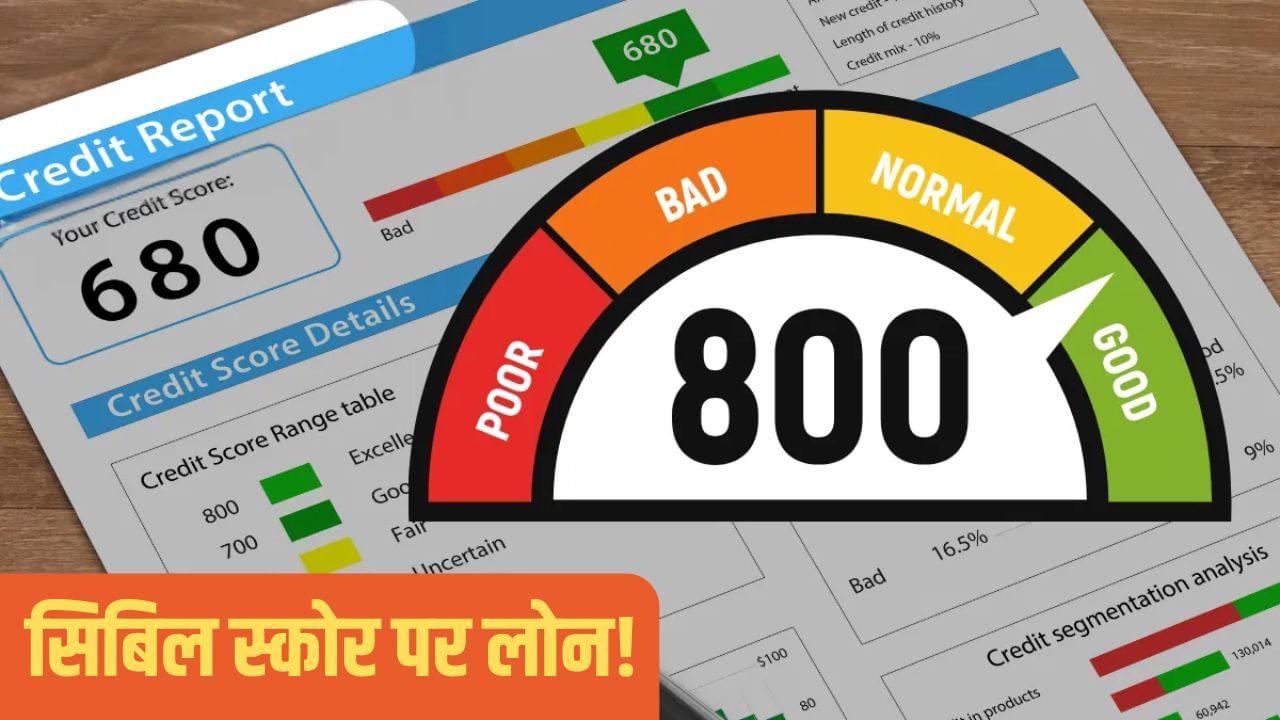

CIBIL Score

Whenever there is talk of taking a loan from any bank, it is inevitable to mention the CIBIL score. Even if you mention taking a loan to anyone, within the first two or three minutes the other person will ask you about your CIBIL score. Because, to take a loan it is necessary to have a good CIBIL and it is considered better at 750. But, do you know that even if you have 750 CIBIL, the loan gets rejected. Let us tell you in detail about the things related to CIBIL score and the loan related rules of RBI.

Even if the CIBIL score is above 750, the loan gets rejected because banks not only look at your score, but also check your overall financial position, job stability and liabilities. If there is any back and forth, you will not be able to get the loan even if your CIBIL score is fine.

These are also important

- Financial status- Your income and job stability matter most in getting the loan approved. If you change jobs frequently or have been unemployed for a long time, banks consider you a bit risky. At the same time, if you are continuously working in the same field and are associated with a trustworthy company, then the bank has confidence. Apart from this, your existing debts are also very important. If 40-50% of your income is already going towards EMIs, then banks hesitate in giving a new loan.

- Applying for multiple loans or cards simultaneously- Many people apply for multiple loans or credit cards at the same time. This results in a number of “hard inquiries” appearing on your report, which banks consider a sign of financial stress. In such cases the possibility of loan rejection increases. Also, if your past record with the bank you are applying for is not good. Like missing EMI or delay in loan settlement. So this can also go against you.

Relief in new rules

In the new rules, the minimum credit score requirement for first-time loan takers has been removed. That means banks can no longer reject anyone just by looking at low scores. They will have to take the decision keeping in mind the overall financial condition of the customer, ability to repay the loan and job stability.