Volatility in crypto markets led to more than $1.3 billion in long bets getting wiped out, alongside roughly $400 million in short positions, according to CoinGlass data.

- Bitcoin and major cryptocurrencies remain under pressure amid geopolitical tensions, credit concerns, hawkish Fed commentary, and scrutiny of AI-driven tech stocks.

- Analysts see a structural shift toward institutional adoption shaping crypto markets.

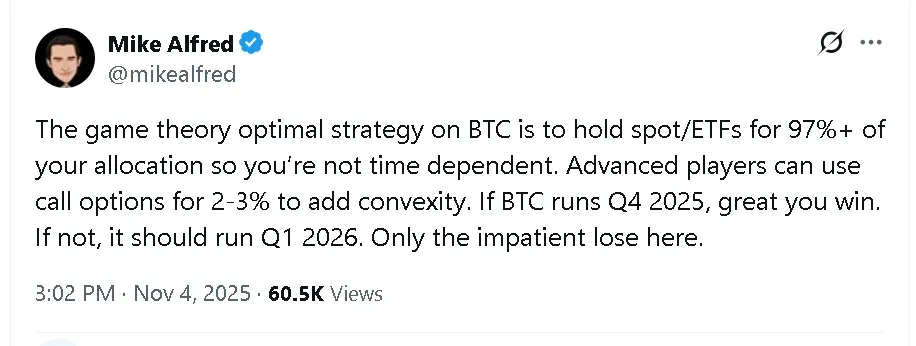

- Mike Alfred of Alpine Fox LP advises holding most Bitcoin in spot or ETFs, using a small portion of call options for upside exposure.

Crypto markets experienced another sharp selloff on Wednesday, with more than $1.7 billion in positions liquidated over the past 24 hours, and investor sentiment reached its weakest level since April.

CoinMarketCap’s Fear and Greed Index showed a reading of 20 in the ‘fear’ territory, signaling deep caution among investors. If the index falls any lower, sentiment will be in the ‘extreme fear’ zone.

Meanwhile, Bitcoin (BTC) was attempting to stage a recovery in early morning trade on Wednesday. Bitcoin’s price rebounded to about $101,700 briefly after it slipped below $100,000 in the previous session – still down 1.9% in the last 24 hours. On Stocktwits, retail sentiment around the apex cryptocurrency improved to ‘neutral’ from ‘bearish’ territory as chatter increased to ‘high’ from ‘normal’ levels over the past day.

Ethereum (ETH) posted the sharpest losses among large-cap tokens, dropping more than 6% in 24 hours to trade near $3,290. Solana (SOL) slipped 3.3%, followed by Cardano (ADA) at 2.6%, Dogecoin (DOGE) at 2.3%, XRP at 2.1%, and Binance Coin (BNB) at 1.7%.

Liquidations Highlight Fragility

The volatility in Bitcoin’s price and the risk-off sentiment in the rest of the crypto market led to more than $1.3 billion in long bets getting wiped out, alongside roughly $400 million in short positions, according to CoinGlass data. Ethereum led the selloff with over $570 million in liquidations, followed by Bitcoin at $488 million and Solana at $92 million.

This marks the second large liquidation event in less than a month for crypto markets. In early October, more than $1.9 billion was wiped out after President Donald Trump threatened to impose 100% tariffs on China, one of the largest liquidation events in crypto history. Since then, Bitcoin and other major tokens have struggled to regain momentum amid geopolitical tensions, credit concerns, hawkish Federal Reserve commentary, and renewed scrutiny of tech-sector valuations tied to AI.

Decoding The Crypto Market Slump

Some market observers believe a structural shift toward institutional adoption is underway. “Retail is licking its wounds, and institutions are coming fast, but it takes time to fully close the infrastructure and market gaps,” said Christopher Perkins, president of CoinFund and former MD at Citi and Lehman, in a post on X.

Traders are adjusting to the volatility. Mike Alfred, founder of Alpine Fox LP, recommends holding the majority of Bitcoin in spot or ETFs, with a small allocation to call options to add convexity.

On the equities side, shares of Strategy (MSTR), the largest corporate holder of Bitcoin, edged up 1.2% in pre-market trade. Meanwhile, shares of Ethereum-backed digital asset treasury (DAT) firm Bitmine Immersion Technologies (BMNR) were up 3%. Crypto-exchange Coinbase (COIN) gained 1.3%.

Read also: Dow Futures Edge Lower As Investors Remain Cautious On AI Valuation Concerns: AMD, ANET, SMCI, HOOD Among Stocks To Watch

For updates and corrections, email newsroom[at]stocktwits[dot]com.<