The move comes after the company posted a strong third-quarter performance, suggesting a potential turnaround after years of cyclical challenges.

- Baird analyst Andrew Wittmann upgraded the stock to ‘Outperform’ from ‘Neutral’.

- Wittmann described Q3 as a “watershed quarter.”

- The firm stated that falling interest rates could provide additional support for WillScot.

WillScot Inc. (WSC) drew investor attention on Friday after Baird analyst Andrew Wittmann upgraded the stock to ‘Outperform’ from ‘Neutral’, raising the price target to $22 from $20.

The move comes after the company posted a surprisingly strong third-quarter (Q3) performance, suggesting a potential turnaround after years of cyclical challenges.

Strong Quarterly Performance

The third quarter marked a notable shift for WillScot, which had witnessed a multi-year downturn. Wittmann described Q3 as a “watershed quarter,” highlighting that the company’s lowered expectations and operational adjustments now point to an “investable bottom,” giving investors renewed confidence in the stock.

In Q3, the company reported a revenue of $567 million and an adjusted earnings per share of $0.30. Revenue missed the analysts’ consensus estimate of $579.6 million while EPS exceeded the estimate of $0.29, according to Fiscal AI data.

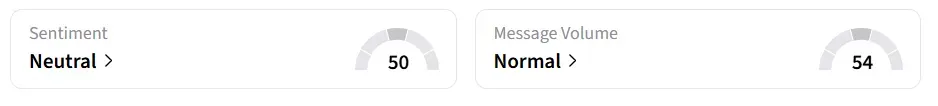

WillScot stock traded over 12% higher on Friday afternoon. On Stocktwits, retail sentiment around the stock remained in ‘neutral’ territory, with ‘normal’ message volume.

Market Conditions And Interest Rates

Falling interest rates could provide additional support for WillScot, particularly as market rotations favor companies poised for growth after extended downturns, the analyst said.

On November 6, the company’s Board of Directors declared a quarterly dividend of $0.07 per common share. The cash dividend will be paid on Dec. 17, 2025, to shareholders of record as of the close of business on Dec. 3, 2025.

WillScot provides easy-to-use modular spaces. The company’s product mix includes mobile offices, modular buildings, classrooms, climate-controlled spaces, protective structures, and clearspan buildings.

WSC stock has lost over 49% in the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<