The new Income Tax Bill has passed 2025 from the Lok Sabha. It will be effective from 1 April 2026. This has made tax related laws easier. There is an attempt to bring transparency throughout the system. Let us understand the Income Tax Bill 2025 by 10 questions and their answers.

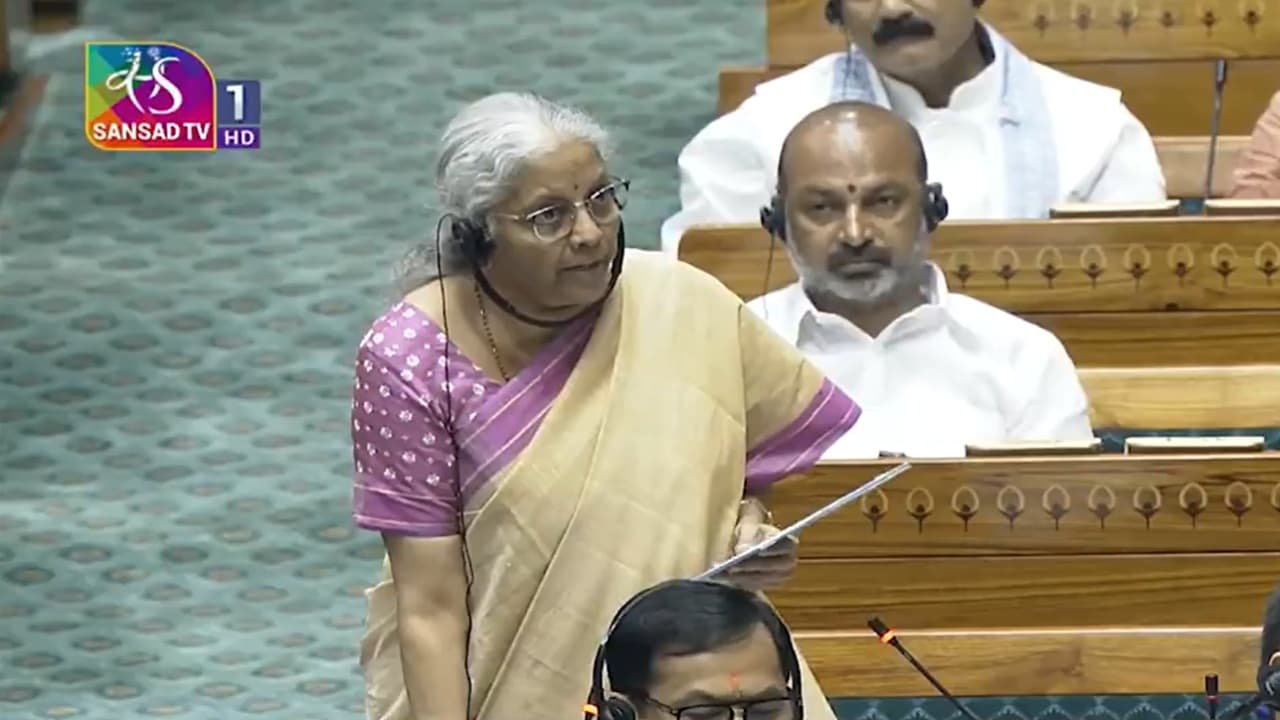

Income tax bill 2025: The Lok Sabha passed the Income Tax Bill 2025 on Monday during the monsoon session of Parliament. This is an important step towards changing India’s six -decade -old direct tax structure. The government is trying to balance investors with new laws, relief to taxpayers and balanced administrative efficiency. Let us understand the new Income Tax Bill 2025 from 10 questions and their answers.

What is the new Income Tax Bill 2025?

The Income Tax Bill 2025 is a new bill replaced by the Old Income Tax Act 1961. Its purpose is to make tax laws simple and modern in India. It has clear language and low streams. Earlier there were more than 700 sections in the Income Tax Act. These have been reduced to 536. The new bill has reduced litigation and ambiguities.

When will the new tax bill apply?

The new bill will be effective from 1 April 2026. It matches the financial year 2026-27.

What are the main changes in the tax slab in the new bill?

Tax slabs are progressive. It has more discount limit and many slabs:

Income and tax rate per year

- Up to 4 lakh rupees: zero

- 4-8 lakh rupees: 5%

- 8-12 lakh rupees: 10%

- 12-16 lakh rupees: 15%

- 16-20 lakh rupees: 20%

- 20-24 lakh rupees: 25%

- Above 24 lakh rupees: 30%

Has there been any change in tax exemption?

Yes, under Section 87A, a discount on income up to Rs 12 lakh has been increased to Rs 60,000. Taxpayers who earn Rs 12 lakh per year will not have to pay any income tax after exemption.

Are there simple rules for cuttings?

Some cuttings are clear and simple. Such as 30% standard deduction on home property income after municipal tax and a phased deduction of interest on construction-east home loans for self-occupied and rent assets.

What about capital gains and digital properties?

The new Bill restructures capital profit provisions. Cryptocurrency and digital properties are clearly included as taxable capital benefits.

How does a new bill simplify tax compliance and evaluation?

The new bill has reduced human intervention in tax related cases. Faceless digital evaluation and compliance have been promoted to increase transparency and reduce the risk of corruption.

What improvement does this bill bring in tax code?

The new Bill has covered tax related laws in 536 sections in 23 chapters. Tax -related laws have been made easy and common people are made to understand. The complexity and repetition have been reduced.

Has there been changes in filing income tax?

The Central Board of Direct Taxes (CBDT) now has more rights to decide compulsory filing conditions. CBDT can ask for detailed information from taxpayers, which will simplify the process and improve compliance.

Also read- New tax bill passed in Lok Sabha: 1961 Act ends, change from refund relief to TDS rules, know new tax year concept

Will the new tax bill affect the rights of taxpayers?

Yes, this bill includes a taxpayer charter. This promotes transparency and protects the taxpayers by issuing advance zero-TDS certificates to non-paying taxpayers before tax action, requiring prior information before tax action.