According to Scion Asset Management’s most recent disclosure, the fund held approximately 50,000 put contracts on Palantir and 10,000 on Nvidia.

- Market veteran says Palantir stock would need to drop another 5% for Burry to reach a break-even point.

- Scion Asset Management held about 50,000 put contracts on Palantir and 10,000 on Nvidia.

- Alex Karp noted that by shorting Palantir and Nvidia, Burry is actually shorting AI.

Famed hedge fund manager Michael Burry, best known for predicting the 2008 housing crash, spooked markets with new bets against artificial intelligence leaders Nvidia Corp. (NVDA) and Palantir Technologies Inc. (PLTR).

However, a market veteran reportedly believes that those bearish wagers are likely underwater. Market Rebellion’s co-founder Jon Najarian thinks the positions are likely underwater, according to the report.

According to a CNBC report, Burry’s hedge fund, Scion Asset Management, disclosed in its most recent filing that the fund held approximately 50,000 put contracts on Palantir and 10,000 on Nvidia as of the end of the third quarter.

The revelation triggered a sharp sell-off in AI stocks on Tuesday, reflecting renewed investor worries about overheated valuations. Palantir’s stock traded over 2% higher on Wednesday mid-morning.

Burry’s Trades

According to the report, Najarian estimated that Palantir’s stock would need to drop another 5% while Nvidia would have to fall another 7% for Burry to reach breakeven.

Palantir’s CEO Alex Karp also called out Michael Burry’s short bet and expressed surprise about the fact that ‘The Big Short’ legend was betting that Palantir and Nvidia would not perform well.

Karp noted that by shorting Palantir and Nvidia, Burry is actually shorting AI and added that Palantir delivered “the best results anyone’s ever seen.”

What Are Stocktwits Users Saying?

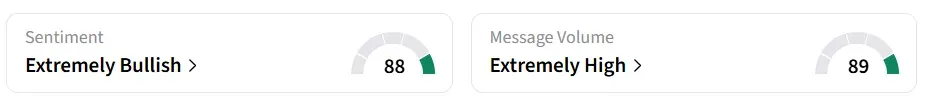

Despite the stock’s slide, on Stocktwits, retail sentiment around Palantir remained in ‘extremely bullish’ territory amid ‘extremely high’ message volume levels.

A bullish user believes, “Burry is covering or selling his positions for sure.”

Another user touted the dip in the stock as an opportunity to take a larger position.

Palantir stock has gained 146% in 2025 and over 263% in the last 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<