The trading platform’s shares have fallen by more than 13% since Monday.

- The stock slipped amid a decline in equities and cryptocurrencies, following mixed September jobs data that further lowered rate cut expectations.

- Cofounder Baiju Bhatt dumps $48.8 million in stock, leaving him with just 887 shares.

- Cathie Wood’s Ark Investment Management scooped up 63,991 shares of Robinhood on Thursday.

Robinhood Markets Inc.’s stock fell over 10% on Thursday amid broader market weakness and was headed for its worst weekly drop in eight months.

The trading platform’s shares have fallen by more than 13% since Monday. If losses continue, it would be the biggest decline for the stock since the first week of April, when President Donald Trump’s “Liberation Day” tariffs upended the markets.

Why Is Robinhood Stock Falling?

The stock slipped amid a decline in equities and cryptocurrencies, following mixed September jobs data that further lowered rate cut expectations. The U.S. economy added 119,000 jobs just before the government shutdown, well above expectations of 50,000. However, the unemployment rate also rose to 4.4%, the highest since 2021.

A regulatory filing on Wednesday also revealed that cofounder and co-CEO Baiju Bhatt sold 418,338 shares for about $48.8 million, leaving him with just 887 shares of HOOD. That likely adds pressure on the shares.

Despite inflation remaining above the Fed’s 2% target, the dovish camp at the U.S. central bank was advocating a rate cut, citing labor-market weakness. “Today’s strong headline number, combined with initial jobless claims that remain contained, helps push back against these concerns and point to a decelerating, but not yet cratering, labor market,” said Seema Shah, the chief global strategist at Principal Asset Management, according to Livewire.

According to CME Group’s FedWatch tool, only 36% traders expect a rate cut after the next Federal Open Market Committee meeting in December, compared with over 98% a month earlier. The tech-heavy Nasdaq composite fell by more than 2%, the S&P 500 fell 1.6%, and Bitcoin dipped to its lowest since April 21.

“The dated nature of this report may do little to shift the narrative one way or another. Moreover, with the October report canceled and the November report pushed back to December 16, the data fog continues to plague markets and policymakers alike,” she added.

What Are Stocktwits Users Thinking?

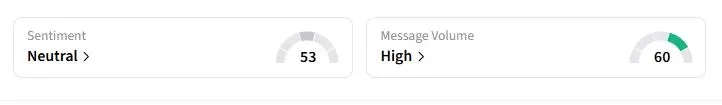

Retail sentiment on Stocktwits about Robinhood was in the ‘neutral’ territory at the time of writing.

“You want to be buying here, not selling. Nothing has fundamentally changed about the earnings story,” one investor wrote.

Ark Sees Buying Opportunity

Cathie Wood’s Ark Investment Management scooped up 63,991 shares of Robinhood on Thursday, alongside Nvidia, Bullish, and Coinbase shares. Based on Thursday’s closing price, the firm would have paid about $6.8 million to acquire the shares.

Earlier this month, Ark analysts estimated that Robinhood’s average revenue per user (ARPU) could triple from roughly $130 in 2024 to more than $430 by 2030. Robinhood is diversifying its business beyond its stock and cryptocurrency trading platform. Tenev had told Stocktwits earlier this year that the company aims to become a consumer-focused bank by offering luxury financial services at an affordable price to subscribers of its Gold services, which were launched last year.

“Its bundled approach is deepening engagement, expanding wallet share, and establishing the foundation to monetize across multiple verticals, laying the groundwork for Robinhood to become one of the most important financial operating systems of the next generation,” Ark analysts wrote earlier.

Robinhood stock has more than doubled this year, amid its inclusion in the S&P 500 and strong revenue growth.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<