According to a Hunterbrook media report, Jumia has overcome stiff competition from Chinese rivals like Shein and Temu and is leveraging local infrastructure and community-focused services to stage a comeback.

- Jumia’s revival comes after a complete overhaul of the leadership and strategy, and moving executives closer to customers.

- Jumia’s stock had fallen more than 95%, from over $60 in 2021 to under $2 in 2025.

- Jumia’s products are now frequently 60% to 70% cheaper than Temu’s equivalent items.

Jumia Technologies (JMIA), once dismissed as the “Amazon of Africa,” is reportedly reclaiming its foothold in Nigeria’s e-commerce market after years of financial struggles.

The company has overcome stiff competition from Chinese rivals like Shein and Temu and is leveraging local infrastructure and community-focused services to stage a comeback.

Resilient Comeback

According to a Hunterbrook Media report, the revival comes after a complete overhaul of the leadership and strategy, moving executives closer to customers and tailoring operations to local needs. Jumia CEO Francis Dufay admitted to Hunterbrook that the company once seemed doomed. “This company was as good as dead,” he stated.

The new approach emphasizes pickup stations, localized support, and operational efficiency. In Isolo, Lagos, Jumia’s distribution center runs 24/7 during peak seasons, such as Black Friday.

Jumia’s stock traded over 6% higher on Friday mid-morning.

From Collapse To Strategic Growth

After a decade of missteps in attempting to replicate Western delivery models, Jumia’s stock had fallen by more than 95%, from over $60 in 2021 to under $2 in 2025, the report said.

Initiatives, including opening pickup stations in underserved regions, reducing prices on essential goods, and prioritizing practical products over luxury brands, helped Jumia regain lost trust and control costs.

When Temu and Shein entered the Nigerian market, they flooded it with aggressive promotions. Yet, Jumia’s localized model, cash-on-delivery payments, faster delivery times, and responsive customer support allowed it to maintain an advantage. Data from Hunterbrook indicates Jumia’s products are frequently 60% to 70% cheaper than Temu’s equivalent items.

What Are Stocktwits Users Saying?

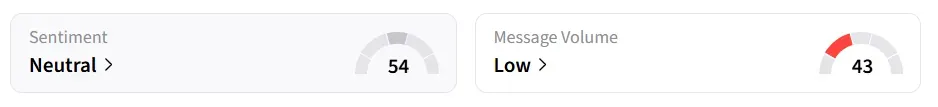

On Stocktwits, retail sentiment around the stock remained in ‘neutral’ territory amid ‘low’ message volume levels.

A Stocktwits user expressed optimism about the company’s prospects.

Another user highlighted the growing population in Africa and the region’s untapped demand.

JMIA stock has gained over 222% in the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<