Delaware Chancery Judge Morgan Zurn ruled that Pfizer’s objections did not justify delaying Novo’s $10 billion acquisition of obesity-drug startup Metsera.

- Delaware Chancery Judge Morgan Zurn ruled that Pfizer’s objections did not justify delaying Novo’s $10 billion acquisition of obesity-drug startup Metsera.

- The court decision follows Metsera’s board reaffirming Novo’s revised $86.20-per-share offer as superior to Pfizer’s $8.1 billion counterproposal.

- Pfizer vowed to continue its legal and antitrust challenges in Delaware federal court.

Novo Nordisk’s U.S.-listed shares rose Wednesday, ending an 11-session losing streak, after a Delaware judge rejected Pfizer’s request to block the Danish company’s $10 billion acquisition of obesity-drug startup Metsera Inc.

Delaware Chancery Judge Morgan Zurn said Pfizer’s objections didn’t warrant delaying the transaction and found no evidence Metsera’s board acted in bad faith when it labeled Novo’s offer “superior.” The ruling allows Novo to proceed with the deal, which topped Pfizer’s earlier $4.9 billion agreement announced in September, according to a Bloomberg report.

Revised Offers Raise The Stakes

On Tuesday, Metsera said it received a revised offer from Novo valuing the company at up to $86.20 per share, or about $10 billion. The new proposal includes $62.20 per share in cash, up from $56.50 in the original bid, plus contingent value rights worth up to $24.00 per share if certain milestones are achieved.

Pfizer also revised its terms, increasing upfront consideration to $60 per share and trimming the contingent payout to $10 per share, valuing its bid at roughly $8.1 billion. Despite the adjustment, Metsera’s board reaffirmed Novo’s offer as superior and gave Pfizer two business days to counter before terminating its merger agreement.

Pfizer Vows To Keep Fighting

Pfizer said the ruling “fails to address the legal issues raised” and vowed to continue litigation in Delaware federal court, calling Novo’s bid “an unprecedented and illegal scheme to circumvent antitrust scrutiny.” The company alleges Novo’s move is designed to protect its dominance in the GLP-1 obesity-drug space by neutralizing a future competitor.

Novo countered that the court’s ruling validates its approach and serves shareholders’ best interests. Its offer, which includes both upfront and milestone-based payments, aims to bring Metsera’s experimental weight-loss portfolio, which is a potential rival to Ozempic and Wegovy, under its umbrella.

FTC Flags Premerger Concerns

The U.S. Federal Trade Commission warned that Novo’s offer could breach the Hart-Scott-Rodino Act if completed without premerger review. In a Nov. 4 letter, the FTC said the structure of Novo’s bid, which grants substantial upfront payments before regulatory approval, could reduce Metsera’s independence and incentive to pursue its drug pipeline.

Stocktwits Bulls Cheer, Bears Question The Deal

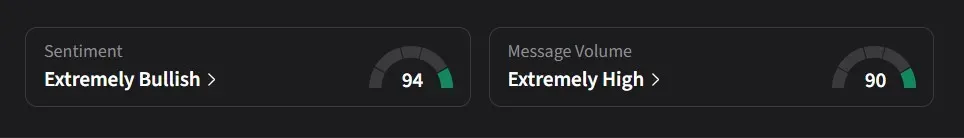

On Stocktwits, retail sentiment for Novo Nordisk was ‘extremely bullish’ amid a 159% jump in 24-hour message volume.

One user suggested that better days could be close, urging others to “hold strong.”

Another user, however, questioned whether Novo’s management understood investor sentiment, noting that Pfizer’s stock tends to rise each time it appears closer to reclaiming the Metsera deal, suggesting that shareholders aren’t convinced by Novo’s acquisition push.

Novo Nordisk’s U.S.-listed stock has declined 43% so far in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<