D.A. Davidson analysts said Rivian’s December 11 Autonomy & AI Day will emphasize everyday driving assistance features over robotaxis, focusing on usability for commuters.

- D.A. Davidson analysts said Rivian’s December 11 Autonomy & AI Day will emphasize everyday driving assistance features over robotaxis, focusing on usability for commuters.

- The analysts said Rivian’s stock may stay rangebound until the R2 SUV launch, improved margins, and better visibility on its Volkswagen partnership.

- Retail traders on Stocktwits expect strong demand for the R2, with some predicting a breakout above Rivian’s 52-week high this week.

Rivian shares rallied to their highest level in nearly six months ahead of the company’s Autonomy & AI Day on Dec. 11, with analysts saying the focus will likely be on personal-vehicle autonomy rather than fully self-driving robotaxis.

Analysts Expect Focus On Personal Autonomy

D.A. Davidson analysts Michael Shlisky and Linda Umwali said the event will showcase Rivian’s latest advancements in autonomous driving and artificial intelligence but emphasized that the company’s strategy centers on “personal-automobile autonomy” technology designed to make Rivian vehicles easier and more enjoyable to drive, rather than replacing the driver altogether, according to a report by Dow Jones.

The analysts noted that Rivian’s existing driver-assist features have already attracted customers who value its “fun-to-drive” nature. They said the company’s approach appears focused on part-time autonomy for commutes and daily trips, rather than on full-time, driverless robotaxi systems.

Market Still In ‘Wait-And-See’ Mode

Shlisky and Umwali also pointed out that Rivian has made meaningful progress in offsetting tariff-related costs but said the stock may stay rangebound in the near term as investors wait for greater visibility on several key developments.

They said investor confidence would depend on milestones such as a successful R2 SUV launch, tangible results from the Volkswagen partnership, a recovery in consumer demand, and continued improvement in gross margins and EBITDA losses. “All of this is achievable,” the analysts said, adding that the market remains in wait-and-see mode until those catalysts take clearer shape.

CEO Compensation Plan

The stock rally also follows Rivian’s board last week approving a new 10-year, performance-based compensation package for CEO RJ Scaringe that could be worth up to $4.6 billion if operational and share-price targets are met. Incentivized around profitability and share-price milestones through 2032, the plan is aimed at keeping Scaringe on board as Rivian scales production of its existing model and readies a lower-cost R2 SUV due out in 2026.

The company also doubled Scaringe’s base salary to $2 million and linked his incentives to operating income and free cash flow goals.

Expanding AI And Robotics Ambitions

Rivian has also been deepening its involvement in AI through Mind Robotics, a new spinoff developing industrial automation and intelligent systems. Scaringe was granted a 10% economic interest in the unit upon its profitability and will serve as its chair, signaling a broader push into technology-driven manufacturing.

Stocktwits Traders See R2 As Rivian’s Next Big Catalyst

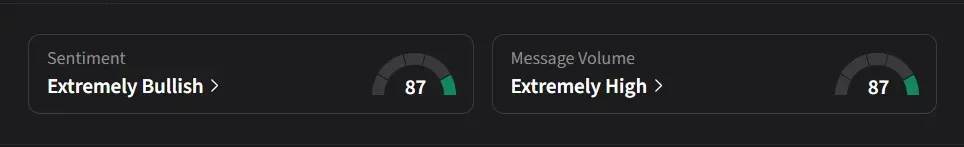

On Stocktwits, retail sentiment for Rivian was ‘extremely bullish’ amid ‘extremely high’ message volume.

One user said Rivian’s upcoming R2 SUV could be a major growth driver, predicting the model would “sell faster than they can make them.” Another user said they expected Rivian’s stock to break above its 52-week high this week.

Rivian’s stock has risen 23% so far in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<