Novo Nordisk cut its 2025 profit and sales forecasts as slower GLP-1 growth and pricing pressure hit margins.

- Novo Nordisk cut its 2025 profit and sales forecasts as slower GLP-1 growth and pricing pressure hit margins.

- Q3 sales rose 5% to 75 billion kroner, with Wegovy revenue up 18% but below expectations.

- UBS said a potential $149-per-month U.S. pricing deal for obesity drugs could expand Medicare access but also weigh on Novo Nordisk’s global pricing power.

Novo Nordisk’s new CEO, Mike Doustdar, cut the company’s profit forecast after slower Wegovy sales and rising competition in the obesity-drug market. The downgrade comes as the firm pursues a $10 billion bid for Metsera and, reportedly, nears a White House deal that could cap obesity-drug prices at $149 a month in exchange for Medicare coverage.

Earnings Review

Novo Nordisk, the maker of Wegovy and Ozempic, lowered its full-year guidance on Wednesday, signaling a rocky start for new CEO Mike Doustdar. The company now expects operating profit growth of 4%–7% in local currencies for 2025, down from an earlier 10%–16%, and sales growth of 8%–11%, below the previous 8%–14% range.

Doustdar attributed the cut to “lower growth expectations for our GLP-1 treatments,” adding that the company will accelerate efforts “to compete better in dynamic and increasingly competitive markets.”

Third-quarter sales rose 5 % to 75 billion Danish crowns ($11.7 billion). Wegovy sales climbed 18% to 20.35 billion Danish crowns, but missed expectations of 21.35 billion Danish crowns, as pricing pressure and rising competition from Eli Lilly’s Zepbound weighed on performance.

New CEO Faces Early Test

Doustdar, who took charge in August, faces one of Novo Nordisk’s toughest transitions in years. The company’s shares have dropped 43% in 2025, as pricing wars, U.S. policy headwinds, and management reshuffles have dented investor confidence in what was once Europe’s most valuable firm.

Novo Nordisk said its company-wide restructuring aims to streamline operations and reinvest for growth, with a renewed focus on obesity treatments.

Metsera Bid And Legal Battles

The Danish drugmaker’s revised $10 billion offer for U.S. obesity biotech Metsera has intensified its rivalry with Pfizer, which has filed two lawsuits alleging anticompetitive behavior.

Novo Nordisk dismissed the claims as “false and without merit.” Metsera said Novo’s latest proposal was “superior” to Pfizer’s, but the escalating bid raises investor concerns about cost discipline amid narrowing profit growth.

US Pricing Talks

Adding to the uncertainty, UBS said in a research note that Novo Nordisk and Eli Lilly’s supposed deal with the White House on obesity-drug pricing would cap prices at $149 per month for the lowest dose in exchange for Medicare coverage.

The investment bank described its stance as “mixed,” while Medicare inclusion could drive volume upside, the $149 price level represents a major discount versus global obesity-drug pricing. UBS, which rates Novo Nordisk shares as ‘Neutral’ with a 340 Danish crowns price target, said investors will watch whether the deal includes the Inflation Reduction Act’s Part D drug-price negotiation for semaglutide, and whether Novo has offered deep Wegovy discounts to preserve Ozempic pricing.

Investor Sentiment

Before the earnings announcement, Bourbon Capital noted in a post on X that the company’s earnings yield and return on capital were considered “attractive,” signaling confidence in Novo’s long-term profitability.

Stocktwits Users Debate Novo Nordisk’s Post-Earnings Dip

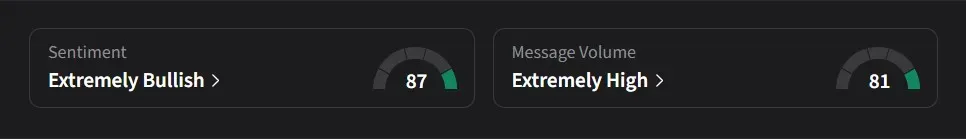

On Stocktwits, retail sentiment for Novo Nordisk was ‘extremely bullish’ amid ‘extremely high’ message volume.

One user said approval of Novo Nordisk’s GLP-1 pill in the U.S., combined with its recent acquisitions, could “make this stock explode,” predicting that the post-earnings dip would be quickly bought once European markets opened.

Another user said the results amounted to a “small miss as expected,” noting that guidance had merely narrowed and speculated on the market’s move ahead of the Trump deal.

For updates and corrections, email newsroom[at]stocktwits[dot]com.<