Analysts expect XPeng to report higher revenue and a narrower quarterly loss when it releases Q3 results on Monday.

- Analysts expect XPeng to report higher revenue and a narrower quarterly loss when it releases Q3 results on Monday.

- Delivery momentum has remained strong through recent months, supported by steady demand for the company’s core models.

- Investors are tracking XPeng’s broader push into AI-led products, including new autonomous systems and upcoming robotaxi models scheduled for 2026.

Retail chatter about XPeng spiked on Sunday ahead of the company’s third-quarter (Q3) earnings, as investors watch for signs that the Chinese electric-vehicle maker’s rapid delivery growth and improving margins could push up expectations for profitability.

Earnings Preview

XPeng will report Q3 results on Monday before U.S. markets open. Koyfin analysts expect revenue of $2.87 billion, up 12.6% year over year. They also forecast an EBIT loss of $108.12 million, narrower than the $130.47 million loss recorded a year earlier.

Koyfin estimates call for a GAAP per-share loss of $0.10, compared with a per-share loss of $0.07 last year, while adjusted EPS is projected to be a loss of $0.07 versus a loss of $0.06 a year ago.

Bocom International analyst Angus Chan said XPeng is now expected to turn a profit in the third quarter, earlier than prior forecasts for a fourth-quarter break-even. Chan cited strong sales momentum, improved margins, and disciplined cost controls, noting that XPeng’s October deliveries reached 42,013 units, a monthly record. Second-quarter gross margin rose to 17.3%, up from 14% a year earlier, according to Dow Jones.

Sales Momentum And Overseas Push

XPeng has posted three straight record months of deliveries. September volume hit 41,581 vehicles, with quarterly deliveries reaching 116,007 units, up 149% year-on-year and at the top of management’s range.

The company also began exporting its high-volume Mona M03 sedan, shipping the first batch to the Middle East and North Africa. The model, priced from about 119,800 yuan ($16,800), has sold more than 10,000 units each month for a year and accounts for more than 40% of XPeng’s monthly sales. CEO He Xiaopeng said the Mona lineup will debut in Europe in 2026, with a broader global rollout planned that year. Spy photos on Chinese social media also indicated XPeng is developing a second Mona model.

AI, Robotics, Driver-Assist Systems

XPeng’s AI Day announcements added to investor interest over the past few weeks. The company said it plans to roll out a new driver-assist system that can autonomously navigate narrow streets by early 2026, with Volkswagen as its first external client. CEO He said the system requires less human intervention than Tesla’s Full Self-Driving and completed a test route several minutes faster. “Next month I will go to the U.S. to compare [XPeng’s latest system] to FSD again,” he said, in Mandarin translated by CNBC.

The system can interpret hand gestures from traffic controllers and respond to traffic-light countdown timers. China has allowed XPeng to deploy advanced driver-assist features since early 2023.

XPeng also plans to launch three robotaxi models in 2026. Footage shared on Weibo showed a next-generation robotaxi based on the X9 MPV, powered by XPeng’s in-house Turing chip and Canghai AI platform, designed to deliver Level 4 autonomy with up to 3,000 TOPS of computing power. The vehicle uses dual visor-mounted displays to communicate with pedestrians and passengers. XPeng’s earlier G9 SUV received public-road robotaxi testing approval in Guangzhou in 2022.

Macquarie Capital’s head of China equity strategy Eugene Hsiao said XPeng could expand into extended-range EVs, robotaxis, eVTOL aircraft, humanoid robotics, and AI semiconductors. He said investors have begun to factor in the potential optionality if any of these initiatives succeed.

Stocktwits Traders Eye Post-Earnings Jump

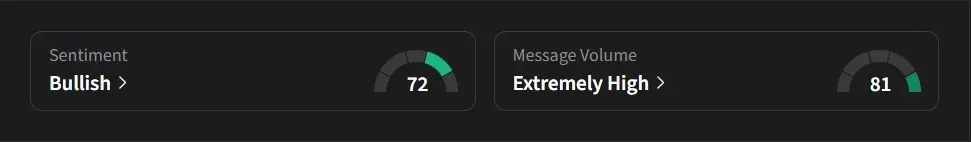

On Stocktwits, retail sentiment for Xpeng was ‘bullish’ amid ‘extremely high’ message volume.

Some users said they were looking for a post-earnings move that could take the stock into the high-20s to low-30s, with expectations ranging up to around $32.

One user argued that XPeng’s humanoid robot program, rising electric-vehicle sales, and growing ambitions in electric vertical-takeoff-and-landing aircraft (eVTOLs) justify a much higher valuation, adding that its robotics effort could warrant a price closer to the mid-$30s to $40 range when compared with Tesla’s.

Xpeng’s U.S.-listed stock has more than doubled so far in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<