With the removal of the $7,500 electric vehicle tax credit to consumers, Barclays expects GM to cut EV production and produce only 150,000 vehicles in 2027.

Barclays on Monday downgraded Aspen Aerogels Inc. (ASPN) to ‘Underweight’ from ‘Equal Weight’, citing its reliance on automaker General Motors (GM) for business.

Barclays also lowered its price target on the stock to $6 from $7. The new price target implies a near 21% downside to the stock’s closing price on Friday. With the removal of the $7,500 electric vehicle tax credit to consumers, the firm expects GM to cut EV production and produce only 150,000 vehicles in 2027. It sees “inescapable macroeconomic forces” putting downward pressure on Aspen’s fastest-growing business, its Thermal Barrier segment.

Barclays cited Aspen’s reliance on GM and the sensitivity of Thermal Barrier gross margins to production volumes for the downgrade. Shares of ASPN traded 4% lower in Monday’s pre-market session at the time of writing.

On Stocktwits, retail sentiment around ASPN trended in the ‘bullish’ territory over the past 24 hours, coupled with ‘extremely high’ message volume.

President Donald Trump signed the Republican tax bill into law on the Fourth of July. Under the new law, tax credits for the purchase of electric vehicles will expire on September 30. This includes the $7,500 federal tax credit on the purchase of new EVs and the $4,000 credit on buying used ones. The move is expected to weigh heavily on the pockets of EV consumers.

A Stocktwits user opined that the market is possibly overestimating the impact of the federal tax credit going away, given that only a few qualify for it.

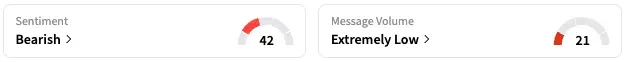

In the second quarter ended June, Northborough-headquartered Aspen Aerogels reported revenue of $78 million, compared to $117.8 million in the second quarter of 2024. Of the total revenue, the thermal barrier segment accounted for a whopping 71%. Meanwhile, retail sentiment around GM trended in the ‘bearish’ territory, coupled with ‘extremely low’ message volume.

Last week, The Wall Street Journal reported that GM intends to import batteries from China despite steep tariffs imposed by the Trump administration on imports from the country for its next-generation Bolt EV. The next generation of Bolt vehicles is expected to start rolling off the production line later this year and be priced around $30,000.

GM CEO Mary Barra noted in July that there was demand for EVs before the federal tax credit, and that real EV demand would be apparent in 2026 once the federal tax credit on the purchase of new EVs ends in September. “We think there is going to be an EV market that will grow over time, albeit it’ll start lower and potentially grow more slowly,” Barra had said while reiterating the company’s commitment to making EVs to meet consumer demand.

While ASPN stock is down by 36% this year, GM is up by about 0.5%.

Read also: Nvidia Stock To Rally 20% After China Export License Agreement Report, Says Wells Fargo: Report

For updates and corrections, email newsroom[at]stocktwits[dot]com.<