Mitapivat met the hemoglobin endpoint but missed the endpoints for pain crises and fatigue, prompting concerns about the mixed Phase 3 readout.

- Mitapivat met the hemoglobin endpoint but missed the endpoints for pain crises and fatigue, prompting concerns about the mixed Phase 3 readout.

- BofA, RBC, and H.C. Wainwright cut price targets, flagging a more uncertain path toward potential FDA approval.

- Stocktwits traders debated the drop, with some buying the dip ahead of the upcoming FDA submission timeline.

Agios Pharmaceuticals, Inc. shares crashed to their worst session on record on Wednesday after the company reported mixed late-stage trial results for its sickle cell disease treatment, triggering a wave of sharply lower analyst price targets.

The stock closed down 51% at $22.34 before edging up 0.9% in after-hours trading.

Wall Street Turns Cautious

Bank of America Securities (BofA) lowered the firm’s price target to $32 from $54 and maintained a ‘Buy’ rating. The note said the RISE UP study showed mitapivat met the primary hemoglobin endpoint but delivered “only modest directional benefit” for sickle cell pain crises and fatigue. While the company has previously said that hitting either primary endpoint would be sufficient for approval, BofA wrote that the results now point to “an uncertain regulatory and commercial path forward.”

RBC Capital took a more cautious stance, downgrading Agios to ‘Sector Perform’ from ‘Outperform’ and slashing its target to $28 from $57. The firm wrote that although mitapivat is “clearly active,” it “fell short on the most important endpoints for patients,” noting gaps in crisis reduction, hospitalization, and fatigue. RBC said the changes reflect lower odds of success for the sickle cell program and reduced potential uptake even if the drug is ultimately approved.

H.C. Wainwright also lowered its target to $48 from $56, while reiterating a ‘Buy’ rating. The firm called the market reaction “overdone” and said it remains “cautiously optimistic” about eventual FDA approval, citing the Oxbryta precedent and the absence of new safety issues, though it acknowledged that the data “increase some uncertainty.”

Trial Results

The Wave of analyst downgrades came after Agios released topline data from its Phase 3 RISE UP study in sickle cell disease, the larger of its two key readouts before year-end 2025. The company reported that mitapivat met the primary endpoint of hemoglobin response, achieving a statistically significant improvement compared with placebo. It also showed positive effects on hemoglobin concentration and indirect bilirubin levels.

However, Agios said the study did not show a statistically significant reduction in sickle cell pain crises and reported no improvement in fatigue, an important quality-of-life measure for patients. Agios plans to share the full clinical program with the FDA in the first quarter of 2026 as it prepares to pursue potential U.S. approval.

Competitors Gain On Agios Miss

Leerink said that early Phase 1b data for Fulcrum Therapeutics’ pociredir suggest a “potentially differentiated and favorable efficacy profile” compared with mitapivat, noting the limits of direct comparison. Oppenheimer said the Agios outcome may be viewed as removing competitive pressure for Fulcrum, adding that the RISE UP results resembled HOPE, with marginal improvements in hemoglobin and no statistical significance for vaso-occlusive crises. The firm reiterated an ‘Outperform’ rating on Fulcrum.

Stocktwits Traders Eye FDA Date

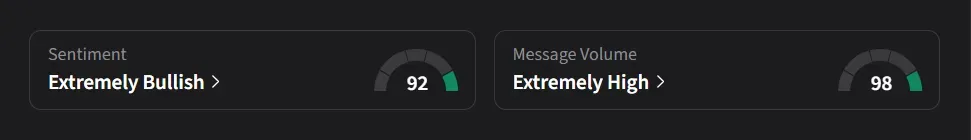

On Stocktwits, retail sentiment for Agios was ‘extremely bullish’ amid a 6,400% surge in 24-hour message volume.

One user said, “I’ll load more tomorrow and Friday. Need to be ready for December 6th FDA approval. Should skyrocket!!!”

Another user argued the selloff was excessive, saying the strong hemoglobin response and clean safety profile still supported a viable approval path, adding that one missed endpoint was unlikely to derail progress and that “it doesn’t take a perfect score for approval.”

Agios’ stock has declined 51% so far in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<