The Indian stock market is witnessing a subdued trend in a choppy session on Tuesday, November 25, despite largely positive cues from global markets.

The benchmark indices, Sensex was flat, while the Nifty 50 was holding above 25,900 level.

Gains were seen in PSU banks, pharma, realty, metals and auto sectors, while IT, media and FMCG sectors saw selling pressure.

Among Nifty 50 constituents, Bharat Electronics, Dr Reddy’s Laboratories, State Bank of India (SBI), JSW Steel and Hindalco Industries were the top gainers, while Adani Enterprises, Infosys, Tata Motors Passenger Vehicles, Adani Ports & SEZ and Eicher Motors led the losses.

In the previous session, Nifty 50 settled 108.65 points, or 0.42%, lower at 25,959.50, forming a big bearish candle on the daily chart, indicating weakness.

Nifty Options Highlights

In the options market, the highest Nifty Open Interest (OI) on the Call side was at the 26,100 strike, followed by 26,200, which could act as resistance levels. On the Put side, the highest Open Interest was at 26,000, followed by 25,700, which may serve as support levels, Axis Securities said.

According to the brokerage firm, the premium for the At-the-Money option is ₹360, indicating a likely trading range for the week between 25,600 and 26,400.

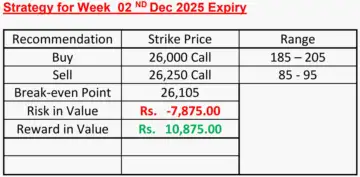

Nifty Options Strategy for 2 December 2025 Expiry

Recommended Strategy: Bull Call Spread

Axis Securities has recommended a Bull Call Spread strategy for Nifty options contracts expiring on 2 December 2025, forecasting a moderately bullish view.

A bull call spread strategy involves buying a call option with a strike price lower than current market price of the underlying asset, which is Nifty 50, and simultaneously selling another call option with a higher strike price (out-of-the-money), both with the same expiration date. This strategy is applied when the outlook is moderately bullish.

Strategy Details

Buy 1 lot of Nifty 26,000 Call at ₹185 – ₹205

Sell 1 lot of Nifty 26,250 Call at ₹85 – ₹95

Break Even Point: 26,105

The strategy involves buying one lot of the 26,000 strike Call Option and simultaneously selling one lot of the 26,250 strike Call Option.

Risk-Reward Analysis

According to Axis Securities, the maximum potential risk for this Nifty options trading strategy is ₹7,875, whereas the potential maximum reward is ₹10,875.

“Traders may consider deploying this spread strategy to achieve moderate returns while maintaining controlled risk and reward,” said Axis Securities. It suggests entering and exiting all the legs in strategy together and squareing-off the strategy before the expiry session closes.