Waymo began offering fully driverless freeway trips across major U.S. cities, widening its autonomous-ride footprint from San Francisco to Los Angeles and Phoenix.

- Waymo began offering fully driverless freeway trips across major U.S. cities, widening its autonomous-ride footprint from San Francisco to Los Angeles and Phoenix.

- Musk’s comment on X heightened attention on the growing rivalry between Tesla’s FSD program and Waymo’s expanding robotaxi network.

- Analysts have highlighted Tesla’s scale of data collection and manufacturing capacity as long-term advantages despite rising competition.

Tesla shares rose over 1% in premarket trading on Monday after CEO Elon Musk took a sharp jab at Waymo’s latest autonomous-driving rollout, signaling renewed competitive tension in the robotaxi race.

Musk replied “Game on” to a post on X from Google Chief Scientist Jeff Dean highlighting Waymo’s newly expanded freeway service, which now covers the San Francisco Bay Area from San Francisco to San Jose and includes curbside access at San Jose’s international airport.

Waymo Widens US Footprint

Waymo last week became the first operator in the U.S. to offer fully driverless freeway travel, extending highway robotaxi coverage across the San Francisco Bay Area, Los Angeles, and Phoenix. The Alphabet-owned unit said the new capability builds on millions of real-world highway miles and extensive testing with employees and early riders.

The expansion also opens the entire Bay Area Peninsula to public robotaxi trips, marking a significant geographic rollout in Waymo’s history. The company has said it plans to bring freeway capabilities to Austin and Atlanta next.

Tesla Pushes Toward Scaling As Competition Intensifies

Tesla currently runs a smaller pilot in Austin, with around 30 robotaxis operating under supervision, according to Electrek. At its recent annual shareholder meeting, the company outlined its next autonomous-network targets, naming Las Vegas, Phoenix, Dallas, Houston, and Miami as the next five cities slated for expansion.

Tesla aims to scale production sharply starting next year, forecasting the ability to build 2-4 million Cybercabs annually, leveraging its vertically integrated manufacturing base. The company also continues to collect significantly more daily real-world driving data than peers, which it uses to train its Full Self-Driving (FSD) system.

Ark Invest’s Robotaxi Math

In August, Ark Investment Management analyst Daniel Maguire said Tesla remained well-positioned to dominate the U.S. robotaxi market over the next several years, citing the company’s vision-only neural network approach, manufacturing scale, and its outsized flow of real-world data compared with geofenced competitors.

Maguire noted that Waymo maintained an early commercial lead with roughly 250,000 fully autonomous paid rides per week at the time, but said Tesla’s global fleet provided nearly 900 times more real-world driving miles when fully counted. His August forecast suggested Tesla’s robotaxi business could account for about 90% of its enterprise value by 2029, based on Ark’s projected $10 trillion robotaxi market.

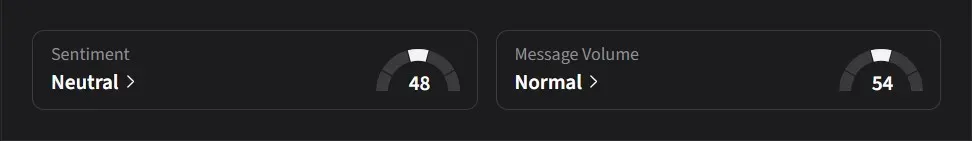

Stocktwits Mood Diverges

On Stocktwits, retail sentiment was ‘neutral’ for Tesla and ‘bearish’ for Alphabet, the parent company of Waymo, in the early hours of Monday, with both seeing ‘normal’ message volume.

While Tesla’s stock has risen 0.1% so far in 2025, Alphabet’s stock has climbed 46% over the same period.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<