The apex cryptocurrency gained 0.2% to $103,471.89 at the time of writing, according to CoinMarketCap data, while Ethereum rose 2.9% to $3,538.77, and BNB was up 1.1% to $966.

- XRP gained over 4%, far outpacing most other primary tokens, as Nasdaq certified the first U.S. spot XRP ETF.

- U.S. President Donald Trump signed a bill on Wednesday that ended the 43-day shutdown, which sent thousands of federal workers home and halted food aid for millions.

- Japan Exchange Group Inc. is reportedly considering measures to curb the growth of listed digital-asset treasury companies amid concerns over losses linked to the crypto hoarding frenzy.

Bitcoin and other major cryptocurrencies gained in early trading on Thursday after President Donald Trump signed a bill to end the longest shutdown in U.S. history.

The apex cryptocurrency gained 0.2% to $103,471.89 at the time of writing, according to CoinMarketCap data, while Ethereum rose 2.9% to $3,538.77, and BNB was up 1.1% to $966. Among other tokens, Solana rose by 0.2%, and Dogecoin was up by nearly 2.3%.

XRP Races Ahead On ETF Launch

XRP gained over 4%, far outpacing most other primary tokens, as Nasdaq certified the first U.S. spot XRP ETF, which is set to launch after the market opens on Thursday. Canary Capital’s spot XRP ETF, ticker XRPC, benefited from the SEC’s 8(a) automatic-effectiveness process, which allows the listing of securities without regulatory approval during shutdowns.

The XRP ETF will custody tokens through Gemini Trust Company and BitGo Trust Company, and will use the CoinDesk XRP CCIXber benchmark for pricing. It is expected to bolster institutional flows in one of the largest cryptocurrencies by market capitalization.

Broader Market Gains As Trump Ends Shutdown

U.S. President Donald Trump signed a bill on Wednesday that ended the 43-day shutdown, which sent thousands of federal workers home and halted food aid for millions. The shutdown also delayed the release of key economic data, with the White House indicating that October jobs and inflation data might not be released.

On Monday, Goldman Sachs analysts estimated that U.S. non-farm payroll likely fell by 50,000 in October. The firm’s job growth tracker slowed to 50,000 new jobs in October from 85,000 in September, and Goldman estimated that the government’s deferred-resignation program might have cut payrolls by about 100,000 positions.

The tepid jobs data from private-sector participants and weak consumer sentiment could likely force the U.S. Federal Reserve to lower the benchmark interest rate by 25 basis points, once again in December. Investors have shown caution this week, with Bitcoin testing the $100,000 support level.

What Are Stocktwits Users Thinking?

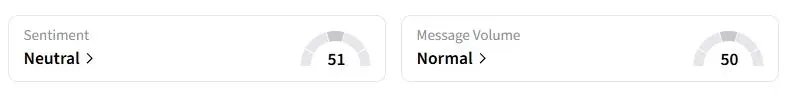

Retail sentiment on Stocktwits about Bitcoin was in the ‘neutral’ territory compared with ‘bearish’ a day ago.

“Fundamentals have never been stronger, and the Supply on exchanges hit a new All Time Low.. the big rebound run is absolutely coming,” one Stocktwits user wrote.

Could Japan Exchange Move Spell Trouble?

According to a Bloomberg News report, Japan Exchange Group Inc. is considering measures to curb the growth of listed digital-asset treasury companies amid concerns over losses linked to the crypto hoarding frenzy.

The operator of the Tokyo Stock Exchange is reportedly exploring options, including stricter enforcement of its backdoor listing rules and requiring firms to undergo a fresh audit. However, the report noted that the exchange has not yet determined a course of action.

The report further stated that since September, three listed Japanese companies have put plans to start buying cryptocurrencies on hold due to pushback from JPX. The exchange has reportedly informed the companies that their fundraising abilities will be restricted if they pursue buying crypto as a business strategy.

Much of the rally of cryptocurrencies has been driven by strong corporate buying in a concept pioneered by Michael Saylor’s Strategy.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<