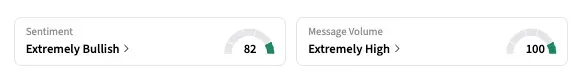

Stocktwits sentiment for MOVE shifted to ‘extremely bullish’ from ‘neutral.’

- Movano’s stock declined in the premarket session on Tuesday.

- The wearable health tech company announced a reverse merger with cloud computing firm Corvex the previous day.

- Stocktwits sentiment for MOVE shifted to ‘extremely bullish’ from ‘neutral.’

Movano, Inc.’s stock declined about 1% in early premarket trading on Tuesday, even as it trended among the top five tickers on Stocktwits. This move follows a massive rally on Monday after the company announced a reverse merger with Corvex, Inc., a cloud company.

The merger deal values Movano shares at $6.25 a piece, the companies said, adding that they had raised $40 million and an additional credit line to fund the deal.

A reverse merger allows a private company to go public by merging with a public one at a lower cost than is involved in traditional initial public offerings.

Shares of MOVE surged 150% to $11.91 on Monday, following the announcement. Upon the deal closure, Corvex shareholders will hold roughly 96.2% of the combined company, while Movano shareholders will own about 3.8%.

The combined entity will operate under the Corvex name. The transaction essentially means that Movano will pivot to cloud computing amid struggles to scale its mainstay wearable health technology and wearable devices business.

What Is Retail Thinking?

On Stocktwits, the retail sentiment shifted to ‘extremely bullish’ as of early Tuesday, from ‘neutral’ the previous day. A user advised booking profits, even as traders struggled to calculate the value of shares as per the deal terms.

Pleasanton, California-based Movano had a market capitalization of less than $4 million as of the end of last week.

MOVE shares had dropped 91% this year through last Friday.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<