The FT reported, citing a White House memo, that Alibaba supplies the Chinese government with technology, which poses risks to U.S. security.

- The FT reported, citing a White House memo, that Alibaba supplies the Chinese government with technology, which poses risks to U.S. security.

- After declining on Friday, following the report, BABA rebounded in premarket trading on Monday.

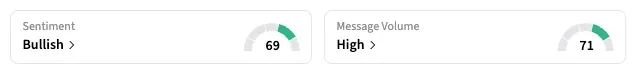

- Stocktwits sentiment for BABA was ‘bullish.’

Alibaba Group’s U.S.-listed shares rose 3.2% in early premarket trading on Monday, with Hong Kong shares ending earlier in the day.

The gain comes after pressure on the stock seen on Friday – signaling that investors are shrugging off concerns raised by a recent report in the Financial Times, which alleged that Alibaba provides technology to the Chinese government that could pose U.S. security risks.

“$BABA Hong Kong is going the opposite way, they didn’t take the bait … We are going up tomorrow!” a Stocktwits user said, with another user going so far as to say the news was fabricated and was an effort to bring down the stock before the earnings.

The FT report cited a White House national security memo that includes declassified intelligence on how Alibaba supplies the People’s Liberation Army with capabilities that could threaten U.S. security. Alibaba provides the Chinese government and PLA with access to customer data, including IP addresses, WiFi information, and payment records, according to the report.

Alibaba had denied the allegations in the FT article, saying, “The assertions and innuendos in the article are completely false.”

On Stocktwits, the retail sentiment shifted to ‘bullish’ as of early Monday, up from ‘neutral’ on Friday, with high message volume. Besides the latest stock moves, retail investors discussed their outlook ahead of the company’s quarterly report, scheduled for release next week.

So far this year, BABA has gained 83% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.