvigorate the domestic economy, which is facing multiple challenges, including a bloated fiscal deficit, a stuttering job market and inflation that stays above the central bank target.

Also, at the October meeting, the Fed stated that it would end its quantitative tightening (QT), a stance that would allow it to shrink its balance sheet by allowing bonds to mature without reinvesting the proceeds. According to MFS Investment Management, the end of QT would exert downward pressure on the dollar.

Will Seasonality Provide Thrust?

Despite uncertainties, the U.S. market is entering one of its seasonally strong periods, following a robust performance so far this year. The year-end rally, referred to as the “Santa Claus rally,” is attributed to year-end tax strategies and portfolio rebalancing, end-of-the-year bonus deployment and to some extent to the holiday cheer.

The S&P 500 Index, a measure of broader market performance, has gained 16.5% this year, with megacap tech stocks exposed to artificial intelligence (AI) powering much of the advance. The index is trading just 1% below its all-time high. That said, year-end gains are not a given. AI skepticism has been building up, causing a reversal in some of the high-flying exposed names, and macro and geopolitical uncertainties abound.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<