Sudeep Pharma IPO Day 1: The initial public offering (IPO) of Sudeep Pharma sailed through on the first day of the bidding process on Friday, November 21, as it garnered a strong response from high-net-worth individuals and retail investors.

Its shares are also enjoying a strong demand in the grey market.

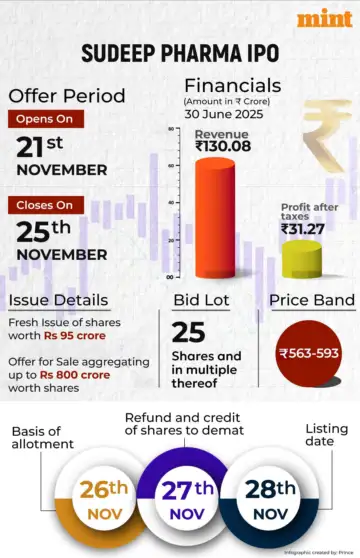

Investors can apply for Sudeep Pharma IPO till Tuesday, November 25.

Sudeep Pharma IPO Subscription Status

Sudeep Pharma IPO received bids for 1,50,09,425 shares as against 1,05,64,926 shares on offer, garnering 1.42 times bids.

The qualified institutional buyer (QIB) quota was subscribed 9%, the non-institutional investor (NII) portion was booked 3 times and the retail investor part received 1.50 times bids.

Sudeep Pharma IPO GMP

Sudeep Pharma IPO grey market premium (GMP) today stood at ₹111. This means that in the grey market, Sudeep Pharma shares are trading ₹111 above the upper end of the price band.

At the prevailing GMP, Sudeep Pharma shares could list at ₹704, a premium of 18.72%. Grey market premium signals investor willingness to pay over and above the issue price.

Sudeep Pharma IPO Details

Sudeep Pharma IPO, worth ₹895 crore, is priced in the range of ₹563-593 per equity share. Investors can apply for the IPO in lots of 25 shares, requiring an investment of ₹14,825 by a retailer at the upper end of the price band.

The IPO is a mix of a fresh issue of equity shares worth ₹95 crore and an offer for sale of nearly 1.35 crore equity shares, aggregating ₹800 crore, by promoters.

Proceeds from the fresh issue worth ₹75.81 crore will be used for capital expenditure towards the procurement of machinery for its production line located at Nandesari Facility 1, Gujarat, and the remaining for general corporate purposes.

In Sudeep Pharma IPO, 50% of the offer is reserved for QIBs, 15% for NIIs and 35% for retail investors.

Following the closure of the issue, investors can expect the allotment of basis to be finalised on November 26, with the listing expected to take place next Friday on November 28.

Sudeep Pharma IPO Review

At the upper price band, the company is valued at 48.3x FY25 P/E, translating to a post-issue market cap of 66,979 million, said Anand Rathi in a note.

“They have also created a wholly-owned subsidiary, SAMPL, to leverage their mineral chemistry capabilities in advanced materials. Additionally, the company aims to strengthen its presence in regulated markets such as the US and Europe by capitalising on USFDA-approved facilities, boosting exports, and transitioning to direct market access supported by local warehousing and sales teams,” said the brokerage. Given these factors, the IPO appears fully priced, and we assign a “Subscribe – Long Term” rating, it added.

Meanwhile, Swastika Investmart advised aggressive investors with a long-term holding horizon of 2-5 years to consider the IPO as it believes that at a P/E of 45-48x, the IPO leaves very little room for immediate listing gains or short-term “pops”.