The move reflects Citi’s growing confidence in Brinker’s ability to navigate a more favorable cost environment.

- Analyst Jon Tower highlighted that the easing of Brazil’s food tariffs could reduce cost pressures.

- Citi said the surge in media spending has contributed to growing brand engagement.

- Brinker’s stock traded over 7% higher on Tuesday mid-morning.

Citi has upgraded Brinker International Inc. (EAT), the operator of Chili’s and Maggiano’s Little Italy, to ‘Buy’ from ‘Neutral’, raising its price target to $176 from $144.

The move reflects Citi’s growing confidence in Brinker’s ability to navigate a more favorable cost environment while maintaining strong sales momentum through fiscal 2026, according to TheFly.

The new price target implies 25% upside from the stock’s Monday closing price.

Cost Pressure Management

According to a CNBC report, analyst Jon Tower highlighted that the easing of Brazil food tariffs could reduce cost pressures, particularly on beef, strengthening the company’s margin outlook.

Tower also emphasized that Brinker’s initiatives to attract younger diners are proving effective, creating sustained traffic growth and loyalty that supports ongoing sales expansion.

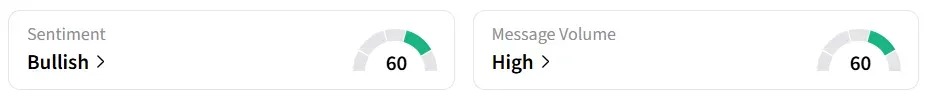

Brinker’s stock traded over 7% higher on Tuesday mid-morning. On Stocktwits, retail sentiment around the stock remained in ‘bullish’ territory amid ‘high’ message volume levels.

Strong Traffic And Brand Loyalty

According to the report, Chili’s has experienced a consistent increase in customer visits over the past six quarters. The surge in media spending, from roughly $58 million in fiscal 2023 to around $145 million in fiscal 2025, has contributed to growing brand engagement, particularly among younger demographics.

Tower stated that the conversion metrics indicate that this rise in traffic is sustainable and likely to persist through fiscal 2026 and beyond. Brinker operates or franchises a restaurant network of more than 1,600 locations in the U.S., two territories, and 28 countries.

EAT stock has gained over 14% in the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<