Black argues Tesla must demonstrate unsupervised robotaxi performance with no safety drivers to validate its autonomy roadmap.

- Black argues Tesla must demonstrate unsupervised robotaxi performance with no safety drivers to validate its autonomy roadmap.

- He says Optimus must show practical, scalable usefulness before investors can expect any valuation impact.

- The comments add to Black’s broader critique of Tesla’s long-term assumptions around autonomy and robotics.

The Future Fund Managing Partner Gary Black said Tesla must show clear, verifiable progress on autonomous driving and its Optimus humanoid robot before investors can expect the valuation shift projected by Elon Musk.

Black Pushes Back On Musk’s Autonomy Claims

In a post on X responding to Musk’s statement that a “major valuation change” will come with unsupervised self-driving and an even larger one once Optimus reaches volume production, Black said Tesla “needs to remove safety drivers from robotaxis” to demonstrate it has solved unsupervised autonomy with 99.999% efficacy, defined as one critical disengagement per 10,000 miles. He added that Optimus must show it can perform tasks that save time, reduce costs or enhance quality, and that it can be produced at scale. “Saying it doesn’t make it so,” he wrote.

Tesla’s Pursuit Of Autonomous Approvals

Tesla is expanding its autonomy efforts through a monitored robotaxi program in Austin, Texas, where a safety monitor rides in the passenger seat. The company also received an Arizona transportation network company permit allowing paid rides with human safety drivers on Tuesday. The authorization does not permit driverless operation. Tesla has separately applied for approval to test without a human operator, and Musk has said he wants robotaxis running in eight to ten U.S. metro areas by year-end, pending regulatory clearance.

Black’s Warnings On Valuation And Autonomy

Black has issued repeated cautions about Tesla’s valuation in recent weeks. He previously described investor optimism around robots and autonomy as a “fool’s narrative,” noting that more than 70% of Tesla’s profits still come from electric vehicles. In earlier posts on X, he said Tesla’s October global volumes were down year over year and argued that fully autonomous ride-hailing is becoming a commodity business, citing Chinese operators such as Baidu, Pony.ai and WeRide.

He also said unsupervised autonomy is “table stakes” for the auto industry and noted that few Wall Street models assign meaningful profits to robotaxis or humanoid robots. Black has also said Tesla’s 200x forward price-to-earnings ratio is difficult to justify as the company competes for market share. This month, he added that the muted stock reaction to Musk’s $1 trillion compensation approval reflected expectations, calling Tesla a “momentum stock” driven more by sentiment than changes in earnings estimates.

Stocktwits Mood Leans Bearish

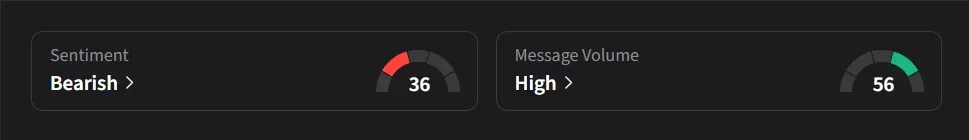

On Stocktwits, retail sentiment for Tesla was ‘bearish’ amid ‘high’ message volume.

Tesla’s stock has risen 0.6% so far in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<