According to Fiscal.ai data, Wall Street expects the company to post revenue of $151.7 million and a narrower net loss of $0.06 per share. The company has topped estimates in all four previous quarters.

- According to TheFly, Stifel analysts wrote last week that Rocket Lab’s results are expected to come in near the high end of its previous forecast, with a sequential increase in adjusted gross margin of 370 basis points.

- Baird analysts said previously that the launch of Rocket Lab’s Neutron rocket will position it as a direct competitor to SpaceX’s Falcon 9.

- The Neutron rocket is being designed to be more powerful than its Electron rocket, with its first launch targeted for late 2025 or early 2026.

Rocket Lab USA (RKLB) stock rose over 4.5% in premarket trading on Monday, recovering part of last week’s 18% slide ahead of its quarterly earnings report due later in the day.

According to Fiscal.ai data, Wall Street expects the company to post revenue of $151.7 million and a narrower net loss of $0.06 per share. The company has topped estimates in all four previous quarters.

What Are Retail Traders Thinking?

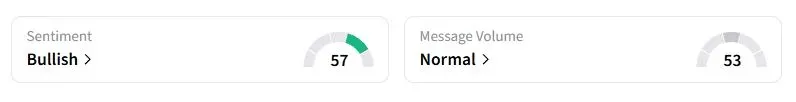

Retail sentiment on Stocktwits about Rocket Lab was in the ‘bullish’ territory at the time of writing, compared to ‘bearish’ a week ago.

“The government [is] opening up, so market sentiment should turn bullish again. Now just have to post some good ER and good news to continue going up,” one trader said.

“Should be $70 and on the way to $100 after a Neutron launch. The time is getting near…whether it’s the end of December or sometime in January,” another trader wrote, referring to the debut of the first-ever Neutron launch vehicle.

What Are Analysts Expecting?

According to TheFly, Stifel analysts wrote last week that Rocket Lab’s results are expected to come in near the high end of its previous forecast, with a sequential increase in adjusted gross margin of 370 basis points.

Baird analysts reportedly said in October that the company’s position as a reliable space launch provider is “firmly established” through its 94% mission success rate. The brokerage noted that the 34% compound annual revenue growth rate through 2030, as projected by consensus, is supported by the larger Neutron rocket. They also added that the development will enable the company to enter the “highly lucrative” medium-lift market, directly competing with SpaceX’s Falcon 9 rocket.

The Neutron rocket is being designed to be more powerful than its Electron rocket, with its first launch targeted for late 2025 or early 2026 from a new dedicated launchpad at Wallops Island, Virginia.

Rocket Lab stock has more than doubled in value this year, outperforming the broader market.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<