During an interaction with Andrew Ross Sorkin, Dalio highlighted that the common theme across the three eras is significant debt.

- Dalio noted that debt ownership is the only thing that is different among the three eras.

- Referring to the soaring debt, Dalio said that these “patterns” exist across all of these bubbles.

- According to data from the U.S. Department of the Treasury, the current national debt stands at $38.18 trillion.

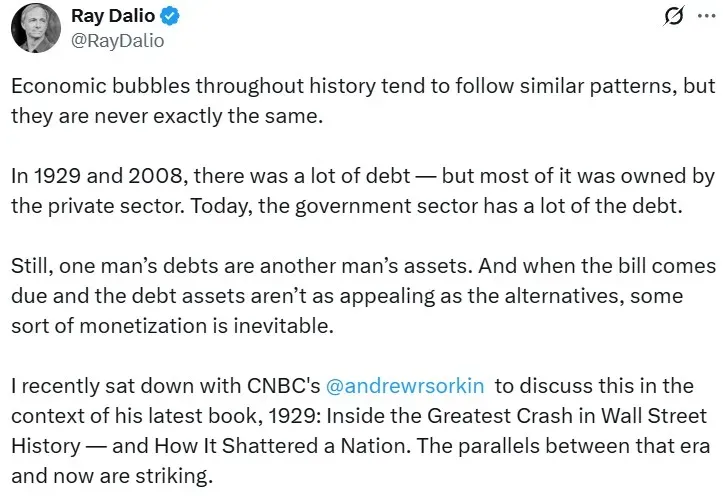

Bridgewater Associates founder Ray Dalio on Wednesday warned that the parallels between the economic bubbles of 1929, 2008, and now are “striking.”

During an interaction with Andrew Ross Sorkin, Dalio highlighted that the common theme across the three eras is the presence of a lot of debt. The only difference is who owns it, Dalio said in a post on X.

“In 1929 and 2008, there was a lot of debt — but most of it was owned by the private sector. Today, the government sector has a lot of the debt.”

— Ray Dalio, founder, Bridgewater Associates

Inevitable Monetization

Dalio noted that debt ownership is the only thing that is different among the three eras. He had previously stated that gold had begun replacing some U.S. Treasury holdings as the riskless asset for investors.

“Still, one man’s debts are another man’s assets. And when the bill comes due and the debt assets aren’t as appealing as the alternatives, some sort of monetization is inevitable,” he added.

Referring to the soaring debt, Dalio said that these “patterns” exist across all of these bubbles.

US’ Current Debt

According to data from the U.S. Department of the Treasury, the current national debt stands at $38.18 trillion. Adjusted for inflation, the U.S. national debt stood at $322 billion in 1929 and $14.88 trillion in 2008.

Earlier this month, Dalio said that the Federal Reserve’s announcement to stop Quantitative Tightening (QT) and begin quantitative easing (QE) next year could be a case of the central bank providing stimulus into a bubble.

Meanwhile, U.S. equities were mixed in Wednesday’s midday trade. At the time of writing, the SPDR S&P 500 ETF (SPY), which tracks the S&P 500 index, was up 0.19%, the Invesco QQQ Trust ETF (QQQ) gained 0.24%, while the SPDR Dow Jones Industrial Average ETF Trust (DIA) declined 0.12%. Retail sentiment around the S&P 500 ETF on Stocktwits was in the ‘bearish’ territory.

The iShares 7-10 Year Treasury Bond ETF (IEF) was up 0.03% at the time of writing.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<