Meme stocks in general have struggled amid broader market sell-offs, with the Roundhill MEME ETF falling 24% this month

- Rigetti Computing stock has plummeted 43%, while Bed Bath & Beyond shares have dropped 23% in November.

- Retail sentiment on AMC has remained in the ‘bullish’ territory despite the stock trading near all-time lows.

- Year-to-date, BYND stock has seen the steepest decline at 73%, followed by GME’s 36% fall and AMC’s 46% decline.

Beyond Meat (BYND) shares drew investor attention on Wednesday, trading at $1 after declining in 16 of the 21 sessions since rising to over $7.6 on October 22.

Notably, BYND’s short interest hit as low as 13.2% last week, the lowest in more than four years, according to Koyfin data. Meme stocks have generally struggled amid broader market sell-offs. While the Dow Jones Industrial Average index (DJI) has shed 3% since the start of November, the Roundhill MEME ETF (MEME) has declined 24%.

Among the top losers so far this month, BYND stock has tumbled 40%, Rigetti Computing Inc. (RGTI) has declined 43%, and Bed Bath & Beyond, Inc. (BBBY) shares have fallen 23%. GameStop Corp. (GME) shares are trading at their lowest levels since September 2024, while AMC Entertainment Holdings (AMC) stock fell to its all-time low on Tuesday.

How Did Retail Investors React?

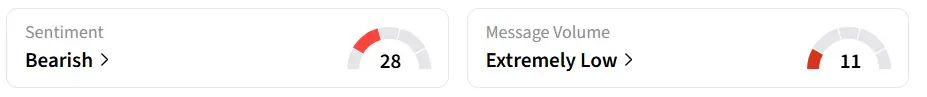

Retail sentiment for MEME and BYND on Stocktwits has remained in the ‘bearish’ zone for the past 24 hours.

Some users expect the BYND board to announce a reverse split to remain compliant with Nasdaq’s $1 minimum bid price requirement.

While GME’s retail sentiment flipped to ‘bearish’ from ‘neutral’ a day earlier, RGTI’s sentiment changed to ‘neutral’ from ‘bearish’. Interestingly, retail sentiment on AMC has remained in the ‘bullish’ territory over the last 24 hours.

Year-to-date, BYND stock has seen the steepest decline at 73%, followed by GME’s 36% fall and AMC’s 46% decline. On the other hand, BBBY shares are up 18%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<