The company raised its 2025 revenue guidance to a minimum of $30 million and projected 2026 revenue to exceed $200 million.

- Datavault’s third quarter (Q3) revenue surged 148% year-on-year (YoY) to $2.9 million.

- The company secured a multi-year partnership with Triton Geothermal.

- Under the agreement, Datavault AI is set to receive up to $8 million in upfront payment.

Datavault AI Inc. (DVLT) shares surged nearly 8% on Monday after the company announced strong revenues for the third quarter, along with a major multi-year partnership with Triton Geothermal LLC, a geothermal development company.

The firm highlighted a rapidly maturing business in data monetization and the tokenization of real-world assets.

Third-Quarter Highlights

Datavault’s third quarter (Q3) revenue surged 148% year-on-year (YoY) to $2.9 million, with a 67% sequential gain over the second quarter (Q2) of 2025.

The company has raised its 2025 revenue guidance to a minimum of $30 million and projects 2026 revenue to exceed $200 million, driven largely by its licensing model and the expansion of its Acoustic Science and Data Science units.

“With our patented IP, global distribution strategy, and scalable business model, Datavault is well positioned to become the central infrastructure partner in the transformation of real‑world assets into monetized digital value.”

-Nathaniel Bradley, Co-Founder and CEO, Datavault AI

Datavault AI stock traded over 2% higher on Monday morning.

Deal With Triton

The deal positions Datavault AI as Triton’s exclusive technology partner, enhancing digital management, valuation, and monetization of real-world assets (RWA) in the geothermal sector.

Under the agreement, Datavault AI is set to receive up to $8 million in upfront payment and milestone-based fees linked to Triton’s planned $125 million RWA offering, alongside a 5% share in Triton’s ongoing transaction fees.

What Are Stocktwits Users Saying?

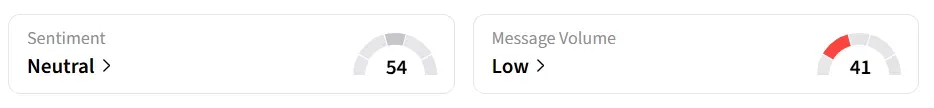

On Stocktwits, retail sentiment around the stock remained in ‘neutral’ territory amid ‘low’ message volume levels.

A bullish Stocktwits user expressed optimism about the earnings.

Another user said they are buying the dip.

DVLT stock has declined by over 9% in 2025 and by more than 10% in the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<