According to sources quoted by a New York Post report, Comcast’s chief, Brian Roberts, is preparing a new proposal that could top existing offers.

- Roberts is weighing a fresh offer for WBD’s studio and streaming segments that could reach as high as $27–$28 per share.

- Comcast’s leadership sees the potential acquisition as a way to revitalize its media arm.

- WBD has requested that interested buyers submit higher offers by December 1.

The fight for Warner Bros. Discovery Inc. (WBD) may get hotter as Comcast Corp (CMCSA) reportedly plans to join the second round of bidding. According to sources quoted by a New York Post report, Comcast’s chief, Brian Roberts, is preparing a new proposal that could top existing offers.

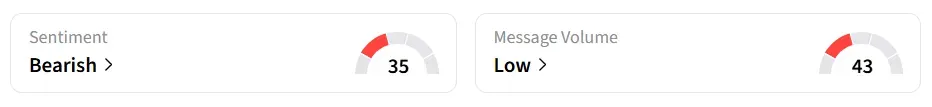

Comcast stock inched 0.04% higher in Friday’s premarket. On Stocktwits, retail sentiment around the stock remained in ‘bearish’ territory, and message volume changed to ‘low’ from ‘normal’ levels in 24 hours.

Comcast Prepares Stronger Bid For WBD

According to the report, Roberts is weighing a fresh offer for WBD’s studio and streaming segments that could reach as high as $27–$28 per share. That price reflects only the entertainment and streaming assets, not WBD’s whole cable network business.

This would surpass the roughly $25‑per‑share bid already submitted by Paramount Skydance (PSKY) for the entire company. Consequently, Paramount Skydance has formed an investment consortium including Saudi Arabia’s Public Investment Fund (PIF), the Qatar Investment Authority (QIA), and the Abu Dhabi Investment Authority (ADIA) and is expected to submit a $71 billion bid.

Why Comcast Is Making Its Move

Comcast’s leadership reportedly sees the potential acquisition as a way to revitalize its media arm. With a modest studio, a lagging streaming service in Peacock, and growing debt, Comcast could gain a considerable advantage by pairing its distribution infrastructure with WBD’s studios and marquee streaming content, the report added.

According to a Reuters report, WBD has asked interested buyers to submit higher offers by December 1. The company has so far received initial bids from Paramount Skydance, Comcast, and Netflix (NFLX).

CMCSA’s stock has lost over 29% in 2025 and over 38% in the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<