Ives expressed optimism despite AI valuation concerns, which have gained prominence after Wall Street CEOs warned of the possibility of a pullback in equities.

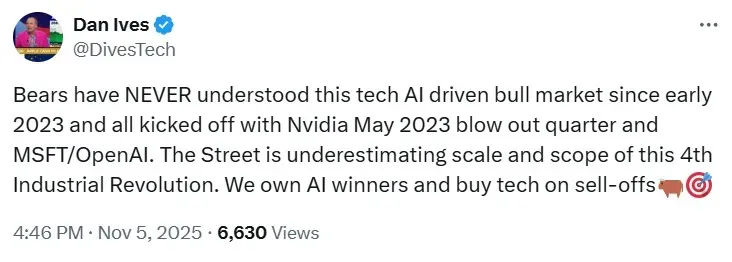

Wedbush Managing Director Dan Ives on Wednesday called out bears on Wall Street for “underestimating” the ongoing boom in U.S. equities driven by artificial intelligence.

In a post on X, Ives expressed optimism despite concerns about AI valuation, which have gained prominence after Wall Street CEOs warned of the possibility of a pullback in equities.

“Bears have NEVER understood this tech AI driven bull market since early 2023 and all kicked off with Nvidia May 2023 blow out quarter and MSFT/OpenAI,” Ives said in the post.

He maintained his bullish outlook on the technology sector, saying, “We own AI winners and buy tech on sell-offs.”

Goldman Sachs CEO David Solomon warned about a potential drawdown at an investment summit in Hong Kong on Tuesday, according to a report by CNBC. “It’s likely there’ll be a 10 to 20% drawdown in equity markets sometime in the next 12 to 24 months,” he said. At the same event, Morgan Stanley CEO Ted Pick also warned of the possibility of a 10% to 15% pullback, according to the report.

Get updates to this story developing directly on Stocktwits.<

For updates and corrections, email newsroom[at]stocktwits[dot]com.<