Firefly rolled out a nearly 18% price cut in Norway after weaker-than-expected demand and significantly reduced delivery targets.

- Firefly rolled out a nearly 18% price cut in Norway after weaker-than-expected demand and significantly reduced delivery targets.

- Nio is expanding the brand into new global markets, including right-hand-drive regions, while scaling exports beyond China.

- Investors head into earnings, watching whether Nio can balance discounting with its push to improve margins and Q4 profitability.

Nio’s effort to reach fourth-quarter profitability came under fresh pressure after its budget EV sub-brand Firefly cut prices sharply in Norway and acknowledged it is racing to clear unsold vehicles before the end of the year. The move comes ahead of the company’s third-quarter (Q3) earnings report, where investors are watching whether Nio can protect margins while aggressively expanding into lower-priced markets.

Firefly Cuts Prices After Weak Start

Firefly introduced a steep 17.9% price reduction on its debut hatchback in Norway, marking its biggest promotional move since deliveries began roughly ten weeks ago. The “Pre-Christmas Offer” applies only to existing inventory and lowers the starting price from 279,900 DKK ($27,300) to 229,900 DKK ($22,400), according to a report by EV.

The discount reportedly applies to about 85 vehicles, and Firefly’s Norway marketing chief said the brand “hopes to empty” its remaining inventory before year-end.

The move follows slower-than-expected early demand. Firefly had planned to deliver about 500 units in Norway in 2025, but has reportedly cut that target to around 200. As of Monday, the brand had registered just 20 vehicles in the country.

Rapid Expansion Plans

The cuts arrive as Nio accelerates its multi-brand global strategy. Firefly surpassed 30,000 cumulative deliveries and recently began right-hand-drive production in Hefei for upcoming launches in Singapore, followed by Macau and Hong Kong later this year.

The brand sold 26,242 units in October, with the majority delivered in China. Exports went to Norway, the Netherlands, and Belgium. Nio expects to enter Firefly in 17 markets globally within the next two years, including Portugal, Greece, Luxembourg, Austria and Denmark, with the UK, Thailand and Australia among those also to be added in 2026.

Norway’s EV Dominance Offers No Boost To Firefly

Norway is one of the world’s most electrified auto markets, with fully electric vehicles accounting for 97.4% of October sales. However, Firefly’s early traction has been limited. The company had also launched financing promotions, including a 1.99% nominal interest rate through a local banking partner, in an effort to boost demand.

Q3 Earnings: What Wall Street Expects On Tuesday

Analysts expect Nio to report revenue of $3.14 billion for Q3, up from $2.65 billion a year earlier. EBITDA is forecast at a loss of $415.99 million, while EBIT is expected to come in at a loss of $519.8 million, compared with a loss of $685.22 million last year. GAAP EPS is estimated at a loss of $0.23, with adjusted EPS projected at a loss of $0.22.

Koyfin data show a 12-month average price target of $6.83, versus Friday’s close of $5.58, implying 22% potential upside. Consensus ratings sit between ‘Buy’ and ‘Hold,’ with 27 analysts covering the stock, with 4 rating it a ‘Strong’ Buy, 10 ‘Buy,’ 10 ‘Hold,’ 1 ‘Sell,’ and 2 ‘Strong Sell.

Stocktwits Traders Keep Long-Term Faith

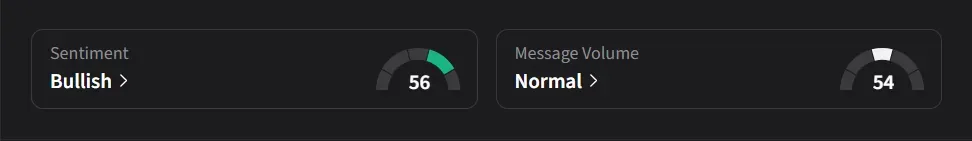

On Stocktwits, retail sentiment for Nio was ‘bullish’ amid ‘normal’ message volume.

One user said short-term moves don’t matter to long-term holders who keep buying, arguing they see Nio as a future “multi-trillion-dollar” tech giant.

Another user expects “excellent results and 5-6% red today. Nio, the most manipulated stock in the market.”

Nio’s U.S.-listed stock has risen 32% so far in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<