The company will ask shareholders to approve a charter amendment to double its authorized common stock from 1.5 billion to 3.0 billion shares.

- Plug Power has planned a special virtual meeting for its shareholders on Jan. 15, 2026.

- Plug said it needs more authorized shares to support future growth plans.

- The company finalized the sale of $375 million in 6.75% convertible notes due 2033.

Plug Power Inc. (PLUG) announced on Friday that it plans to hold a special virtual meeting for its shareholders on Jan. 15, 2026, to approve an amendment to the company’s charter to increase its authorized common stock from 1.5 billion to 3.0 billion shares.

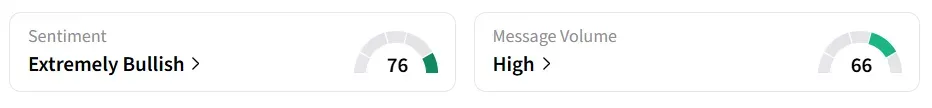

Plug Power stock traded over 1% higher on Friday afternoon. On Stocktwits, retail sentiment around the stock improved to ‘extremely bullish’ from ‘bullish’ territory amid ‘high’ message volume levels.

Objective

The company said it needs more authorized shares to support future capital needs, equity programs, strategic transactions, and its growth plan. It currently has less than 0.4% of its common stock unissued.

“These proposals are essential to ensuring Plug has the resources and flexibility needed to execute on our strategy, meet contractual obligations, reward talent, and advance the hydrogen economy.”

-Andy Marsh, CEO, Plug Power

Debt Offering Completed

Additionally, the company said it finalized the sale of $375 million in 6.75% convertible notes due 2033, including an additional $56.25 million purchased through an over-allotment option, bringing the total to $431.25 million.

Plug received roughly $399.4 million in net proceeds, which the company is using to overhaul its debt profile. The refinancing eliminates all remaining high-interest 15% borrowings, pays off its 2026 convertible notes, and removes the first-lien claim held by a prior lender.

The firm said these moves reduce interest expense and simplify its overall financial obligations.

PLUG stock has lost over 9% in 2025 and gained over 2% in the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<