U.S. spot Bitcoin ETFs saw record net monthly outflows of $3.79 billion in November.

- BlackRock’s IBIT led November withdrawals with $2.47 billion pulled from the fund.

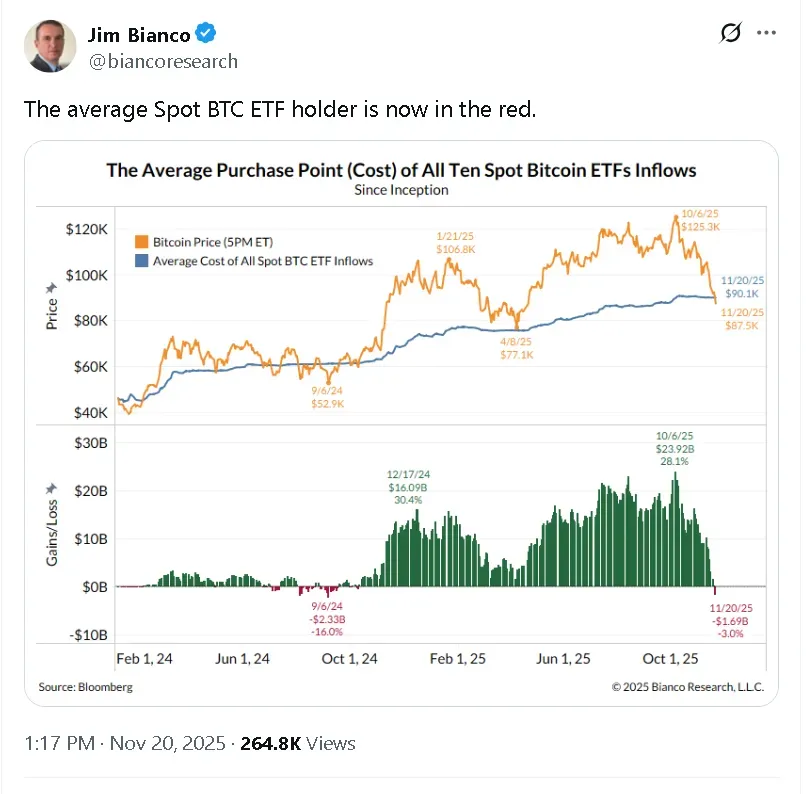

- The average U.S. spot Bitcoin ETF holder has now moved into negative territory, according to Bianco Research.

- Newly launched Solana and XRP ETFs bucked the trend.

U.S. Spot Bitcoin (BTC) exchange-traded funds (ETFs) saw net monthly outflows reach a record $3.79 billion in November, following nearly $1 billion in net withdrawals on Wednesday alone.

The increase in redemptions indicates the mounting pressure across digital asset markets after Bitcoin’s price fell to roughly $82,000 on Thursday morning. According to data from Bianco Research, the average holder of U.S.-listed spot Bitcoin ETFs has moved into negative territory.

On Stocktwits, the apex cryptocurrency was among the top trending tickers with retail sentiment in the ‘bearish’ zone as chatter rose to ‘extremely high’ from ‘high’ levels over the past day.

Record Outflows Hit Bitcoin ETFs

The 11 spot Bitcoin ETFs currently trading in the U.S. have now posted their largest monthly net outflows on record, surpassing the previous high of $3.56 billion set in February. On Thursday alone, spot Bitcoin ETFs logged more than $900 million in redemptions, marking the second-largest single-day outflow since the products launched in January 2024, as per data from SoSoValue,

BlackRock’s IBIT led November withdrawals with $2.47 billion pulled from the fund, extending a month-long reversal from earlier inflows. On Wednesday, it saw net outflows of around $355 million. IBIT’s price fell more than 3% in pre-market trade. On Stocktwits, retail sentiment around the fund dipped to ‘bullish’ from ‘extremely bullish’ but chatter rose to ‘extremely high’ from ‘high’ levels.

IBIT was followed by Grayscale’s Bitcoin Fund (GBTC) and Fidelity’s Bitcoin Fund (FBTC), each posting net outflows exceeding $190 million.

Ethereum (ETH) ETFs were not immune to the selloff. Data shows that outflows across U.S. Ethereum spot ETFs totaled $1.79 billion in November. Ethereum’s price dipped nearly 10% in the last 24 hours to trade at around $2,700, lows that were last seen in July.

The newly launched Solana and XRP ETFs continued to record inflows of $300.46 million and $410 million, respectively.

Read also: Bitcoin Drops To $82,200 Wiping Out $2 Billion In Liquidations – Crypto Market Cap Falls Below $3 Trillion

For updates and corrections, email newsroom[at]stocktwits[dot]com.<